Price Action Trading: Day-Trading the T-Bonds Off Pat By Bill Eykyn

30.43 $

| Author |

Bill Eykyn |

|---|---|

| Pages |

165 |

| Format |

eBook |

| File Type |

|

What the Book Covers: Price Action Day Trading in T-Bonds

This book is your gateway into the fast-paced world of day trading, with a focus not on lagging indicators or complex formulas, but on what truly matters — raw price action.

At the heart of this approach lies the U.S. 30-Year Treasury Bond Futures, widely known as T-Bonds. Chosen for their exceptional trading characteristics, these instruments offer a rare blend of high liquidity, reliable price movement, and clearly defined behavioral patterns, especially around key support and resistance levels. Best of all, you don’t need an in-depth understanding of bond mechanics to start trading them effectively.

Whether you’re just beginning your trading journey or you’re a market veteran looking for an edge, T-Bonds present consistent, high-quality setups almost every trading day. Combined with a solid money management framework, they open the door to sustainable, repeatable profits.

Inside this book, you’ll discover a hands-on, chart-driven guide built entirely around real market conditions. Every example is taken from live trading screens and presented just as you would have seen them unfold on your own monitor. You won’t just see what happened — you’ll understand why it mattered and exactly how you could have capitalized on each opportunity.

Who This Book is For

Whether you’re a seasoned trader seeking refinement or a newcomer intrigued by the world of discretionary day trading, Price Action Trading: Day-Trading the T-Bonds Off Pat offers a roadmap that speaks to both ends of the spectrum.

If you’ve been disillusioned by rigid mechanical systems and crave a more intuitive, real-time engagement with the markets, this book is built for you. New traders will find a user-friendly gateway into the world of price action, while experienced market participants will appreciate the clarity, depth, and practical examples woven throughout.

Even if you’re just starting out, you won’t feel overwhelmed—this book is designed to guide you step by step, encouraging thoughtful learning and real understanding rather than rushed results.

Inside Bill Eykyn’s Strategy: Step-by-Step Price Action Learning

Bill Eykyn has designed this guide with both efficiency and depth in mind. If you’re a veteran trader, you may find yourself browsing quickly at first, but don’t be surprised if you circle back and discover rich details that are easy to miss at first glance. Newer readers, on the other hand, will immediately recognize from the detailed chart annotations and explanations that this is a hands-on learning experience requiring careful attention.

From start to finish, the structure flows logically: clear trading principles, a straightforward methodology, and a focus on real-time interpretation of price movement—what many call “reading the tape”—all while keeping complexity to a minimum.

But make no mistake—this isn’t some magical shortcut to profits. It’s about building a mindset of discipline, resilience, and consistency. Success comes not from trying to outsmart the market, but from working in sync with its rhythm—aligning yourself with high-probability setups, managing risk smartly, and embracing both wins and losses with composure.

Why Day-Trading the T-Bonds Off Pat Stands Out

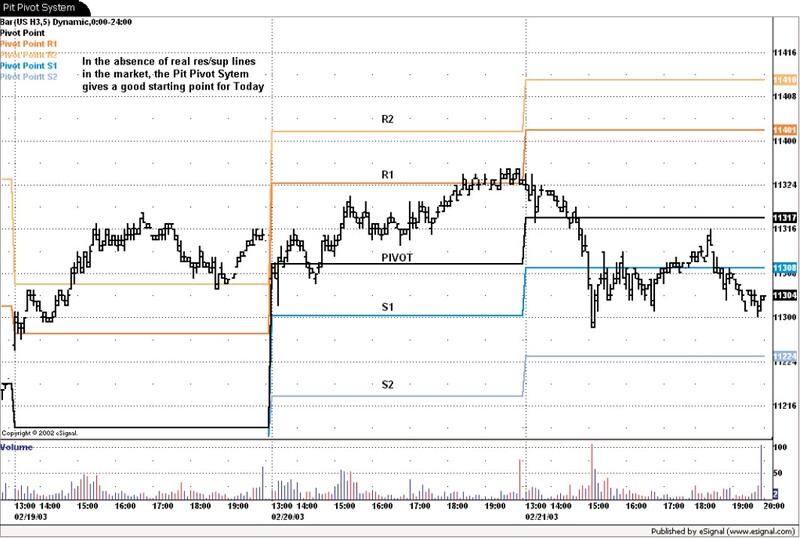

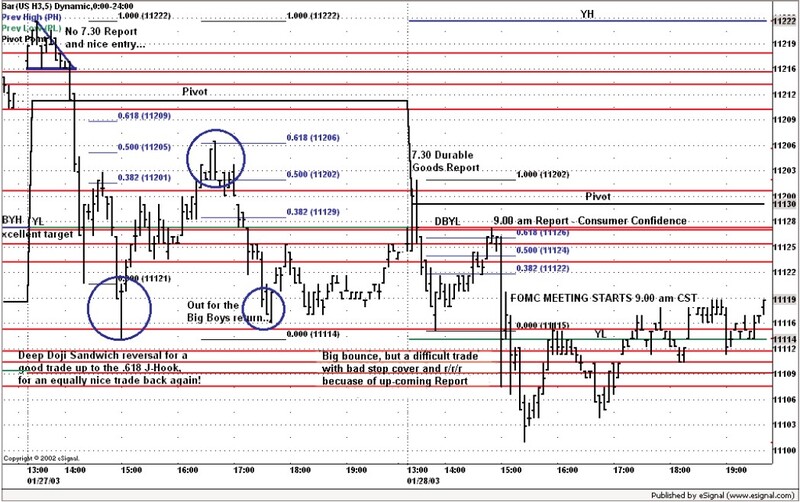

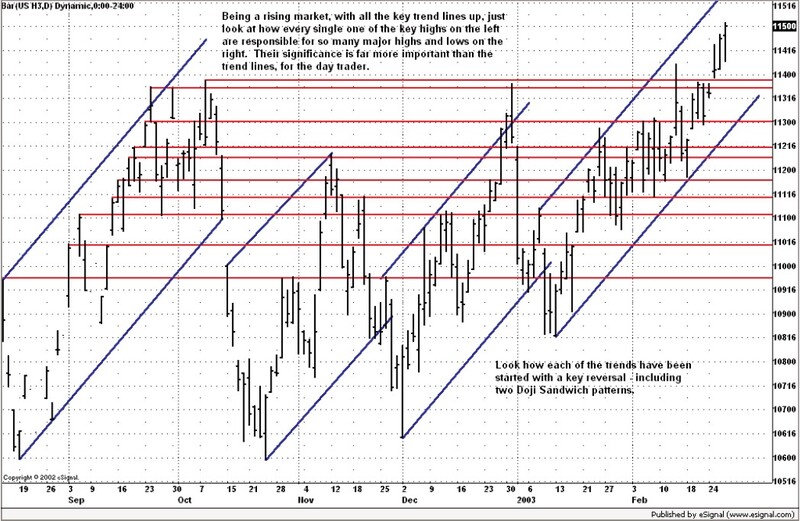

Much like the craft of technical analysis itself, this book is deeply visual. As you’ll quickly notice, the charts aren’t just illustrations—they’re the foundation. Packed with support and resistance lines, each chart serves as a real-world canvas for the strategies discussed throughout the book. While some levels carry more weight than others, all are deliberately included because, when you’re trading live, these are exactly the kinds of reference points you’ll need to see—and use.

Since the majority of charts were captured in real-time, the author openly acknowledges the presence of minor typos or chart quirks that couldn’t be fixed post-capture. Abbreviations are also used throughout, all of which are explained in the included glossary. Where possible, key insights have been embedded directly within the charts; where not, they’re clearly marked and explained within the text.

Bill Eykyn grew up reading books with a clear beginning, middle, and end—and he’s applied that same logical flow to explaining his method. While the amount of information may seem dense, it’s presented in a step-by-step structure that builds naturally. You’ll discover that certain events repeat routinely. Markets might feel random, but the people who operate in them are largely creatures of habit.

For example, major players—what the author calls “the big guys”—tend to step away from their screens at the same time every day for lunch or breaks. Their return to the market? Also like clockwork. Recognizing this behavioral pattern—and understanding what their reentry means for market direction—can offer you a subtle but powerful edge. Surprisingly, very few traders notice it, let alone use it to their advantage.

Day trading successfully requires access to a large, liquid market—one where you can enter and exit freely without drawing attention. The challenge? Most of these markets, like the S&P or FTSE, are highly volatile. Their violent price swings make survival tough for retail traders with limited capital and tighter stop losses.

That’s where the U.S. T-Bond market comes in. As this book demonstrates, Treasury Bonds offer a compelling balance: enough liquidity to trade freely, but moderate enough price movement to avoid the whipsaws of the broader indices. Even better, their pace is often slow and steady—ideal for reading price action and confirming trade setups without feeling rushed.

For intraday traders working on lower timeframes, nothing beats the precision of pure price action. It’s the most timely, forward-looking tool in a trader’s arsenal—far ahead of lagging indicators. When combined with dynamic support and resistance zones, price action opens up a world of opportunity for those willing to observe, interpret, and act.

This book is built around that core philosophy. You’ll learn how to plan your day in advance, execute with the flow of the market, and potentially test your skills using modern methods like spread betting—even with modest capital. The goal? To help you see that the market is readable, navigable, and—if you’re disciplined—consistently tradable.

Some Pictures From t-bond day trading Book

Table of Contents:

- Establishing a home-based trading business

- Choosing your markets

- Setting the scene

- Before the market opens

- The Fibonacci legacy

- Pattern recognition and price action

- Formations, First Fridays and other phenomena

- Risk/Reward ratio

- Low-risk learning

- Doing it all off PAT!

Price Action Trading: Day-Trading the T-Bonds Off Pat By Bill Eykyn