How to Trade with Price Action – Strategies By Galen Woods

9.99 $

| Author |

Galen Woods |

|---|---|

| Pages |

62 |

| Format |

eBook |

| File Type |

|

Price Action Strategies

If you’re ready to move beyond theory and experience real-world price action trading, this book is your next must-read. In How to Trade with Price Action Strategies, seasoned trader Galen Woods shares a practical, structured approach to mastering price behavior. This guide organizes a wide range of strategies based on market structure, candlestick patterns, volatility conditions, and technical tools like moving averages and Bollinger Bands.

You’ll not only learn how price action works, but also how to apply it in live market scenarios with confidence. The strategies are grouped into clear categories—such as candlestick-based setups, trendline techniques, reversal patterns, and volatility-driven entries—giving you a complete framework to grow as a confident, disciplined trader. But what truly sets this book apart is its real-world application.

Galen Woods walks you through actual trade examples in the YM Futures market, showing how theoretical setups translate into real profits—or losses. From identifying high-probability inside bar setups to avoiding false signals in congested markets, you’ll gain sharp insights into how price action plays out in live environments.

This book teaches you how to analyze price action like a pro, plan smart entries, place stop-losses precisely, and target exits based on market structure, not guesswork.

A Quick Glance at the Structure of Price Action Strategies

This book is neatly divided into key sections, each focused on strengthening one core area of price action mastery:

✅ Merging Indicators with Price Action

Learn to combine technical tools like SMA, Bollinger Bands, and MACD with pure price movement for sharper, data-supported trade setups.

✅ Candlestick Patterns & Price Behavior Mastery

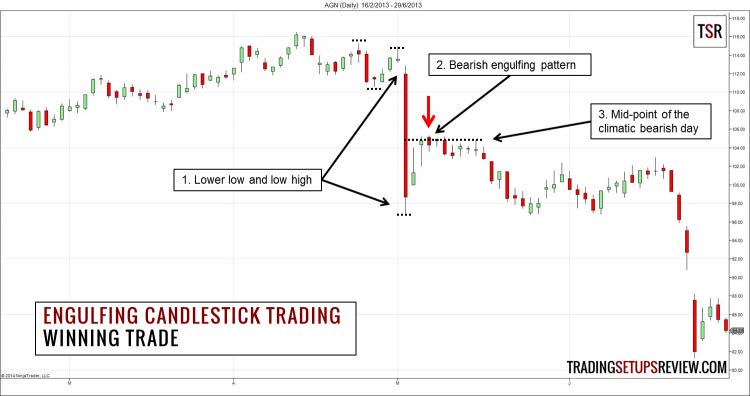

Explore powerful candlestick formations—like engulfing patterns, Hikkake, and Belt Hold—to decode market psychology and trend signals.

✅ Pinpoint Reversal Patterns

Discover proven setups like Pin Bars, Head & Shoulders, and 1-2-3 reversals to catch major turning points with precision.

✅ Turning Market Volatility into Opportunity

Capitalize on volatile conditions with pattern-based entries using Inside Bars, NR7, and Popgun Bars.

✅ Trendlines and Price Channels in Action

Master trend analysis with trendlines, price channels, and tools like Andrew’s Pitchfork for breakout confirmation and structure-based entries.

What You’ll Learn

- How to identify trends and reversals using candlesticks and structure

- Practical intraday strategies using inside bars and moving averages

- How to combine price action with tools like MACD and Bollinger Bands

- The difference between trending markets and congestion zones

- How to set realistic targets and place stops based on price behavior

- Lessons from real winning and losing trades with full analysis

Key Benefits

- Step-by-step training based on real market conditions

- Designed for beginner to intermediate traders

- Includes categorized strategies for different trading styles

- Features actual trade examples with annotated charts

- A great resource to build your own simple and effective system

Real Trade Analysis by the Author

One of the standout features of this book is the hands-on trade analysis shared by Galen Woods. By showcasing actual setups executed in the YM Futures market (Dow Mini) on a 4-minute timeframe, the author demonstrates how to put theory into action.

🟢 A Profitable Bearish Inside Bar Trade

- Price was initially trading above the 21-period SMA.

- A strong bearish candle broke below the SMA, hinting at a potential trend shift.

- After three failed attempts to reclaim the moving average, a bearish inside bar formed.

- The trade was triggered one tick below the inside bar’s low.

- Price dropped smoothly without retesting the SMA.

- The profit target was set at the most recent swing low—a conservative approach that produced a solid 2:1 reward-to-risk ratio.

📌 Outcome: A high-probability setup supported by clear market structure and price behavior—offering positive expectancy and low risk.

Winning Trade – YM Futures Bearish Inside Bar

🔴 A Failed Bullish Inside Bar Trade

- The session opened with price below the SMA.

- Within the first 30 minutes, price climbed back above the SMA, with the first pullback being rejected—suggesting possible bullish continuation.

- However, the market shifted into consolidation: smaller candle bodies and wicks on both sides appeared.

- A bullish inside bar printed during this range.

- A buy order was placed above the high of the inside bar, but was quickly stopped out.

📌 Key Lesson: The market was transitioning into a sideways structure, where setups based on momentum typically fail. No trade should have been taken under these conditions.

Losing Trade – YM Futures Bullish Inside Bar

Technical Insights from the Author

- Inside Bars can be powerful timing tools for entry and risk control—but only when used within a trending environment, not in consolidation.

- Traders must learn to distinguish Inside Bars in trends from those in choppy markets.

- Your target should be at least the most recent swing high or low. If strong momentum is present, targets can be extended using support/resistance zones built from prior pivot points.

✅ Bottom Line: This book doesn’t just teach you the “what” of price action—it shows you the “how” through real trades, thoughtful analysis, and practical application. Whether it’s a textbook example or a failed trade, Galen Woods helps you develop the judgment to know when to pull the trigger—and when to stand aside.

Price Action Strategy Examples – Galen Woods PDF Preview

Table of Contents:

- A Simple Inside Bar Day Trading Strategy Using YM Futures

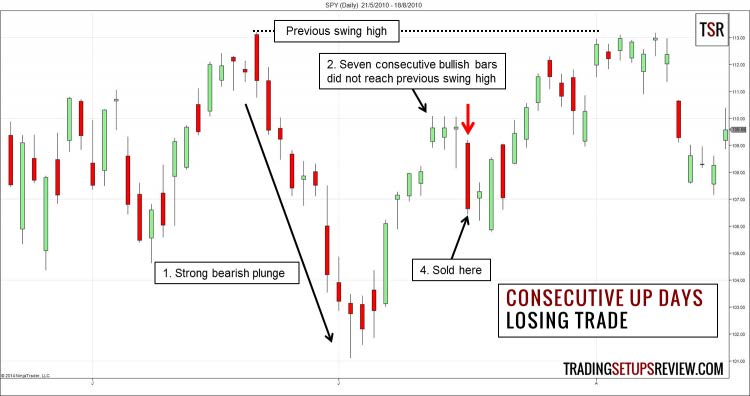

- Trading Consecutive Up/Down Days With Lower Risk

- Three-Bar Reversal Pattern For Day Trading

- NR7 Trading Strategy

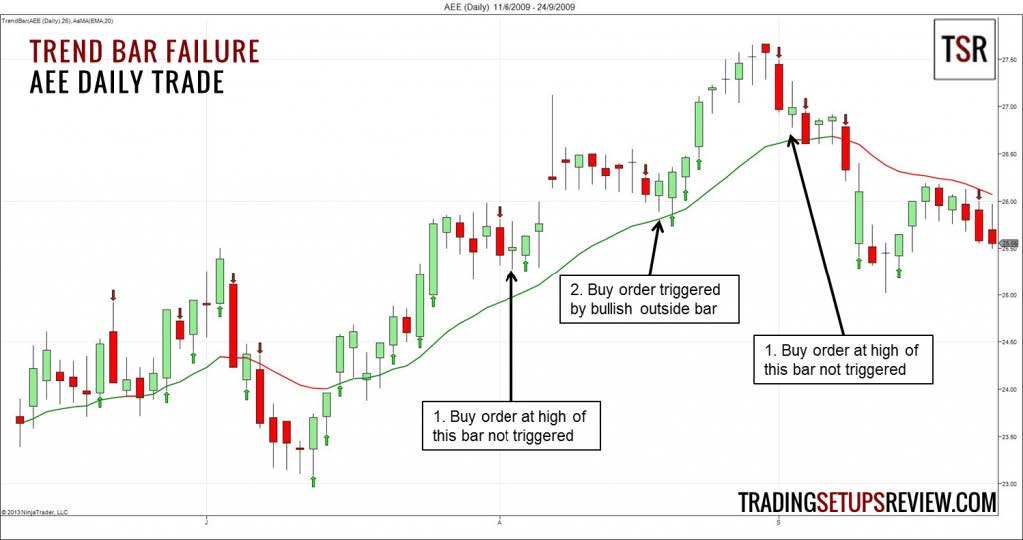

- A Simple and Effective Price Action Trading Setup

- Two-legged Pullback to Moving Average (M2B, M2S)

- Candlestick and Pivot Point Day Trading Strategy

- Trading The Engulfing Candlestick Pattern With Market Structure

- Hikkake Trade Setup

- Capture High Profits with Low Volume Pullback Trading Strategy

If you’re looking for a reliable, structured way to learn real price action trading from an experienced mentor, this book delivers both the theory and hands-on practice to help you trade with clarity and confidence.

How to Trade with Price Action - Strategies By Galen Woods