Articles

How to Trade With Price Action – Kickstarter

Author’s Note:

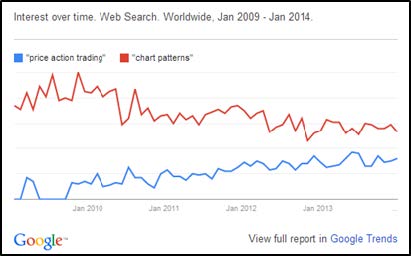

Price action trading is the process of observing market price movement to anticipate future price movement. The purpose is to transact in the market to make a profit. As it uses past and current price action to predict market movement, it is a branch of technical analysis. Traditional technical analysis focuses on chart patterns like double top/bottom, head and shoulders, and flags. However, price action trading is increasingly used as an umbrella term that includes analyzing chart patterns, bar patterns, and candlestick patterns. Look at how search volume in price action trading has increased steadily while searches of chart patterns has fallen.

Price Action versus Chart Patterns in Google Trends

In its current context, price action trading focuses more on short-term bar patterns and candlestick patterns. Some examples include pin bar, inside bar, engulfing candlestick, harami candlestick. Price action trading is often contrasted with indicator trading, which uses mathematically derived formulas to produce trading signals.P ure price action trading excludes the use of any trading indicator. However, price action analysis and trading indicators are not mutually exclusive. In fact, many price action trading strategies include indicators as a complement.

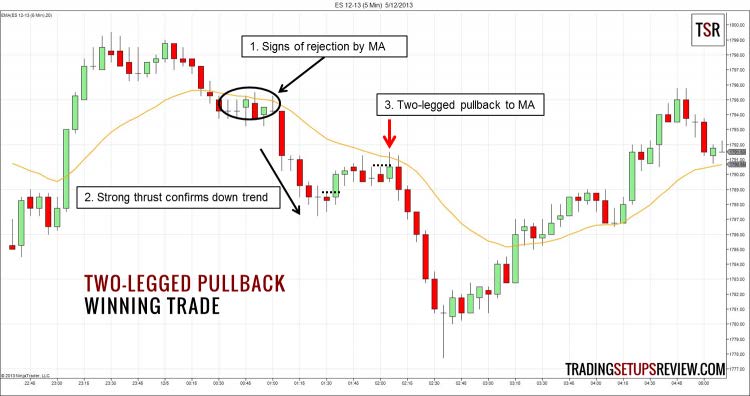

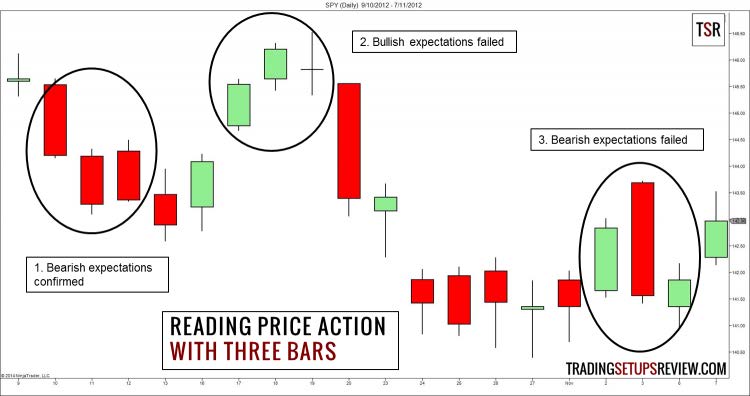

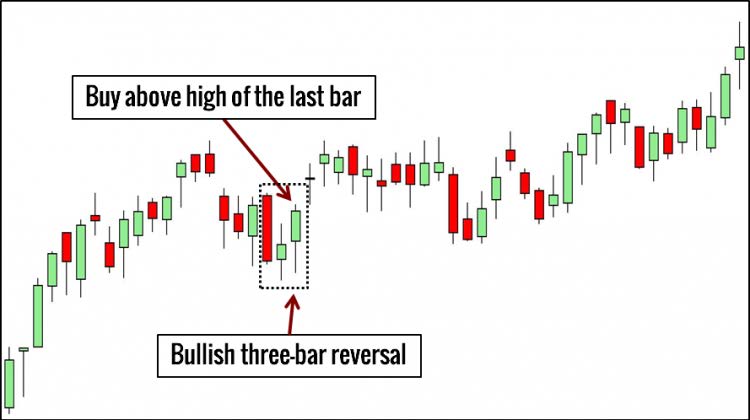

Some Pictures From the Book

Table of Contents:

- Price Action Trading Primer

- Beginner’s Guide To Reading Price Action

- A Beginner’s Guide to Day Trading Futures Using Price Action

- 10 Price Action Bar Patterns You Must Know

- 10 Price Action Candlestick Patterns You Must Know

- 10 Chart Patterns For Price Action Trading

- Price Action Trading Strategies (Beyond Price Patterns

- Instantly Improve Your Trading Strategy with Support and Resistance

- 4 Ways to Trade a Channel

- How to Keep Trading Records as a Discretionary Price Action Trader

How to Trade with Price Action - Kickstarter By Galen Woods