Trading Tips

The Wisdom Of Wyckoff

At the root of all markets are the participants. Human nature does not change and therefore there is...

Are Three-Bar Patterns Reliable For Stocks?

Futures traders often use a three-bar swing low as a reversal pattern, but is the three-bar pattern ...

Triangles And Trends

Building positions is an essential exploitation of a successful trade, and triangle formations can b...

Candlestick Filtering

Using candlestick patterns alone to generate buy and sell signals may be risky. Combining them with ...

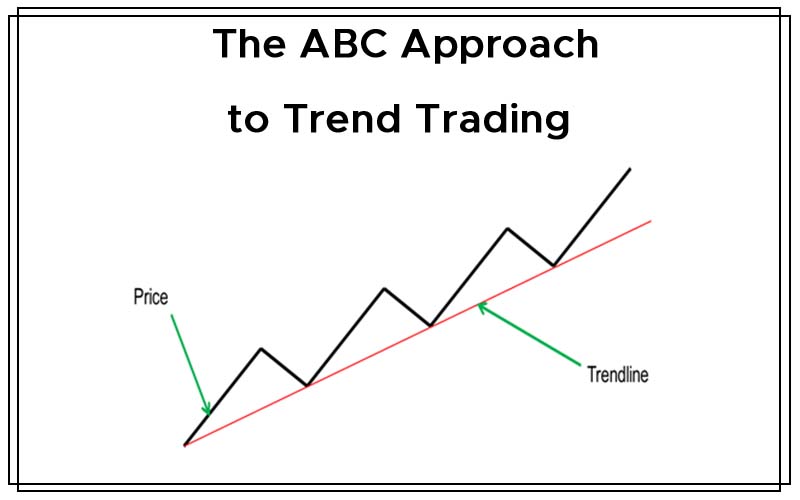

The ABC Approach to Trend Trading

With fundamental releases being the order of the day, the Forex market is ever moving and occasional...

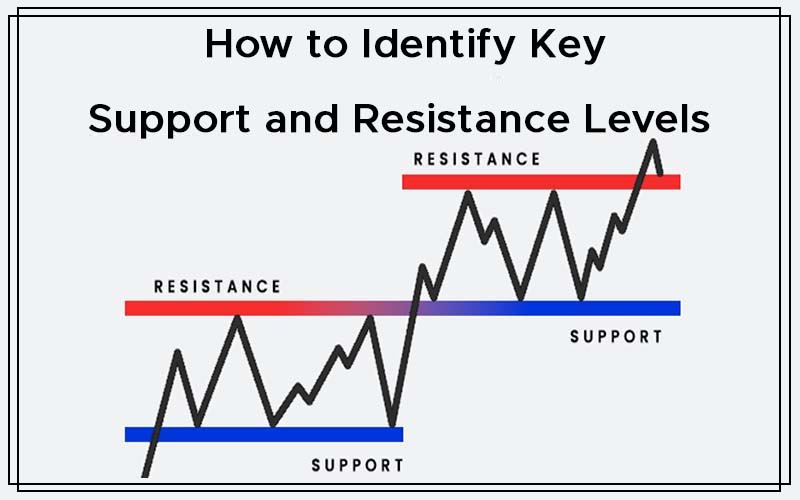

How to Identify Key Support and Resistance Levels

Key Support and Resistance levels are simply regions where the prices on the chart have found it dif...

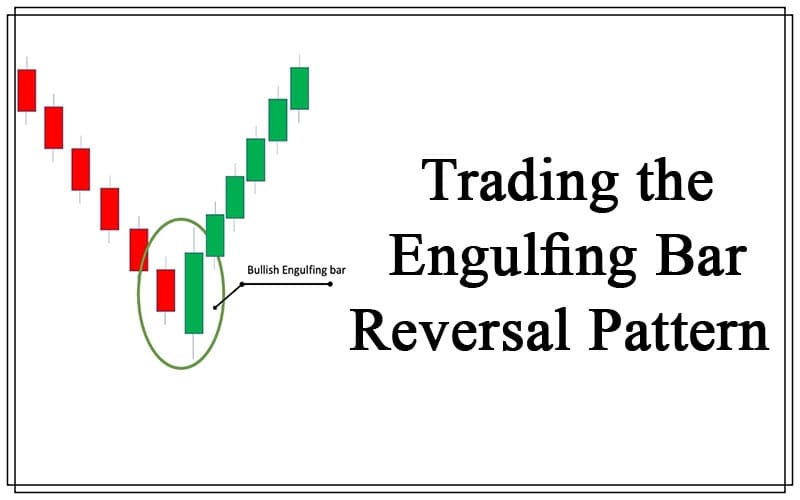

Trading the Engulfing Bar Reversal Pattern

The engulfing bar reversal pattern is one of the important candlestick patterns that traders can use...

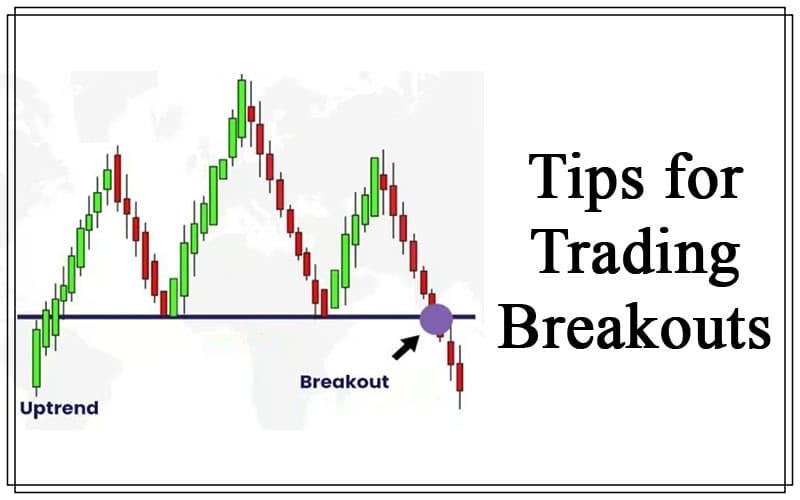

Tips for Trading Breakouts

Trading breakouts can prove to be extremely fruitful. As we all know a breakout occurs when the unde...

How to Trade Forex Using Dynamic Support and Resistance

Evolving or dynamic support and resistance is one topic that has been attracting many questions, esp...

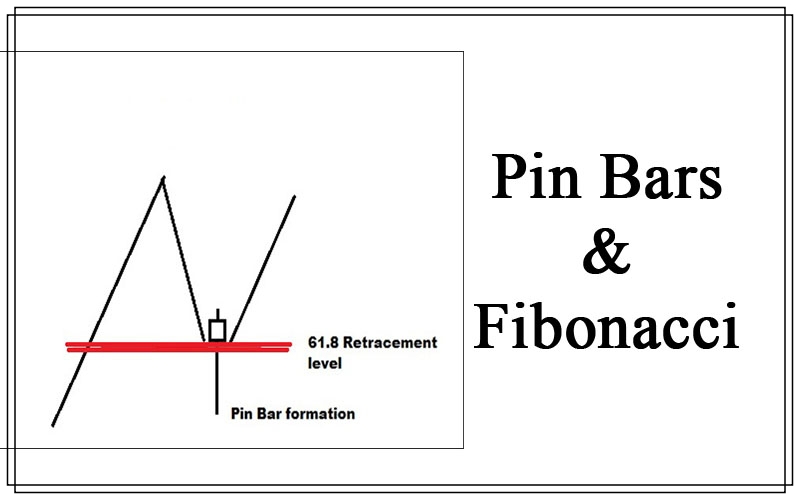

Pin Bars & Fibonacci – A Great Mix

Every trader knows that Pin Bars are an excellent reversal pattern, strongly recommended when a corr...

Price Action Reversal Setups

Price action provides different reversal setups for traders across all markets. There are several pr...

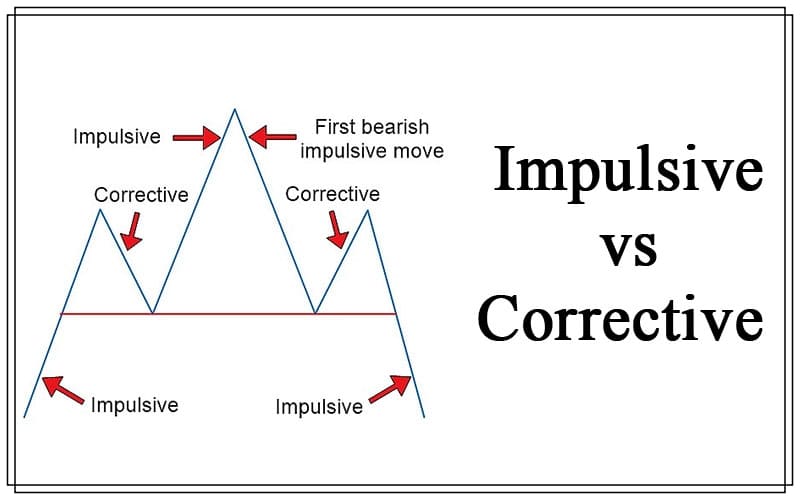

Impulsive vs. Corrective Moves

The idea of Impulsive vs Corrective moves stem from one very useful concept of the Elliot wave princ...