Articles

The Art and Science of Technical Analysis: Market Structure, Price Action, and Trading Strategies

The Art and Science of Technical Analysis is a groundbreaking work that bridges the gaps between the academic view of markets, technical analysis, and profitable trading. The book explores why randomness prevails in markets most, but not all, of the time and how technical analysis can be used to capture statistically validated patterns in certain types of market conditions. The belief of the book is that buying and selling pressure causes patterns in prices, but that these technical patterns are only effective in the presence of true buying/selling imbalance.

Author’s Note:

The book you are holding in your hands is the product of nearly two decades of my study and experience as a trader, covering the full span of actively traded markets and time frames. I owe much to authors and traders who have come before me, for no one produces anything significant in a vacuum. I would not have been successful without the help and guidance of my mentors, but I learned many of the lessons here from my own mistakes. In some ways, this work represents a radical break from many of the books that have preceded it, and I hope it encourages you to question much of the traditional thinking of technical analysis.

This book does not present a rigid system to be strictly followed, nor a set of setups and patterns that can be assembled at the trader’s whim. Rather, it offers a comprehensive approach to the problems of technically motivated, directional trading. The book is structured to be read from beginning to end, but individual sections and chapters stand on their own. Through the entire work, deliberate repetition of important concepts helps to build a complete perspective on many of the problems traders face. The tools and techniques must be adapted to the trader’s personality and business situation, but most will find a firm foundation between these covers.

There are some underlying themes, perhaps not expressed explicitly, that tie this work together, and they may be surprising to many readers: Trading is hard. Markets are extremely competitive. They are usually very close to efficient, and most observed price movements are random. It is therefore exceedingly difficult to derive a method that makes superior risk-adjusted profits, and it is even more difficult to successfully apply such a method in actual trading. Last, it is essential to have a verifiable edge in the markets—otherwise no consistent profits are possible. This approach sets this work apart from the majority of trading books published, which suggest that simple patterns and proper psychology can lead a trader to impressive profits. Perhaps this is possible, but I have never seen it work in actual practice.

This book is divided into four parts:

- Part One begins with a look at some of the probability theory supporting the concepts of successful trading. Next comes an in-depth look at a specific approach to chart reading that focuses on clarity and consistency lays the foundation for building and understanding of price patterns in markets. This section concludes with an overview of the Wyckoff market cycle, which is already well known in the literature of technical analysis.

- Part Two focuses on the details of trends, trading ranges, and critically, the transitions from one to the other in considerable detail. This is a deep look at the underlying foundation of price movements, and there is information here that, to my knowledge, has never appeared in print before.

- Part Three might appear, at first glance, to be the meat of this book, as it includes specific trading patterns and examples of those patterns applied to real markets. It also advocates a way of looking at indicators and other confirming factors that requires a deep understanding of the nuances of these tools. One of the key elements of any trading plan is how the trader sizes the trade and manages the position as it develops; these elements are also covered in considerable depth. Much attention is devoted to the many risks traders will encounter, both from the market and from themselves. Though most traders are going to be tempted to turn directly to this section, remember that these patterns are only the tip of the spear, and they are meaningless unless they are placed within the context provided by Parts One and Two.

- Part Four is specifically written for the individual trader, and begins by focusing on elements of psychology such as cognitive biases and issues of emotional control. Chapter 11 takes a look at many of the challenges developing traders typically face. Though it is impossible to reduce the trader development process to a one-size-fits-all formula, the majority of traders struggle with the same issues. Most traders fail because they do not realize that the process of becoming a trader is a long one, and they are not prepared to make the commitment. This section concludes with a look at some performance analysis tools that can help both the developing and the established trader to track key performance metrics and to target problems before they have a serious impact on the bottom line.

- Last, there are three appendixes in this work. The first appendix is a trading primer that will be useful for developing traders or for managers who do not have a familiarity with the language used by traders. Like any discipline, trading has its own idioms and lingo, an understanding of which is important for effective communication. The second expands on the some specific details and quirks of moving averages the MACD, which are used extensively in other sections of this book. The last appendix simply contains a list of trade data used in the performance analysis of Part Four.

This book is written for two distinct groups of traders. It is overtly addressed to the individual, self-directed trader, either trading for his or her own account or who has exclusive trading authority over a number of client accounts. The self-directed trader will find many sections specifically addressed to the struggles he or she faces, and to the errors he or she is likely to make along the way. Rather than focusing on arcane concepts and theories, this trader needs to learn to properly read a chart, and most importantly, to understand the emerging story of supply and demand as it plays out through the patterns in the market.

Though this book is primarily written for that self-directed trader, there is also much information that will be valuable to a second group of traders and managers who do not approach markets from a technical perspective or who make decisions within an institutional framework. For these traders, some of the elements such as trader psychology may appear, at first glance, to be less relevant, but they provide a context for all market action. These traders will also find new perspectives on risk management, position sizing, and pattern analysis that may be able to inform their work in different areas.

The material in this book is complex; repeated exposure and rereading of certain sections will be an essential part of the learning process for most traders. In addition, the size of this book may be daunting to many readers. Once again, the book is structured to be read and absorbed from beginning to end. Themes and concepts are developed and revisited, and repetition is used to reinforce important ideas, but it may also be helpful to have a condensed study plan for some readers. Considering the two discrete target audiences, I would suggest the following plans:

- Both the individual and the institutional trader should page through the entire book, reading whatever catches their interest. Each chapter has been made as self-contained as possible, while trying to keep redundancy to an absolute minimum.

- After an initial quick read, the individual trader should carefully read Chapters 1 and 2, which provide a foundation for everything else. This trader should probably next read Part Four (Chapters 11 and 12) in depth, paying particular attention to the elements of the trader development process. Next, turn to Chapters 6 and 10, which focus on often-misunderstood aspects of risk and position sizing. Two important aspects of the book are missed on this first read: in-depth analysis of market structure and the use of confirming tools in setting up and managing actual trades. These are topics for deeper investigation once the initial material has been assimilated.

- For the institutional trader, Chapter 1 is also a logical follow-up to a quick read. Next, Chapter 2 would provide a good background and motivation for the entire discipline of technical analysis. Chapters 8 and 9 will likely be very interesting to this trader. For managers who are used to thinking of risk in a portfolio context, there are important lessons to be learned from a tactical/technical approach to position and risk management. Last, many of these readers will have an academic background. Chapters 2 through 5 would round out this trader’s understanding of evolving market structure.

The title of this book is The Art and Science of Technical Analysis. Science deals primarily with elements that are quantifiable and testable. The process of teaching a science usually focuses on the development of a body of knowledge, procedures, and approaches to data—the precise investigation of what is known and knowable. Art is often seen as more subjective and imprecise, but this is not entirely correct. In reality, neither can exist without the other. Science must deal with the philosophical and epistemological issues of the edges of knowledge, and scientific progress depends on inductive leaps as much as logical steps. Art rests on a foundation of tools and techniques that can and should be scientifically quantified, but it also points to another mode of knowing that stands somewhat apart from the usual procedures of logic. The two depend on each other: Science without Art is sterile; Art without Science is soft and incomplete. Nowhere is this truer than in the study of modern financial markets.

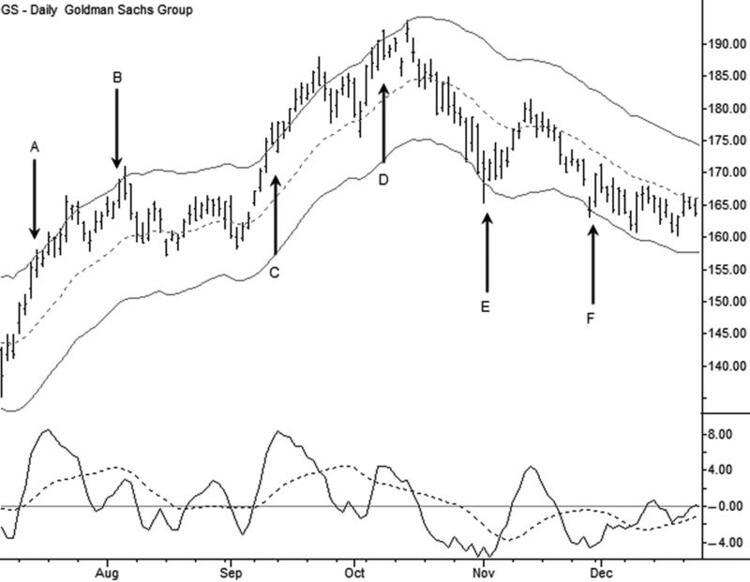

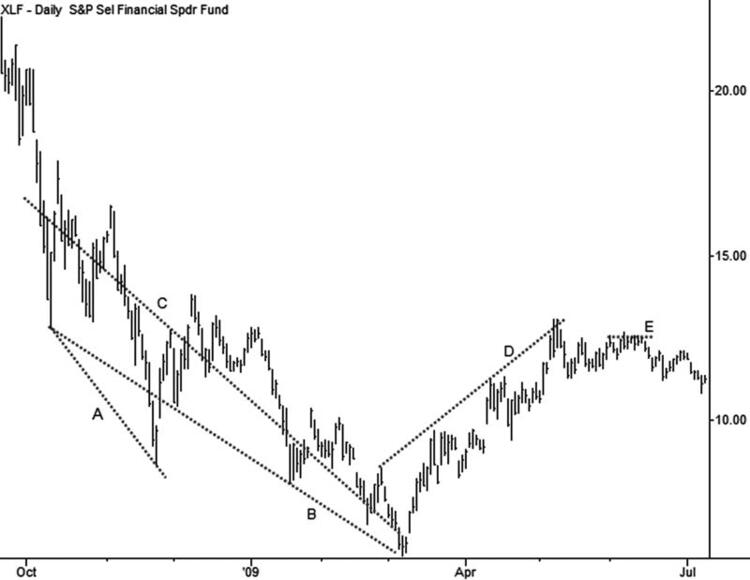

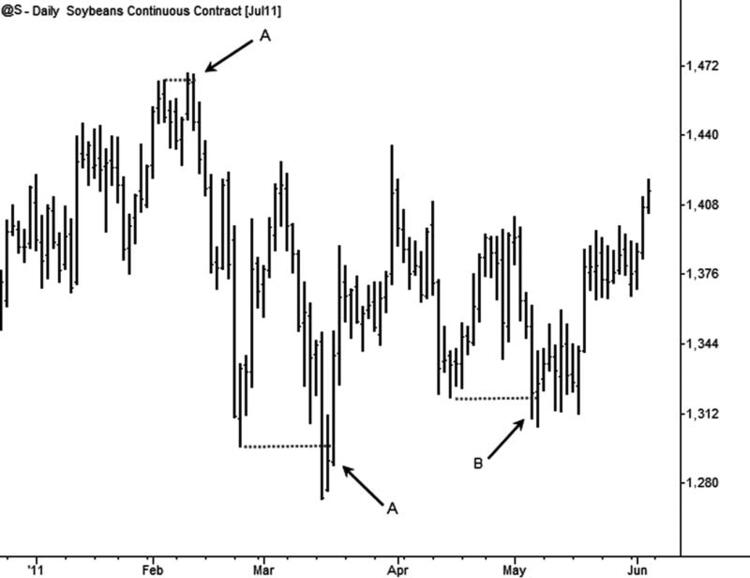

Some Pictures From the Book

Table of Contents:

- The Trader’s Edge

- The Market Cycle and the Four Trades

- On Trends

- On Trading Ranges

- Interfaces between Trends and Ranges

- Practical Trading Templates

- Tools for Confirmation

- Trade Management

- Risk Management

- Trade Examples

- The Trader’s Mind

- Becoming a Trader

The Art and Science of Technical Analysis: Market Structure, Price Action, and Trading Strategies By Adam Grimes