Understanding Price Action: Practical Analysis of the 5-Minute Time Frame By Bob Volman

18.93 $

Author’s Note:

In these modern times of high-tech trading devices, with all the latest gadgets at the push of a button, price action traders may come off as somewhat old-school. With nothing in front of them but the bars in the chart, there is little in their workspace that bears witness of the digital wave. Are they mere relics from a fading past, soon to be extinct, or could it be that there is merit in this seemingly stubborn defiance of trading evolution?

One way to answer this is to point out the actual benefits of every indicator craze that has swept across the trading landscape for the past so many years. Not an easy chore by any means. A simpler solution, perhaps, is to focus attention on the price action trader instead and see if we can come to appreciate his one and only tool, the naked chart.

With the latter idea in mind, Understanding Price Action is written not just to establish the virtues of the price action method, but to serve as a practical guide on the matter. The core premise within is that any dedicated student, before long, should be able to trade confidently and profitably from a clean chart without ever feeling lost or otherwise deprived.

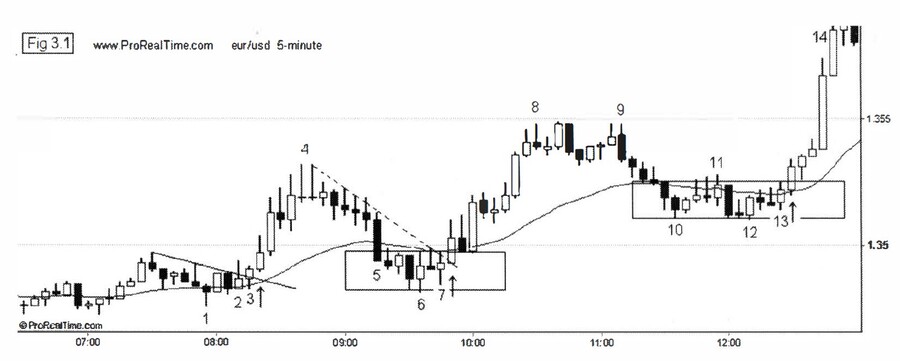

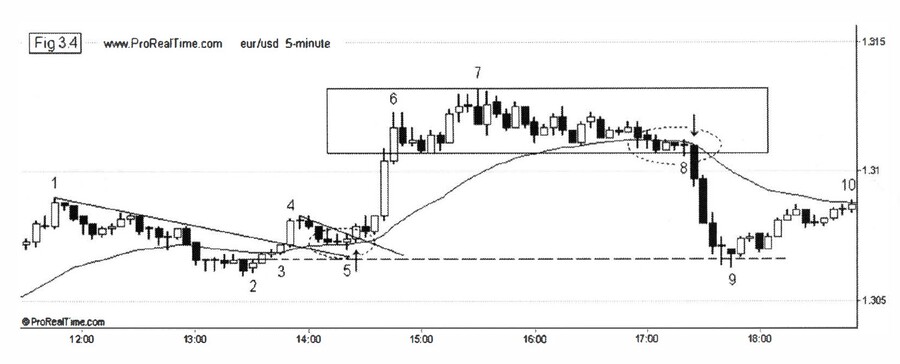

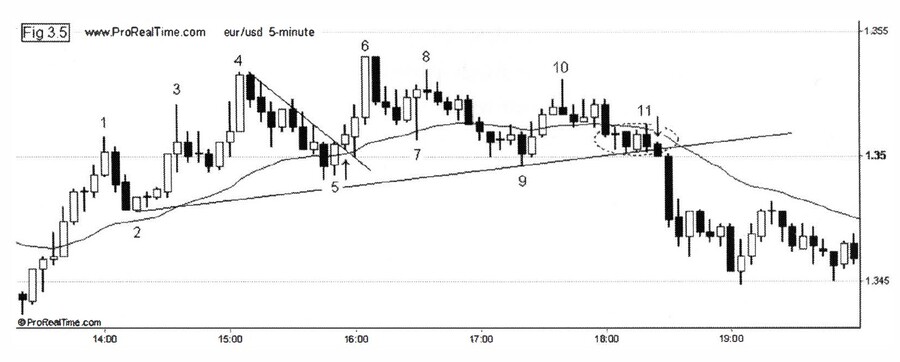

For the purpose of illustration, any price chart could basically do, but few are better suited for the job than the 5-minute chart of the eur / usd currency pair. A true creature of habit, this market has long since been the favorite of countless traders around the globe and it’s hard to think of a more accessible platform for the technical discussions in the chapters ahead. When taking up the task of writing this guide, the objective was not just to show a pallet of trading concepts on a number of cherry-picked charts, but to give a fair impression also of their practical implementation on a day-to-day basis. For this purpose, the book has been split into two parts.

Part I lays out the principles of price action and discusses entry and exit techniques on a broad range of educational charts. In Part 2 we will examine how these findings hold up on a more continuous basis. Included within is a series of six months of consecutive 5-minute sessions of the eur / usd. Besides providing a massive amount of study material, this series should leave little doubt behind as to the amazing continuity and exploitability of price action themes from one session to the next.

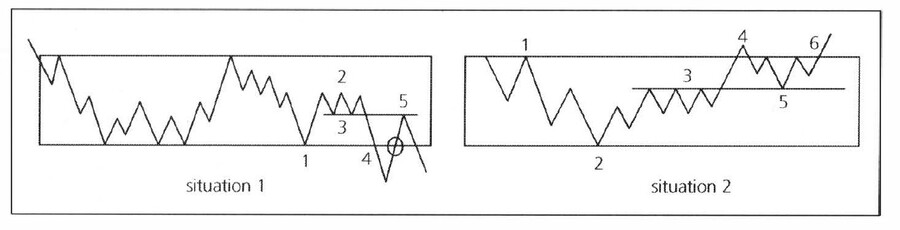

Some Pictures From the Book

One of the most common questions I rec.eived in response to my first book, Forex Price Action Scalping, was if the principles and setups pointed out on a fast scalping chart (70-tick) could also be applied to the higher intraday frames, like the 2 or 5-minute, or even the hourly for that matter. There can only be one answer to this question: price action principles are transposable to any time frame of choice because they bear within them the universal laws of supply and demand. This is not bounded by the time in which it takes place, nor is it a prerogative of any one market. From one instrument or time frame to another, subtle adaptations may be called for, if only to accommodate for the differences in average range or motion; but the trading concepts of the price action method are just as applicable to futures, indices, stocks, commodities, bonds, or what have you, as they are to the Forex markets. As will be demonstrated also, price action principles are not only free from the boundaries of market and frame, they stand above the nature of the trading environment as well. To illustrate this point, a special section is included on how to tackle a very persistent climate of low volatility by slightly tweaking standard procedure to better suit the conditions at hand. We will examine this adaptation process from the viewpoint of a faster intraday frame on several currency pairs and some popular non-Forex markets.

In regard to the absolute novice, it should be noted that to keep the focus at all times directed towards analysis, it is chosen not to disturb the pace of this book with endless pages of introductory fluff that is readily available either online or in more generic trading books. From a technical perspective, however, Understanding Price Action is written for both the novice and the experienced trader, and for all who have taken interest in exploring the benefits and possibilities of the price action method.

Table of Contents:

Part 1: Practical Analysis:

- A Time to Trade and a Time to Study

- Price Action Principles-Theory

- Price Action Principles-Practice

- Orders, Target and Stop

- Trade Setups

- Manual Exits

- Skipping Trades and Trading Breaks for Failure

- Recap Part 1

Part 2: Evaluation and Management

- Consecutive Intraday Charts

- Trade Size-Compounding

- Adapting to Low Volatility

- Final Words

Understanding Price Action: Practical Analysis of the 5-Minute Time Frame By Bob Volman