Articles

Trade Tops and Bottoms

Professional Traders Know When a Market Has Bottomed and Topped – Do You? Learn to Read Tops & Bottoms and Dramatically Improve Your Trading Imagine possessing the ability to know when a market is turning. What would it be like to clearly see this occur—not after the fact—but as it is happening? How would you feel if you were able to capture long trade entries at the bottom of the market and initiate shorts at the top? How would you feel if you could do this frequently in your trading?

Well, all this is very possible.

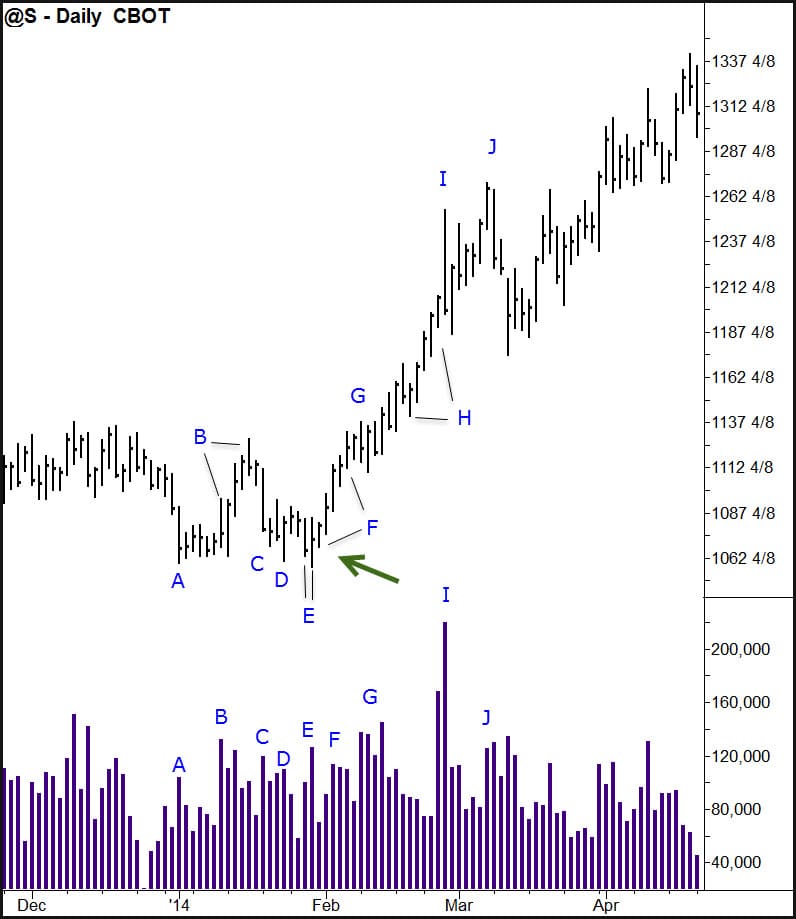

A recent bottom in daily Soybeans. Once the bottom was in, the market moves relentlessly up pushing through resistance for good profits. Savvy traders knew this was a choice opportunity. This tutorial teaches you in detail how to read this and other great opportunities.

Every trader would like to be able to pick off the top and bottom of a market. After all, this is the location for maximal profits. But few traders know how to do it. They jump the gun and sit through sideways movement and feel the pressure. Worse, they try to pick a top or find a bottom but keep getting stopped out as the market trends on. Frustrated, they miss the big move.

Many turn to indicators—and these can be helpful at times—but they often advise the trader to buy when the market is about to sell off or vice versa. Have you had that happen to you, more than once? To be able to read a top or know that a bottom is in, you need more.

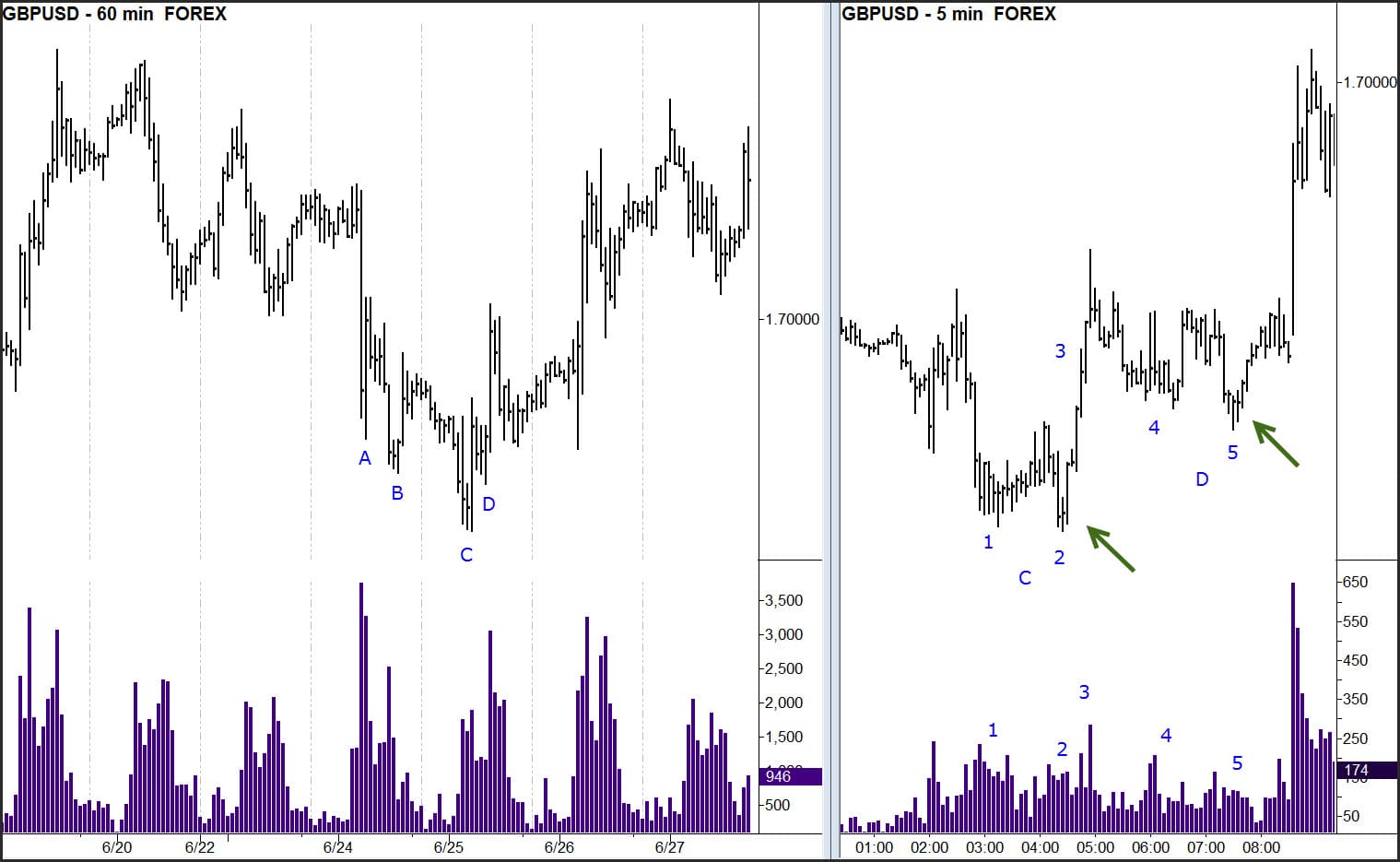

There is great value in this method. Using a combination of higher and lower time frames together with reading tops & bottoms can result in some powerful trades. Here is a recent long trade in the Cable – the British Pound/US Dollar FX Cross Rate. We use the higher time frame to see the structure. The lower time frame gives both the confirmation of the bottom and the entry!

Essential Candlesticks Trading By ChartGuys

Original price was: 199.00 $.24.49 $Current price is: 24.49 $.Imagine what it would be like to possess the knowledge, skills and ability to understand market tops and bottoms. What would it be like for you to see a top clearly form and know where to enter short and set your stop? How would you feel if you saw the market bottom, entered long and saw your trade turn profitable almost immedatiately? How would this feel if it occurred frequently in your trading?

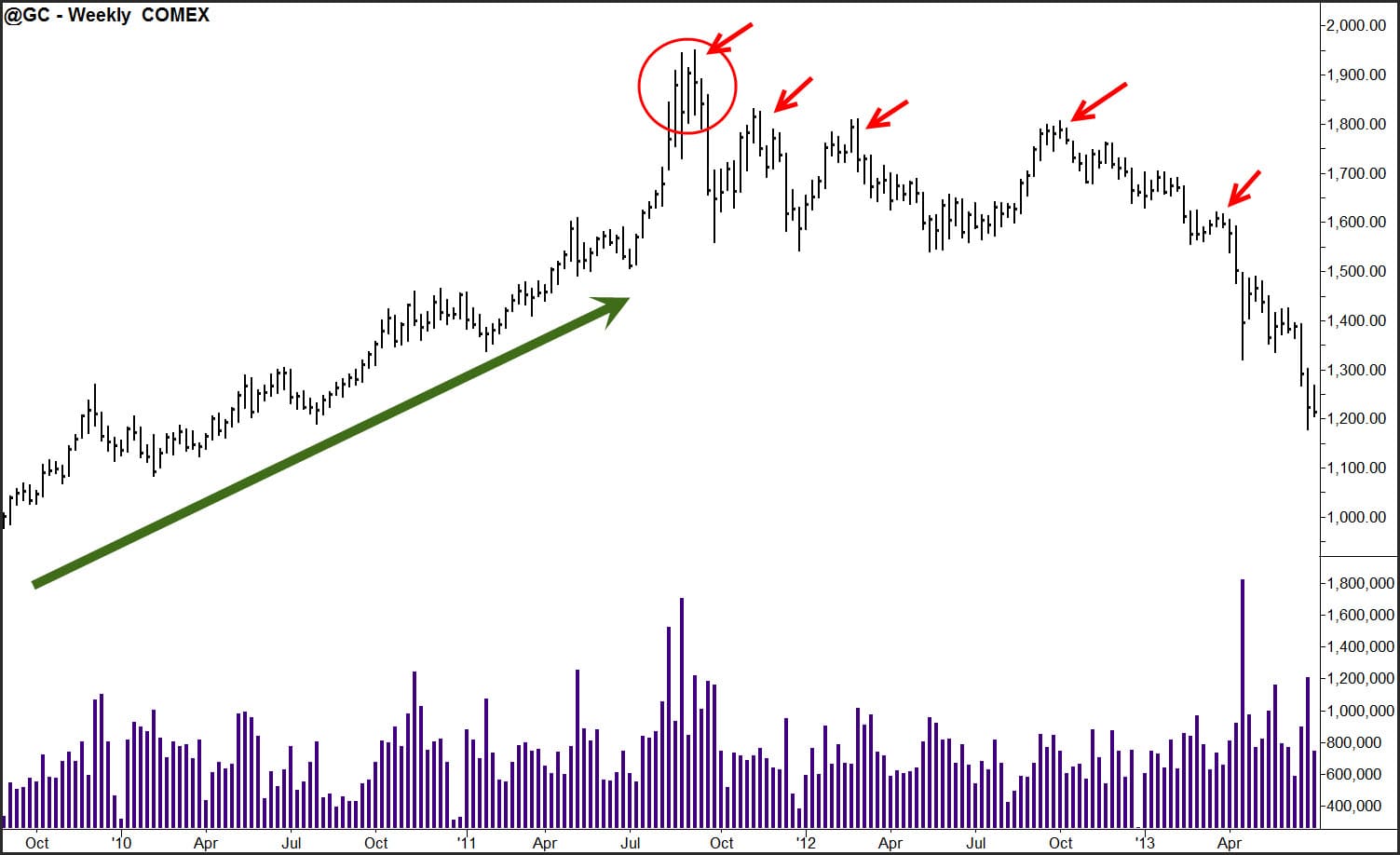

Gold had been in a protracted uptrend. It lulled traders into believing the market would run over $2,000 an ounce. All the news at the time was upbeat and bullish. Those who could read what to look for when a top is forming exited longs and began taking short positions right near the top. Numerous additional opportunities presented themselves for other short trades as intermediate tops formed. Here is a weekly continuation chart of Gold.

Traders need a dependable way to know that a top or bottom is in place. They need a method that:

- Is trustworthy and reliable

- Has high odds for producing solid results

- Is consistent

- Gets you into the trade near the top and near the bottom

- Has clear, close-in stops

- Doesn’t require an indicator, expensive software or fancy calculations to trigger signals

- Produces almost immediate results

- Works on all time frames and in all freely traded markets

- Is easily seen and assessed by the trader

Our Tops & Bottoms tutorial is unique as we explain in clear terms what you need to see in your chart to reliably assess that a top or bottom is in. This includes the overall background conditions and how structure must appear. We tell you clearly when the top or bottom doesn’t form properly and exactly what to look for. No one else does this.

You aren’t just given a few examples. There is over two hours of detailed review with numerous charts where we explain in detail all the key elements of market tops and market bottoms, including:

- A conceptual model of tops and bottoms so you can understand the specific market action you are looking for

- Specific Entry techniques for tops and bottoms

- Understanding protracted tops and the characteristics of secondary distribution

- Reading the chart for accumulation and what it looks like—this alone will keep you from holding onto short trades or going short at the wrong time

- Likely areas a market will turn

- How to read tops and bottoms bar-by-bar using only price and volume

- How to use the Weis Wave for incredibly accurate confirmations of tops and bottoms

- Using multiple time frames to increase the odds of identifying high quality trades

- Key indications that a market has turned

- Specific trade setups for trading tops and bottoms, along with the all-important background conditions that must be in place

- Identifying the “Springboard”—i.e., the very specific point in the top or bottom where the market is poised to move off the highs or lows rapidly.

- And much more …

After four days of downside momentum, SPY was ready to rally intraday. Traders with the knowledge, skills and abilities to understand when a bottom was likely took long positions with close stops right at the bottom on the multiday pullback. This is a 10-minute chart of SPY, the ETF for the S&P 500. The same setup occurred on ES, the S&P futures.

Trade Tops and Bottoms Course By Gary Dayton