Articles

Impulsive vs. Corrective Moves

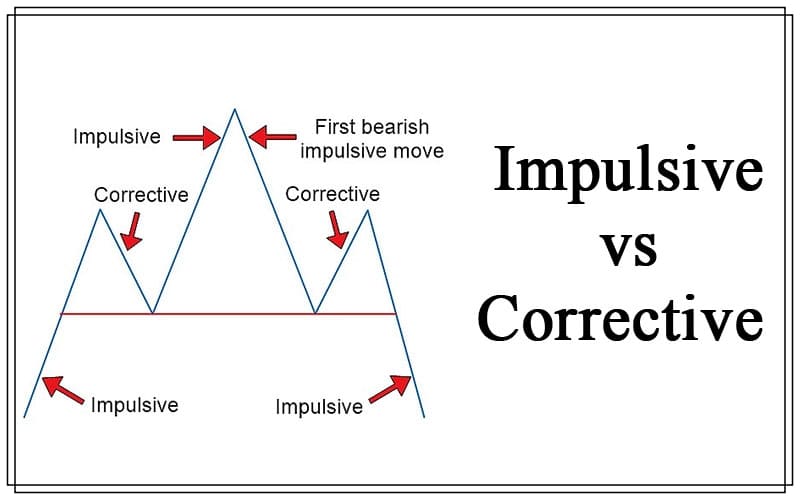

The idea of Impulsive vs Corrective moves stem from one very useful concept of the Elliot wave principle. It was noticed that all market price moves are not equal in size and length and that they could be divided into two sub categories.

1) Impulsive price moves – a market move that is fast and strong with large candles primarily of one color heading in one clear direction either bear or bull, and the close is near the range extreme.

2) Corrective price moves – a market move that is slow and weak with relatively small candles of different colors with an unclear direction and the price closes towards the middle of the range.

The underlying idea is that these two different types of price moves follows an alternating ever continuing pattern in a trend. What it actually shows is the market order flow and how the impulsive moves can be considered heavy in terms of order or transactional flow and the correctional price moves are light in order flow. Or to put it differently, when a price move is impulsive it means that the big players are running the market and that you as a small investor should follow the strong moves with the trend.

It is therefore essential that you trade with the impulsive moves and not against them, looking for a suitable Fibonacci or Pivot level in order to take profits as they can often run much farther than anticipated. Thus, learning to read impulsive price action moves are critical.

Advanced Impulsive vs. Corrective moves

An advanced method for interpreting impulsive vs. corrective moves and developments in the price action are taught in the Advanced Price Action Course, such as ;

Comparative Candles

Rejection Analysis

Pin bar Trading

Inside Bar Trading

Pivot levels

And more…

These above referenced tools are supported statistically by ten years of quantitative data. Of course there are many more, but these are some of the powerful price action forex strategies which can help you to strengthen your ability to interpret price action and thereby increase your edge.

Conclusion

No matter what system or time frame you trade, by understanding price action and learning to read Impulsive vs. Corrective moves, you will increase your edge in the market because you understand what price is doing and why.