Articles

The Wyckoff Method

Legendary technician Richard Wyckoff wrote about financial markets in the early decades of the 20th century at the same time as did Charles Dow, Jesse Livermore, and other iconic market analysis figures. His pioneering approach to technical analysis known as the Wyckoff Method has survived into the modern era. It continues to guide traders and investors in the best ways to pick winning stocks, the most advantageous times to buy them, and the most effective risk management techniques to use.

Wyckoff’s observations on price action coalesced into what’s known as the Wyckoff market cycle. It’s a theory that outlines key elements in price trend development that are marked by periods of accumulation and distribution. Four distinct phases comprise the cycle: accumulation, markup, distribution, and markdown. Wykoff also defined rules to use in conjunction with these phases. These rules can further help to identify the location and significance of price within the broad spectrum of uptrends, downtrends, and sideways markets.

Key Takeaways

- The Wyckoff Method is a technical analysis approach that can help investors decide what stocks to buy and when to buy them.

- The Wyckoff market cycle reflects Wyckoff’s theory of what drives a stock’s price movement.

- The four phases of the market cycle are accumulation, markup, distribution, and markdown.

- According to Wyckoff’s rules, a price trend never repeats itself exactly and trends must be studied in context with past behavior.

- The Wyckoff Method can help investors make less emotional, better-informed decisions about when to buy and sell stocks.

Wyckoff Rules

These rules are derived from Wyckoff’s studies and experience charting the stock market.

Rule 1: The market and individual securities never behave in the same way twice.1 Rather, trends unfold through a broad array of similar price patterns that show infinite variations in size, detail, and extension. Each incarnation changes just enough from prior patterns to surprise and confuse market participants. Many modern traders might call this a shapeshifting phenomenon that always stays one step ahead of profit-seeking.

Rule 2: The significance of price movements reveals itself only when compared to past price behavior.1 In other words, context is everything in the financial markets. The best way to evaluate today’s price action is to compare it to what happened yesterday, last week, last month, and last year.

A corollary to this rule states that analyzing a single day’s price action in a vacuum will elicit incorrect conclusions.

Additional rules:

Wyckoff established simple but powerful observational rules for trend recognition. He determined that there were just three types of trends: up, down, and flat. In addition, there were three-time frames: short-term, intermediate-term, and long-term. He observed that trends varied significantly in different time frames.

This set the stage for future technicians to create powerful trading strategies based on their interplay. Alexander Elder’s Triple Screen method, outlined in his book, Trading for a Living, offers an excellent example of this follow-up work.

Wyckoff Market Cycle

The Wyckoff market cycle theory supports the Wyckoff method. It defines how and why stocks and other securities move. It’s based on Wyckoff’s observations of supply and demand, and that the prices of securities move in a cyclical pattern of four distinct phases. Investors and traders use Wyckoff’s market cycle to identify a market’s direction, the likelihood of a reversal, and when large investors are accumulating and selling positions.

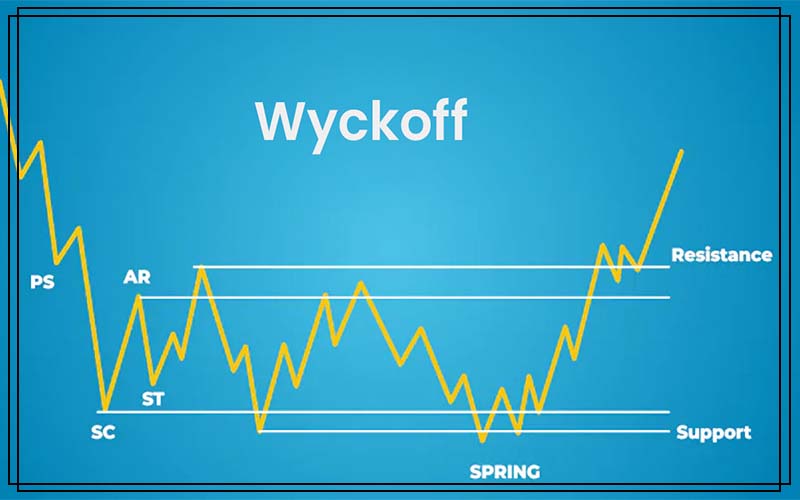

The Wyckoff market cycle phases are accumulation, markup, distribution, and markdown. Essentially, the phases represent the behavior of traders and can reveal the direction of a stock’s future price movement.

Generally speaking, the accumulation phase forms as institutional investors increase their buying and drive demand. As more interest develops, the trading range displays higher lows as prices position themselves to move higher. With buyers gaining power, prices push through the upper level of the trading range. At this Markup phase, a chart will show a consistent upward trend.

In the distribution phase, sellers are trying to gain the upper hand. The horizontal trading range in this phase will display lower price tops and a lack of higher bottoms. The markdown phase is a time of greater selling. It’s confirmed when prices break below the established lows of the trading range. Once this fourth and final phase of the Wyckoff market cycle finishes, the entire cycle will repeat itself.1

Wyckoff Accumulation

A new cycle begins with an accumulation phase that generates a trading range. The pattern often yields a failure point or spring that marks a selling climax, ahead of a strong trend that eventually exits the opposite side of the range. The last decline matches algo-driven stop hunting often observed near downtrend lows, where price undercuts key support and triggers a sell-off. This is followed by a recovery wave that lifts the price back above support.

Markup

The markup phase then follows, measured by the slope of the new uptrend. Pullbacks to new support offer buying opportunities that Wyckoff calls throwbacks, similar to buy-the-dip patterns popular in modern markets. Re-accumulation phases interrupt markup with small consolidation patterns, There are also steeper pullbacks which Wyckoff calls corrections. Markup and accumulation continue until these corrective phases fail to generate new highs.

Wyckoff Distribution

The failure to generate new highs signals the start of the distribution phase. This phase displays rangebound price action similar to the accumulation phase but marked by smart money taking profits and heading to the sidelines. In turn, this leaves the security in weak hands that are forced to sell when the range fails in a breakdown and new markdown phase. This bearish period generates throwbacks to new resistance that can be used to establish timely short sales.

Markdown

The slope of the new downtrend measures the markdown phase. This generates its own redistribution segments, where the trend pauses while the security attracts a new set of positions that will eventually get sold. Wyckoff calls steeper bounces within this structure corrections, using the same terminology as the uptrend phase. Markdown finally ends when a broad trading range or base signals the start of a new accumulation phase.

Apply the Wyckoff Method to Your Trading

- Familiarize yourself with the five steps of the Wyckoff method as well as the Wyckoff cycle.

- As you track your target stocks, note the Wyckoff accumulation and distribution phases.

- Place your trade when a stock’s price moves from accumulation to markup or distribution to markdown.

- In addition, place a stop-loss order at the opposite side of the trading range.

- Keep tracking your stock and exit your trade when either price or volume, or both, indicate a phase is changing.1

Wyckoff Method

The Wyckoff method is underpinned by Wyckoff’s theories, strategies, and rules for trading. Here’s a summary of the principles of this step-by-step approach to selecting stocks and timing your trades.

1. Establish the overall market’s current trend and most likely future direction. Assess whether supply and demand indicate that the market is positioning itself to move up or down.

2. Select stocks that follow the same trend. Especially those that show greater strength than the market during upswings and less weakness during downturns.

3. Select stocks that are under accumulation (or in distribution if you’re selling). These stocks have the potential to increase in price to meet and possibly exceed your price objective.

4. Decide whether a stock is ready to move. Examine the price and volume of your stock and the behavior of the overall market. Be sure that your conclusions are valid and the stock is a good choice before taking a position.

5. Time your trade to take advantage of the larger market’s turns. In general, buy a stock you’ve selected if you determine that the market will reverse and rally. Sell a stock if your analysis indicates that the market will fall.

Is the Wyckoff Method Effective?

Wyckoff’s work provides a variety of reliable tools and techniques with which to assess markets and time trades. His method is studied and used by large institutional investors, traders, and analysts throughout the world who comprehend its value.

What Is the Wyckoff Method Used for?

The Wyckoff Method is used by investors and traders to determine market trends, select investments, and time the placement of trades. It can help them identify the times at which big players are accumulating (or distributing) positions in a security. It can help users to find trades with high-profit potential. What’s more, its straightforward analytical approach means investors can enter and exit the market without emotion that can cloud judgment.

What Are the 4 Phases of the Wyckoff Cycle?

The four phases of the Wyckoff cycle are accumulation, markup, distribution, and markdown. They represent trading behavior and price action. Once the final markdown phase of the Wyckoff cycle is complete, a new accumulation phase will kick off a new cycle.

The Bottom Line

Richard Wyckoff established key principles on tops, bottoms, trends, and tape reading in the early decades of the 20th century. His concepts, including the Wyckoff method, market cycle, and rules, continue to educate traders and investors in the 21st century.