Articles

Price Action Reversal Setups

Price action provides different reversal setups for traders across all markets. There are several price action reversal setups one can choose from. These include;

- Head and Shoulders Patterns;

- Pin Bar Reversals ;

- Engulfing Bar Reversals

- Outside Bar Reversals

Piercing Patterns and more…to name a few, but we will get into a couple here.

It should be noted a setup alone cannot make profits to a Forex trader, but how one uses the price action strategies for trading it can. A trader can achieve consistent profitability by familiarising themselves with one or more price action reversal setups and mechanising an effective strategy to trade them.

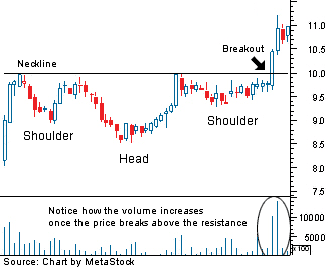

For example, a head-and shoulders pattern is generally considered a reliable top reversal pattern. Many think the reversal pattern is best traded when a breakout of the neckline occurs, but there is a more effective way to trade this pattern, and that is selling near the top of the right shoulder which will usually correspond to a Fibonacci retracement level from the top of the head to the neckline.

An ideal head-and-shoulders reversal has the following volume-price pattern: volume is strong as the left shoulder is formed; volume is normally still strong as the head is formed; volume falls noticeably as the price pushes up to form the peak of the right shoulder.

Figure 1: A chart showing Inverted Head and Shoulder Pattern for volume-price pattern

An engulfing reversal pattern can either have bearish or bullish implications depending on the position it occurs. Thus, we have bearish engulfing pattern and a bullish engulfing pattern appearing at ends of an uptrend and a downtrend respectively. It is characterized by the first day with a small body followed by a large body in the second day which completely engulfs the previous day’s body. The bullish engulfing reversal pattern comprises of two candlesticks, the first dark while the second is light in downtrend. The light candlestick is long enough to engulf the first candlestick and the longer it is the more bullish. The second light candlestick should engulf the first dark body completely.

Figure 2: Graph showing The January 30 engulfing reversal pattern of Wolverine World Wide Inc.

The bearish engulfing reversal pattern has the light candle being first followed by the dark candlestick in an uptrend. The bearish dark candlestick must engulf the first light candle. Hence, the second dark is longer than the light candle. Figure 3: Graph showing The January 21 reversal in Viasys Healthcare Inc

The bullish engulfing reversal pattern occurs after a substantial downtrend. These patterns are strengthened when the volume in the first candlestick is low while volume in the second candlestick is higher.

Price action reversal setups will assist you to determine when the market is likely to reverse a trending or counter-trending move. The setups mentioned above provide directional market signals for trading and possible turning points. Moreover, the price action setups are stronger when they occur at key support and resistance levels. These setups, especially the head and shoulder pattern and the engulfing reversal pattern, are more effective when combined with other price action triggers.