Trading Price Action Reversals: Technical Analysis of Price Charts Bar by Bar for the Serious Trader By Al Brooks

22.79 $

| Author |

Al Brooks |

|---|---|

| Pages |

576 |

| Format |

eBook |

| File Type |

EPUB , |

Master the Art of Reversal Trading with Pure Price Action

When markets change direction, most traders get caught on the wrong side. But what if you could spot those critical turning points with confidence—and profit from them consistently?

In Trading Price Action Reversals by Al Brooks, the third volume in his acclaimed Price Action series, Brooks provides a deeply practical guide to identifying and trading reversals using nothing but the raw price data on your charts. This isn’t about indicators or guessing games. It’s about understanding price behavior—bar by bar—to catch major reversals before the crowd does.

Built around 5-minute candlestick charts (generated with TradeStation), this book breaks down the nuances of trend exhaustion, reversal bars, failed breakouts, and the essential structure behind profitable setups. Brooks walks you through both bullish and bearish reversals- and reveals the signs of strength and weakness that precede turning points in stocks, forex, futures, and more.

Whether you’re trading the E-mini S&P 500 or looking to apply price action to other instruments, this volume is your field manual for high-probability reversal setups.

What You’ll Learn

- How to identify early signs of bullish and bearish reversals

- 20+ characteristics of strong breakouts and failed reversal attempts

- How to interpret micro gaps, pullbacks, breakout failures, and measuring gaps

- The power of urgency, bar overlap, and signal bar psychology

- Why the best countertrend setups often fail—and how to spot the exceptions

- How to apply reversal logic to multiple instruments (futures, forex, stocks, options)

Key Benefits

- Trade with clarity at the most critical turning points in any market

- Remove reliance on lagging indicators—read price action in real time

- Build confidence in executing with-trend and countertrend setups

- Develop pattern recognition for breakout traps and reversal entries

- Adapt Brooks’ strategy across timeframes and asset classes

Who This Book Is For

- Intermediate to advanced traders who want to master reversal trading

- Day traders and swing traders looking to improve timing and entries

- Traders familiar with Trading Price Action Trends and Trading Ranges

- Anyone seeking to trade confidently based solely on price behavior

Bullet Summary

- Skill Level: Intermediate to Advanced

- Genre / Category: Price Action Trading, Technical Analysis

- Author: Al Brooks

- Format: PDF (Digital Download after Purchase)

- Pages: ~600+ pages

- Language: English

- Delivery: Instant download after checkout

Spotting Strength in Trends & Breakouts

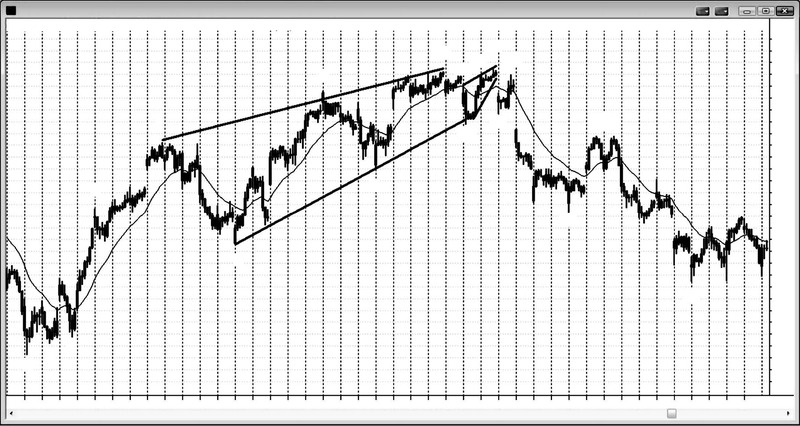

Understanding the anatomy of strong trends is key to anticipating reversals with precision. In Trading Price Action Reversals by Al Brooks, you’ll discover how to recognize the subtle but powerful signs that a trend is either gaining momentum or about to fall apart. Here are some of the core concepts covered:

- Gaps, spikes, and urgency often signal strong institutional activity. Breakouts that begin with large trend bars and follow-through buying or selling are more likely to sustain.

- Trend strength is visible in the details—tight overlap between bars, consistent trend bar closes, and few (if any) profitable countertrend setups.

- Micro gaps and measuring gaps provide valuable clues on whether a breakout will continue or fade.

- Pullbacks in strong trends are often shallow and infrequent. When they occur, they usually come with weak signal bars, forcing disciplined traders to act early or miss the move.

- Volume and bar structure matter. For example, breakout bars with large bodies, small tails, and explosive volume are more likely to succeed.

- Failed reversal attempts (such as spikes against the dominant trend) tend to become continuation flags, offering another opportunity to enter in trend direction.

- Context is everything—whether it’s the behavior of prior swing highs/lows, the location of moving averages, or market structure patterns like wedges, flags, or expanding triangles.

Whether you’re tracking bull or bear breakouts, this book teaches you how to read the signs of strength, distinguish fakeouts from real shifts, and trade with confidence at the turning points.

Preview Images from Trading Price Action Reversals by Al Brooks (PDF Edition)

Table of Contents:

- CHAPTER 1 Example of How to Trade a Reversal

- CHAPTER 2 Signs of Strength in a Reversal

- CHAPTER 3 Major Trend Reversal

- CHAPTER 4 Climactic Reversals: A Spike Followed by a Spike in the Opposite Direction

- CHAPTER 5 Wedges and Other Three-Push Reversal Patterns

- CHAPTER 6 Expanding Triangles

- CHAPTER 7 Final Flags

- CHAPTER 8 Double Top and Bottom Pullbacks

- CHAPTER 9 Failures

- CHAPTER 10 Huge Volume Reversals on Daily Charts

- CHAPTER 11 Key Times of the Day

- CHAPTER 12 Markets

- CHAPTER 13 Time Frames and Chart Types

- CHAPTER 14 Globex, Premarket, Postmarket, and Overnight Market

- CHAPTER 15 Always In

- CHAPTER 16 Extreme Scalping

- CHAPTER 17 Patterns Related to the Premarket

- CHAPTER 18 Patterns Related to Yesterday: Breakouts, Breakout Pullbacks, and Failed Breakouts

- CHAPTER 19 Opening Patterns and Reversals

- CHAPTER 20 Gap Openings: Reversals and Continuations

- CHAPER 21 Detailed Day Trading Examples

- CHAPTER 22 Daily, Weekly, and Monthly Charts

- CHAPTER 23 Options

- CHAPTER 24 The Best Trades: Putting It All Together

- CHAPTER 25 Trading Guidelines

Al Brooks is a seasoned independent day trader and a respected contributor to Futures Magazine, known for his deep expertise in technical analysis. His unique method of reading price charts wasn’t born overnight—it evolved over more than 20 years of hands-on trading experience, following a dramatic career shift from ophthalmology to finance.

Brooks holds a Bachelor of Science degree in Mathematics with honors from Trinity College (1974) and earned his M.D. from the University of Chicago Pritzker School of Medicine in 1978. After years in medicine, he turned his analytical mindset toward the markets and built a reputation for his no-indicator, price-action-focused trading strategies.

Through his official website, BrooksPriceAction.com, he shares his trading philosophy, publishes educational resources, and runs a subscription-based live chat room where he interacts with traders daily—offering real-time insights and market commentary.

Trading Price Action Reversals: Technical Analysis of Price Charts Bar by Bar for the Serious Trader By Al Brooks