The Art and Science of Technical Analysis: Market Structure, Price Action, and Trading Strategies By Adam Grimes

39.61 $

| Author |

Adam Grimes |

|---|---|

| Pages |

480 |

| Format |

eBook |

| File Type |

EPUB ,MOBI , |

The Art and Science of Technical Analysis by Adam Grimes offers a fresh, research-based approach to understanding market behavior. This isn’t about memorizing chart patterns—it’s about knowing when those patterns actually matter. The book explains why markets appear random most of the time, and how real trading opportunities arise only during moments of imbalance between buying and selling pressure.

By combining academic insight with real-world application, Grimes shows how to use technical analysis to identify high-probability setups based on statistically proven price behavior. Ideal for serious traders who want to cut through the noise and focus on what truly drives the market.

Built on nearly twenty years of real-world market experience, The Art and Science of Technical Analysis by Adam Grimes offers a refreshingly honest and insightful take on trading. Drawing from a wide spectrum of actively traded markets and timeframes, this book combines timeless wisdom from seasoned traders with lessons Grimes learned the hard way—through personal trial, error, and persistence. With deep respect for the mentors who guided him, Grimes reminds us that no meaningful contribution in trading—or in life—is made in isolation.

Inside The Art and Science of Technical Analysis

Far from the typical trading manuals that promote rigid strategies or predefined patterns, Adam Grimes’s book introduces a versatile and adaptive framework tailored for technical, directionally biased traders. While designed for a start-to-finish read, each chapter is independently valuable, making it easy to reference again and again. Key principles are intentionally reinforced throughout the text, helping traders internalize the critical concepts needed to navigate the challenges of live markets.

One of the book’s most powerful underlying themes is its unflinching honesty: trading is hard. Financial markets are ruthless, competitive, and largely driven by randomness. Building a strategy that consistently generates superior, risk-adjusted returns is a significant challenge—and executing that strategy in the real world is even tougher. Grimes makes it clear that lasting success in trading depends on having a measurable edge—something most trading books overlook in favor of oversimplified patterns or motivational fluff.

What truly sets this book apart is its realism. Grimes doesn’t sell illusions—he delivers grounded, experience-based guidance. If you’re ready to leave behind false promises and build a trading approach based on logic, structure, and statistical advantage, this book will be an invaluable asset in your journey.

Structure of Adam Grimes Technical Analysis Book

The Art and Science of Technical Analysis is thoughtfully divided into four key sections, each designed to progressively build the reader’s understanding of real-world trading.

- Part One opens with foundational insights into probability theory as it applies to successful trading practices. This section then transitions into a detailed method of chart reading, emphasizing clarity and consistency—two essential components for recognizing and interpreting market price patterns. It concludes with a concise yet impactful overview of the renowned Wyckoff Market Cycle, a cornerstone concept in technical analysis literature.

- Part Two dives deep into the anatomy of market behavior, dissecting trends, trading ranges, and—critically—the complex transitions that connect them. This portion delivers a nuanced analysis of price action mechanics, offering rare insights that are seldom found in published trading material.

- Part Three brings theory into practice. It presents specific trading patterns and real-market examples while introducing a disciplined way to interpret indicators and other confirmation tools. This section also tackles key components of trade management—position sizing, risk control, and strategy execution. Importantly, it stresses that these techniques only gain meaning when grounded in the frameworks established in the earlier chapters.

- Part Four shifts focus to the psychological side of trading, targeting the needs of individual traders. It explores common cognitive biases, emotional challenges, and the mental discipline required to succeed. A dedicated chapter examines the most frequent struggles faced by aspiring traders, emphasizing that trading success is a long-term endeavor requiring patience and commitment. The section closes with performance tracking tools that help both new and seasoned traders monitor metrics, identify weaknesses, and optimize outcomes before losses mount.

The book also includes three valuable appendices:

- The first is a beginner-friendly guide to trading terminology—ideal for newer traders or managers unfamiliar with market language.

- The second delves into the intricacies of moving averages and the MACD indicator, expanding on concepts introduced earlier in the book.

- The final appendix offers a complete dataset used in the performance analysis section, providing transparency and practical context.

Who Will Benefit from Adam Grimes’ Book?

The Art and Science of Technical Analysis by Adam Grimes is thoughtfully crafted for two distinct types of readers: self-directed individual traders and institutional professionals such as portfolio managers and analysts.

For independent traders managing their own accounts—or trading on behalf of clients—the book delivers practical guidance tailored to real-world obstacles. Rather than getting lost in overly complex theories, it emphasizes essential trading skills like chart reading and interpreting price action through the lens of supply and demand.

Institutional traders and decision-makers, even those less familiar with technical methods, will also find value in the book’s fresh perspectives on risk control, position sizing, trader psychology, and tactical market behavior. These insights can complement more traditional, fundamentally driven strategies.

How to Approach The Art and Science of Technical Analysis by Adam Grimes

While the book is best absorbed when read in full, both types of traders are encouraged to begin with a quick browse through the chapters to find what resonates most. Each chapter is designed to stand alone, minimizing unnecessary repetition.

For self-directed traders, start with Chapters 1 and 2 to build a strong foundation, then move to Chapters 11 and 12 for a deep dive into the development process of becoming a skilled trader. After that, Chapters 6 and 10 provide essential insights into managing risk and position sizing effectively.

For institutional traders, Chapters 1, 2, 8, and 9 offer practical frameworks that bridge the gap between technical tactics and portfolio-level decision-making. Additionally, Chapters 2 through 5 provide a clearer understanding of how market structure evolves over time.

Despite its depth and complexity, the book’s clear organization, repeated reinforcement of key ideas, and real-world relevance make it a must-read for anyone serious about mastering technical analysis.

Why Technical Analysis Is Both a Science and an Art?

The title The Art and Science of Technical Analysis reflects the essential balance between wo ways of understanding markets. Science brings structure—focused on data, logic, and measurable results. Art adds intuition, experience, and the ability to see patterns beyond the numbers. While science builds on facts and testing, it also requires creativity to push the boundaries of knowledge.

Likewise, art isn’t just emotion—it relies on tools and techniques that can be studied and improved. In trading, these two disciplines are deeply connected. Pure science lacks flexibility, and pure art lacks consistency. Real success comes from combining both—something especially true in today’s complex financial markets.

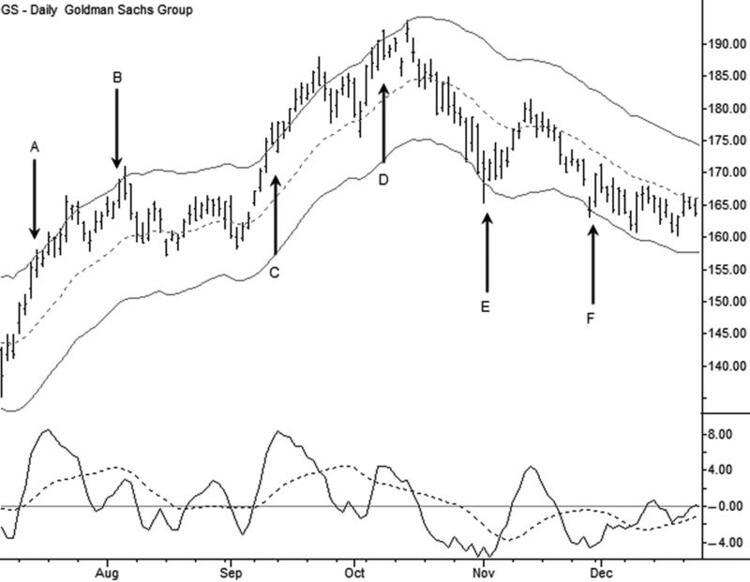

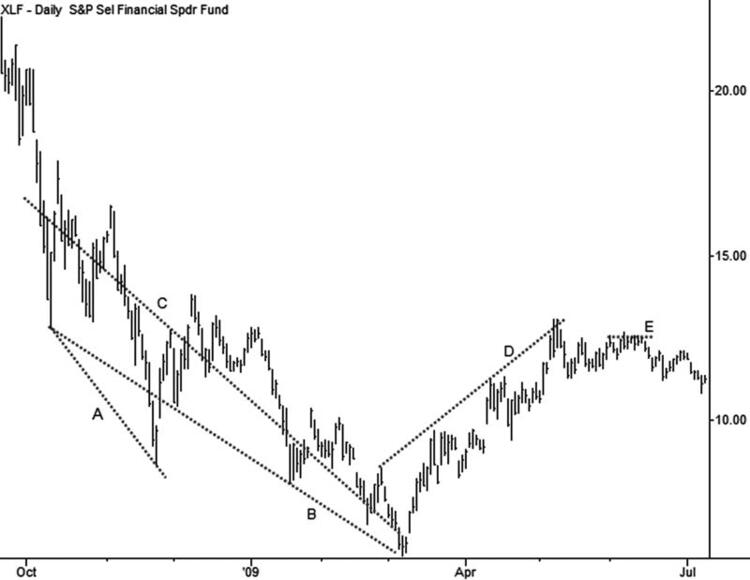

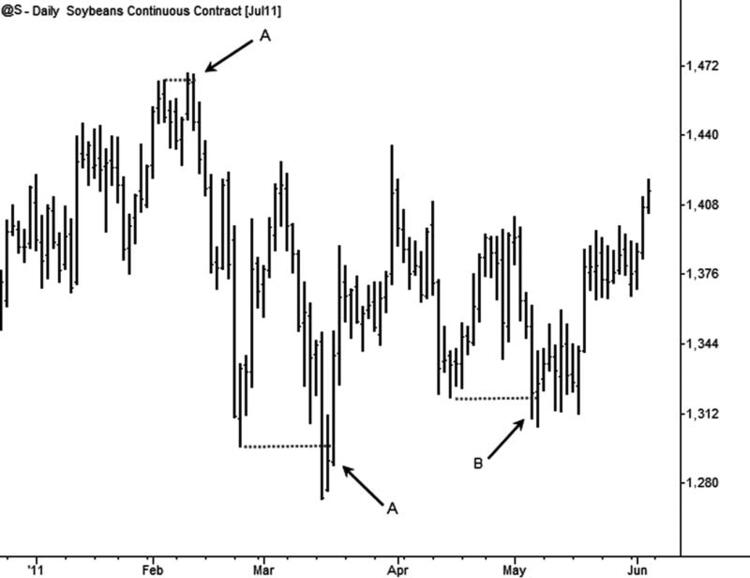

Some Pictures From the art and science of technical analysis book

Table of Contents:

- The Trader’s Edge

- The Market Cycle and the Four Trades

- On Trends

- On Trading Ranges

- Interfaces between Trends and Ranges

- Practical Trading Templates

- Tools for Confirmation

- Trade Management

- Risk Management

- Trade Examples

- The Trader’s Mind

- Becoming a Trader

Frequently Asked Questions

1- Is The Art & Science of Technical Analysis suitable for beginners?

While the book is best suited for intermediate to advanced traders, beginners can still benefit, especially from the glossary, foundational chapters, and step-by-step breakdowns of real-world trading concepts.

2- Does this book only focus on chart patterns and setups?

No. Unlike many technical analysis books, Adam Grimes’s work emphasizes statistical edge, market structure, and behavioral dynamics—showing when patterns actually matter and when they don’t.

3- What does “Market Structure, Price Action, and Trading Strategies” refer to in the book title?

These are the book’s core themes. Grimes deeply explores how market trends evolve, how to interpret price behavior in real time, and how to build actionable trading strategies with measurable performance.

4- What makes this book different from other trading books?

Its realism. This book avoids hype and presents a grounded, research-backed trading approach. It blends data-driven analysis with hard-earned market experience, offering a comprehensive framework rather than recycled strategies.

5- Is the EPUB or PDF version of The Art and Science of Technical Analysis available?

Yes, digital versions like EPUB and PDF are widely available for convenient access across devices, including tablets and e-readers.

6- Who is The Art and Science of Technical Analysis by Adam Grimes written for?

This book is crafted for two main audiences: self-directed traders managing their own or client accounts, and institutional professionals such as portfolio managers or analysts seeking deeper technical insight and psychological edge.

The Art and Science of Technical Analysis: Market Structure, Price Action, and Trading Strategies By Adam Grimes