Articles

Trading Price Action Trading Ranges: Technical Analysis of Price Charts Bar By Bar for the Serious Trader

In order to put his methodology in perspective, Brooks examined an essential array of price action basics and trends in the first book of this series, Trading Price Action Trends; provides important insights on trading ranges, breakouts, order management, and the mathematics of trading in this current book Trading Price Action Trading Ranges; and then moves on to discuss trend reversals, day trading, daily charts, options, and the best setups for all time frames in the third, and final, book of this series, Trading Price Action REVERSALS.

Divided into five comprehensive parts, Trading Price Action Trading Ranges skillfully addresses how to spot and profit from trading ranges―which most markets are in, most of the time―using the technical analysis of price action. Along the way, it touches on some of the most essential aspects of this approach, including:

- Trading breakouts, which are transitions from trading ranges to trends, and understanding the gaps they create

- The two types of “Magnets,” Support and Resistance, and what they mean once the market breaks out and begins its move

- Pullbacks, which are transitions from trends to trading ranges

- The characteristics commonly found in trading ranges―areas of largely sideways price activity―and examples of how to trade them

- Honing your order and trade management skills so that you can make more informed entry and exit decisions

- And much more

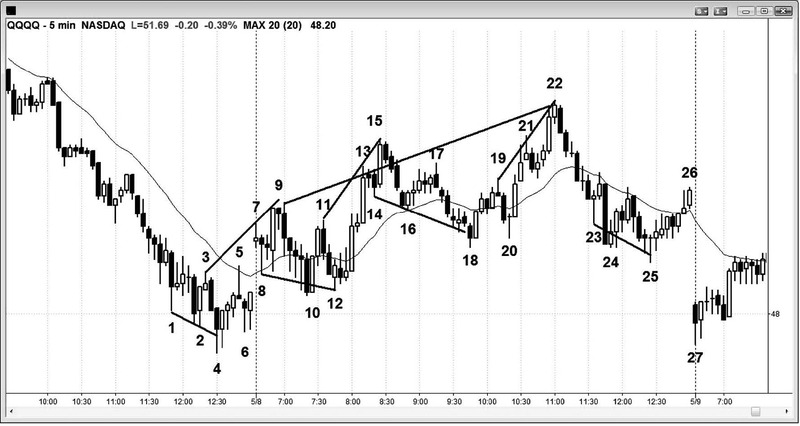

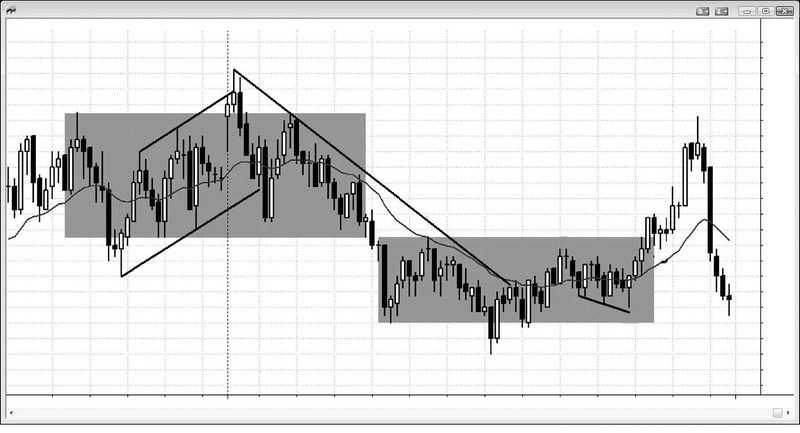

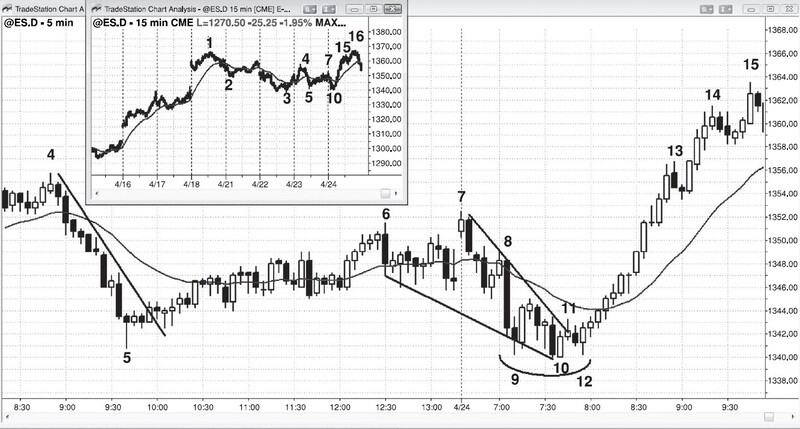

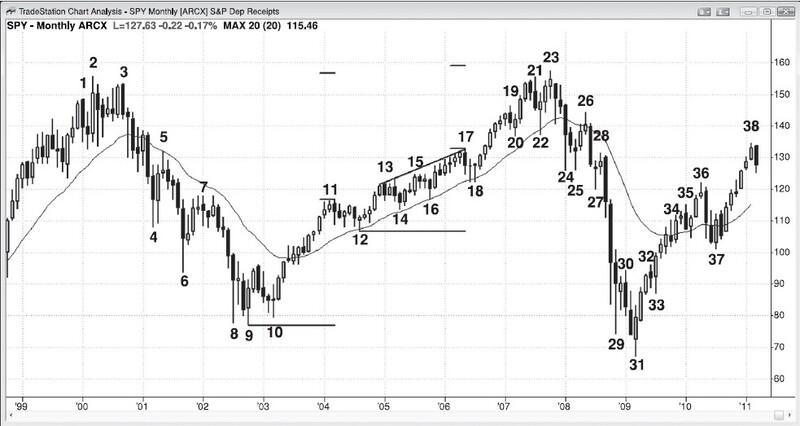

Throughout the book, Brooks focuses primarily on 5 minute candle charts―all of which are created with TradeStation―to illustrate basic principles, but also discusses daily and weekly charts. And since he trades more than just E-mini S&P 500 futures, Brooks also details how price action can be used as the basis for trading stocks, forex, Treasury Note futures, and options. For your convenience, a companion website, which can be found atwiley.com/go/tradingtrends, contains all of the charts provided in the book.

Trading is a rewarding endeavor, but it’s hard work and requires relentless discipline. To succeed, you have to stick to your rules and avoid emotion―and you have to patiently wait to take only the best trades. Understanding, and utilizing, the information found in Trading Price Action Trading Ranges is the next logical step to achieving this goal. With this guide, and the other two books in the series, you’ll discover how to develop the patience and discipline to follow a sound system, and reap potentially huge financial rewards in the process.

Some Pictures From the Book

Table of Contents:

- CHAPTER 1 Example of How to Trade a Breakout

- CHAPTER 2 Signs of Strength in a Breakout

- CHAPTER 3 Initial Breakout

- CHAPTER 4 Breakout Entries in Existing Strong Trends

- CHAPTER 5 Failed Breakouts, Breakout Pullbacks, and Breakout Tests

- CHAPTER 6 Gaps

- CHAPTER 7 Measured Moves Based on the Size of the First Leg (the Spike)

- CHAPTER 8 Measured Moves Based on Gaps and Trading Ranges

- CHAPTER 9 Reversals Often End at Signal Bars from Prior Failed Reversals

- CHAPTER 10 Other Magnets

- CHAPTER 11 First Pullback Sequence: Bar, Minor Trend Line, Moving Average, Moving Average Gap, Major Trend Line

- CHAPTER 12 Double Top Bear Flags and Double Bottom Bull Flags

- CHAPTER 13 Twenty Gap Bars

- CHAPTER 14 First Moving Average Gap Bars

- CHAPTER 15 Key Inflection Times of the Day That Set Up Breakouts and Reversals

- CHAPTER 16 Counting the Legs of Trends and Trading Ranges

- CHAPTER 17 Bar Counting: High and Low 1, 2, 3, and 4 Patterns and ABC Corrections

- CHAPTER 18 Wedge and Other Three-Push Pullbacks

- CHAPTER 19 Dueling Lines: Wedge Pullback to the Trend Line

- CHAPTER 20 “Reversal” Patterns: Double Tops and Bottoms and Head and Shoulders Tops and Bottoms

- CHAPTER 21 Example of How to Trade a Trading Range

- CHAPTER 22 Tight Trading Ranges

- CHAPTER 23 Triangles

- CHAPTER 24 Scalping, Swinging, Trading, and Investing

- CHAPTER 25 Mathematics of Trading: Should I Take This Trade? Will I Make Money If I Take This Trade?

- CHAPTER 26 Need Two Reasons to Take a Trade

- CHAPTER 27 Entering on Stops

- CHAPTER 28 Entering on Limits

- CHAPTER 29 Protective and Trailing Stops

- CHAPTER 30 Profit Taking and Profit Targets

- CHAPTER 31 Scaling Into and Out of a Trade

- CHAPTER 32 Getting Trapped In or Out of a Trade

Trading Price Action Trading Ranges: Technical Analysis of Price Charts Bar by Bar for the Serious Trader By Al Brooks