Articles

Trading the Engulfing Bar Reversal Pattern

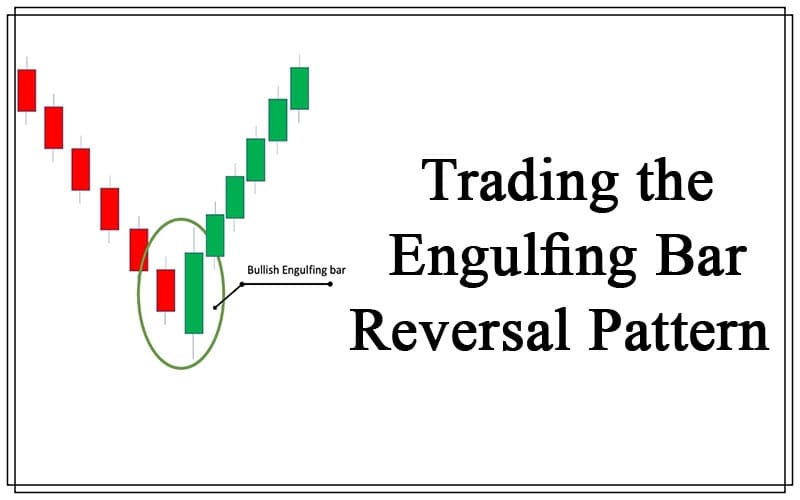

The engulfing bar reversal pattern is one of the important candlestick patterns that traders can use to benefit from when trading the forex market. It is a candlestick reversal pattern that can be used to trade bullish and bearish reversal setups. In this article, we explain what the engulfing bar trade setup is all about and how it can serve you as a profit maker in the forex market.

It should be noted the engulfing bar is an AB pattern, meaning it is composed of an A candle and a B candle, or a 2 bar setup. The A candle will refer to the first candle and the B the second. Many websites use this AB description, although others have tried to make cute names to make it seem original or like theirs, but in reality, it’s just an AB pattern.

What Is the Engulfing Bar?

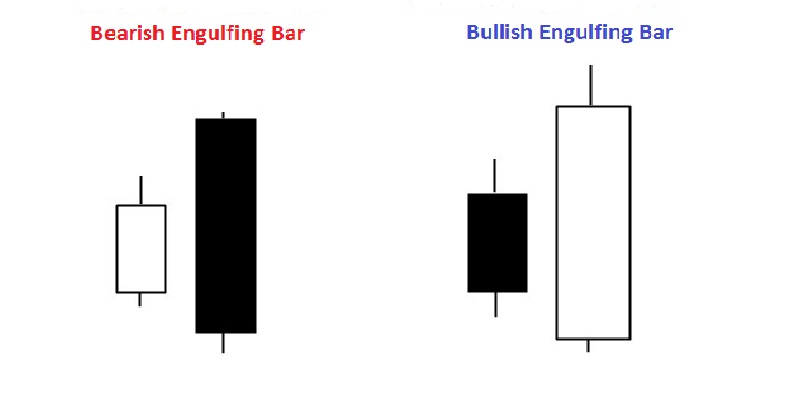

An engulfing consists of a smaller first candle (known as the A candle) and a larger second candle (B candle) which has a higher high and lower low than the A candle, so that is seen to “engulf” the A candle.

Now by itself, this description could mean a lot, so we have to be more specific. The B candle must close above or below the high/low of the A bar, depending upon whether it’s a bullish or bearish engulfing pattern. This is a key difference often overlooked by others.

The engulfing bar pattern by itself (the two bars) is designed to be a reversal pattern, meaning it is reversing the prior price action move. This is done with the bullish engulfing bar, being of trade significance at a market or swing bottom, and the bearish engulfing bar gaining relevance as a trade signal when it occurs at a market top. You can find examples in the image below.

What Does an Engulfing Bar Setup Signify?

Candlestick patterns are not randomly assigned roles of being bullish or bearish, reversal or continuation on an arbitrary basis. Rather, they assume those roles because of the information that the respective candlesticks give to the discerning trader. This is because the order flow behind the price action is revealed in the price action.

An engulfing bar setup is a typical example of how the candlestick arrangement and pattern gives a clear indication of what is happening in the market. For the bearish engulfing pattern where the B candle has a higher high and lower low than the A bar, along with a close below.

It is this sudden sharp reversal of the prior candle’s price action, that make this a powerful setup.

The same pattern of events occur in reverse for the bullish engulfing pattern, in which the A candle is bearish and the B candle is bullish in orientation, completely taking out the highs of the A bar and closing above it.

How to Trade the Engulfing Bar

The first step a trader should take when a decision has been made to trade an engulfing bar setup is to determine what the underlying trend is. Once you have determined the trend, then you can look for reversal setups using the engulfing bar pattern.

A bearish engulfing bar setup is best traded when it occurs at the top of a prior uptrend, while a bullish engulfing bar setup is significant if it occurs at the bottom of a previous downtrend. It is only when the engulfing bar setup is seen in these two situations that the pattern is tradable. An optimizer in trading the engulfing bar setup is if it occurs at Key Levels.

The chart below shows a bearish engulfing bar setup in an area of resistance which led to a sharp selloff of the asset in question.

Fig2b: Bearish engulfing bar setup in action

As seen in the example above, a bearish engulfing bar at a resistance is a highly effective setup and will improve the chances of success of using this price action pattern.

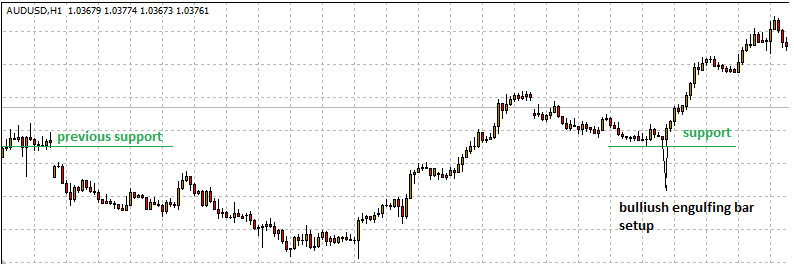

Fig 2c: Bullish engulfing bar setup at a support area

In this chart, we see an engulfing bar setup at a key level of support. In this case, the bullish engulfing pattern was located at an area that had previously formed a support level.

How Do I Place My Entry, Stop and Take Profit?

The entry, stop and profit targets for the engulfing bar trade setups are as follows:

Entry:

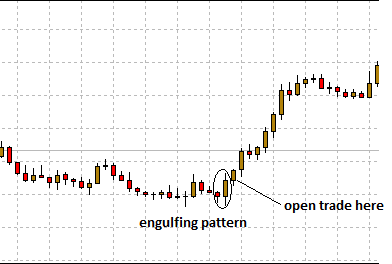

The entry for the trades should only be made when the two candles that form the engulfing pattern have formed and are confirmed to be true engulfing patterns. The trade should be opened with a market order at the open of the next candle.

Stop Loss:

The stop loss for a bullish setup should be placed below the support line, while that for the bearish setup should be placed above the resistance line that the engulfing bar forms at. These levels should resist any drawdowns or pull backs that may occur.

Take Profit

This is left to the trader’s discretion, however a good profit target is to use the next key level of support for a short trade, or the next key level of resistance for a long trade. The trader should aim to make at least 3 pips for every 2 pips risked as stop loss, or 1.5x their risk.

All setups should be practiced on demo before being applied to a real money account.

In Summation

The engulfing bar reversal pattern is a highly effective price action setup when used properly. Practice with it will bring familiarity, and success with it will bring confidence, so take the time to learn and practice it properly.

But when you add this to your list of trading strategies, you will find yourself identifying greater reversal and trade opportunities that can lead to highly profitable trades.