Articles

Encyclopedia of Chart Patterns

In Encyclopedia of Chart Patterns, Thomas Bulkowski updates the classic with new performance statistics for both bull and bear markets and 23 new patterns, including a second section devoted to ten event patterns. Bulkowski tells you how to trade the significant events — such as quarterly earnings announcements, retail sales, stock upgrades and downgrades — that shape today?s trading and uses statistics to back up his approach. This comprehensive new edition is a must-have reference if you’re a technical investor or trader.

The Encyclopedia of Chart Patterns, recognized as the premier reference on chart pattern analysis, extends its lead with this Second Edition. This definitive text includes new bull and bear market statistics, performance sorted by volume shape and trend, more than a dozen additional chart patterns, and a new section covering ten event patterns. Significant events—such as earnings announcements, stock upgrades and downgrades—shape today’s trading, and Bulkowski gives readers the best information on what happens after those events occur. He also shows you how to trade them and uses reliable statistics to back it all up.

In each chapter of Encyclopedia of Chart Patterns, Second Edition you’ll learn the following about each pattern:

- Results Snapshot—A statistical summary of pattern behavior, including its performance rank, breakeven failure rate, average rise or decline—all separated by breakout direction and market type (bull or bear)

- Tour—A broad introduction to the pattern

- Identification Guidelines— Characteristics to look for

- Focus on Failures—What failed patterns look like, why they failed, and how to avoid them

- Statistics—The numbers and what they tell you, separated into bull/bear markets and breakout direction, including average rise or decline, failure rates, volume shapes, performance by size, and busted pattern performance

- Trading Tactics—Strategies to increase profits and minimize risk

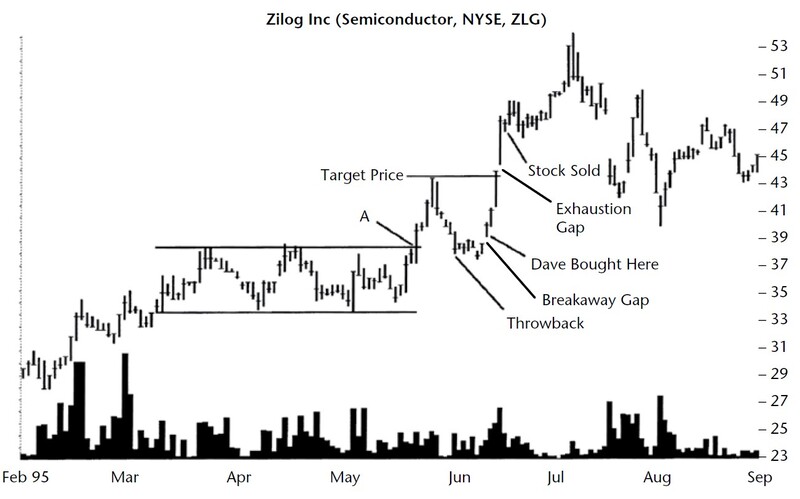

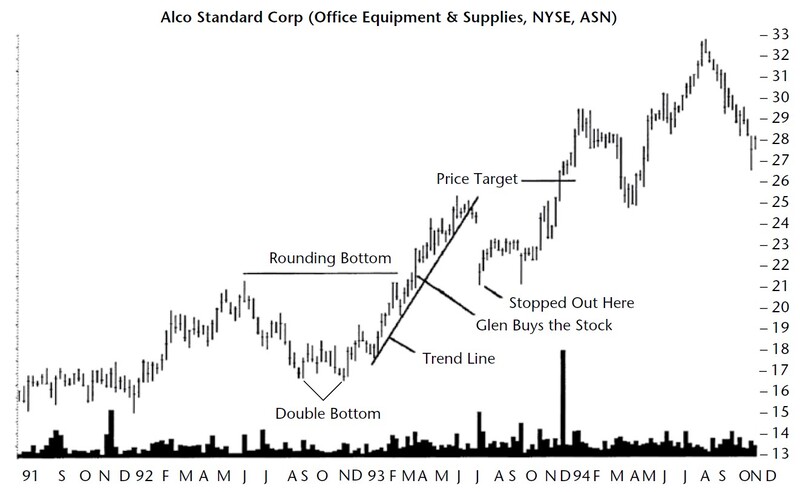

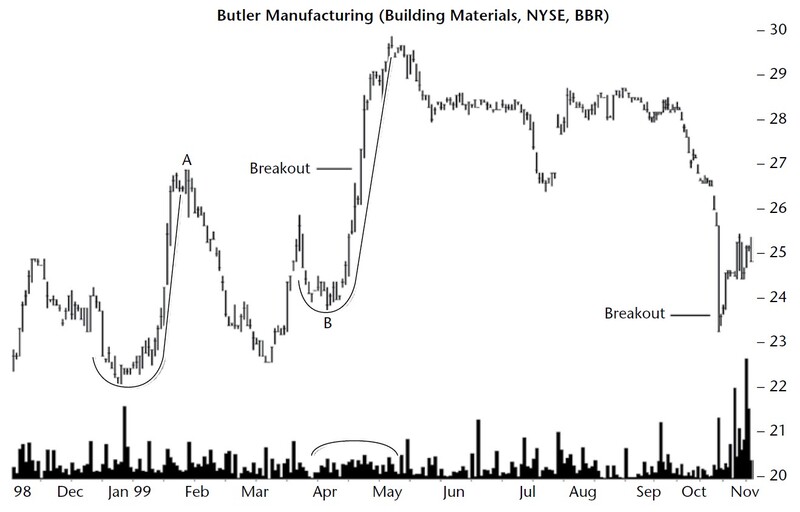

- Sample Trade—Puts it all together, showing the chart pattern in action, with hypothetical or actual trades using real data

- For Best Performance—A table of selection tips to boost performance

Encyclopedia of Chart Patterns, Second Edition also includes summary tables ranking chart- and event-pattern performance for easy reference; a glossary; a chapter on methodology explaining what each statistical table entry means and how it was calculated; and a visual index to make chart pattern identification a snap.

The result is today’s most comprehensive and valuable technical analysis reference—one that will save you critical time in identifying chart patterns and increase your likelihood of buying near the price bottom and selling near the top.

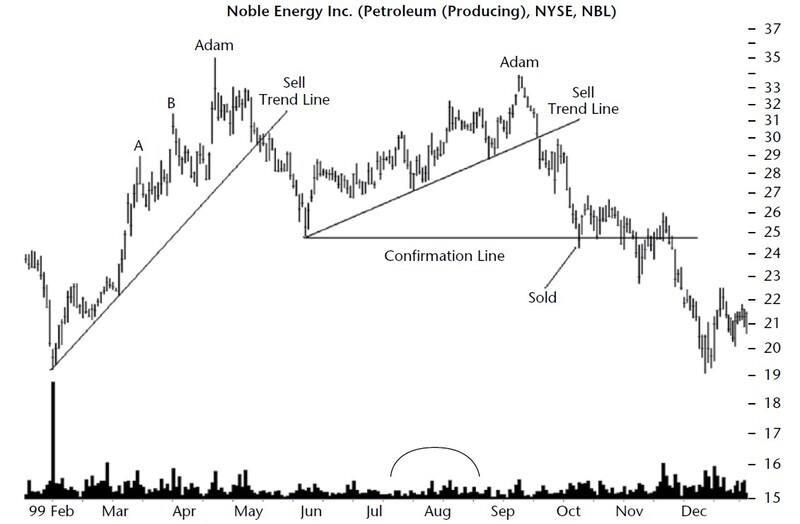

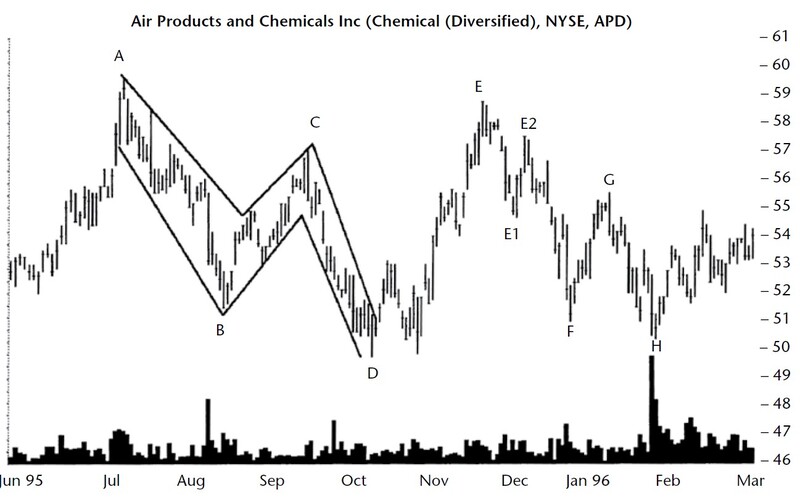

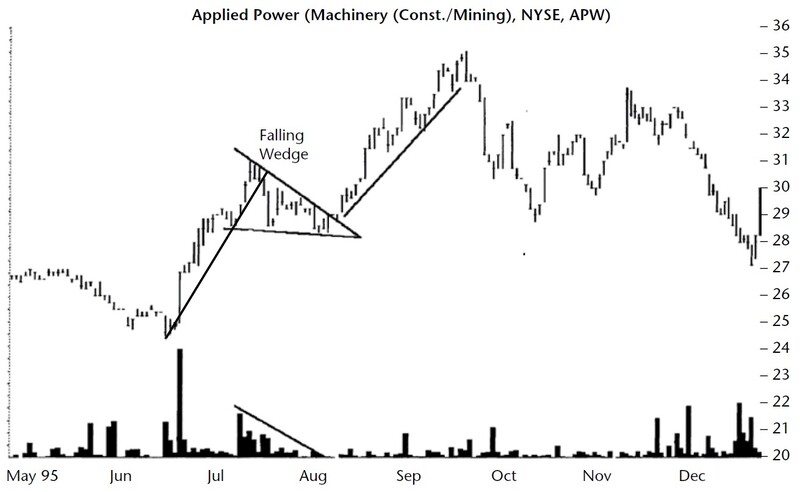

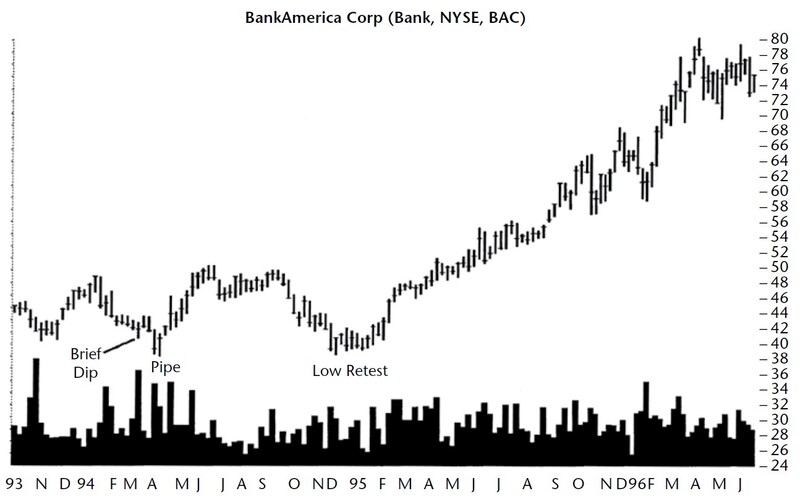

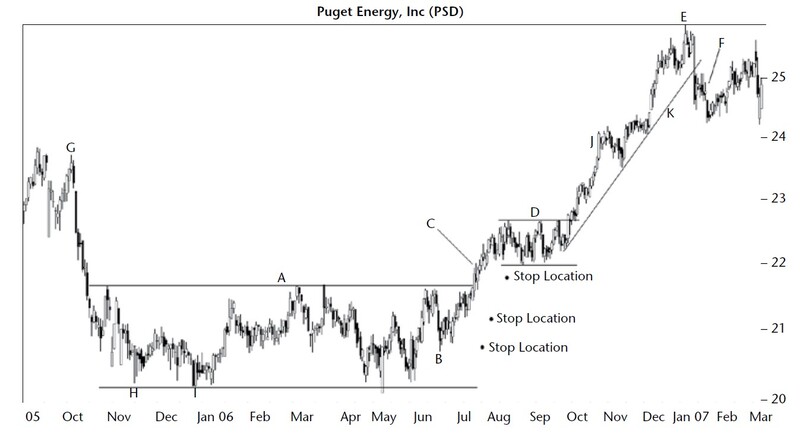

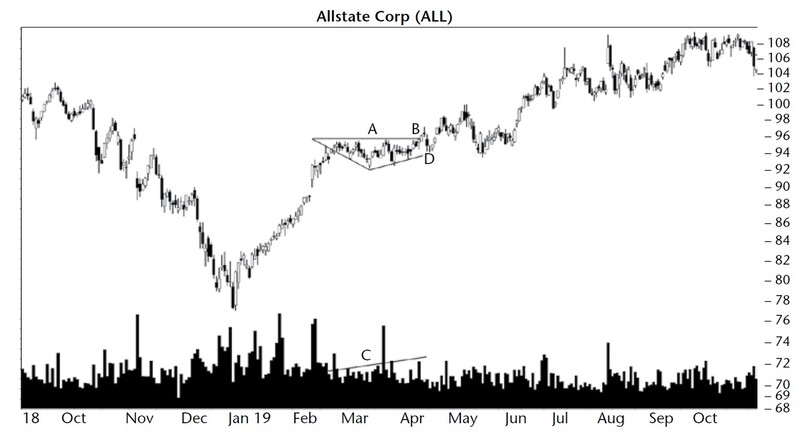

Some Pictures From the Book

Table of Contents:

- 1 How to Trade Chart Patterns

- 2 AB=CD®, Bearish

- 3 AB=CD®, Bullish

- 4 Bat®, Bearish

- 5 Bat®, Bullish

- 6 Big M

- 7 Big W

- 8 Broadening Bottoms

- 9 Broadening Formation, Right-Angled and Ascending

- 10 Broadening Formation, Right-Angled and Descending

- 11 Broadening Tops

- 12 Broadening Wedge, Ascending

- 13 Broadening Wedge, Descending

- 14 Bump-and-Run Reversal, Bottom

- 15 Bump-and-Run Reversal, Top

- 16 Butterfly®, Bearish

- 17 Butterfly®, Bullish

- 18 Cloudbanks

- 19 Crab®, Bearish

- 20 Crab®, Bullish

- 21 Cup with Handle

- 22 Cup with Handle, Inverted

- 23 Diamond Bottoms

- 24 Diamond Tops

- 25 Diving Board

- 26 Double Bottoms, Adam & Adam

- 27 Double Bottoms, Adam & Eve

- 28 Double Bottoms, Eve & Adam

- 29 Double Bottoms, Eve & Eve

- 30 Double Tops, Adam & Adam

- 31 Double Tops, Adam & Eve

- 32 Double Tops, Eve & Adam

- 33 Double Tops, Eve & Eve

- 34 Flags

- 35 Flags, High and Tight

- 36 Gaps

- 37 Gartley, Bearish

- 38 Gartley, Bullish

- 39 Head-and-Shoulders Bottoms

- 40 Head-and-Shoulders Bottoms, Complex

- 41 Head-and-Shoulders Tops

- 42 Head-and-Shoulders Tops, Complex

- 43 Horn Bottoms

- 44 Horn Tops

- 45 Island Reversals

- 46 Measured Move Down

- 47 Measured Move Up

- 48 Pennants

- 49 Pipe Bottoms

- 50 Pipe Tops

- 51 Rectangle Bottoms

- 52 Rectangle Tops

- 53 Roof

- 54 Roof, Inverted

- 55 Rounding Bottoms

- 56 Rounding Tops

- 57 Scallops, Ascending

- 58 Scallops, Ascending and Inverted

- 59 Scallops, Descending

- 60 Scallops, Descending and Inverted

- 61 Three Falling Peaks

- 62 Three Peaks and Domed House

- 63 Three Rising Valleys

- 64 Triangles, Ascending

- 65 Triangles, Descending

- 66 Triangles, Symmetrical

- 67 Triple Bottoms

- 68 Triple Tops

- 69 V-Bottoms

- 70 V-Bottoms, Extended

- 71 V-Tops

- 72 V-Tops, Extended

- 73 Wedges, Falling

- 74 Wedges, Rising

- 75 Wolfe Wave®, Bearish

- 76 Wolfe Wave®, Bullish

Encyclopedia of Chart Patterns By Thomas N. Bulkowski