Articles

Price Action Trading: Day-Trading the T-Bonds Off Pat

What the book covers:

This book is about day trading. Using the price action itself, rather than any of the usual array of indicators based on it. The US 30-year Treasury Bond Futures is the favoured instrument – the T-Bonds, as they are commonly called. There are good reasons for choosing this instrument to learn to trade – one being that they do not require a detailed knowledge of bonds themselves. The other attractions, whether you are a beginner or a seasoned veteran, are to do with liquidity, range, behaviour, patterns and the price action displayed at the key support and resistance points it encounters.

Most days the T-bonds offer trading opportunities which can be taken within a money management environment that can give you an edge for profit – and this book has been designed to show you how to do just that. Fully illustrated with charts taken from a live trading screen and displayed in exactly the way you would have seen them for yourself, on your computer monitor. What you see is not just what happened, in detail, but also clear evidence of just how you could have profited yourself from each trading situation.

Who the book is for:

This book has been written for anyone wishing to day trade, using a discretionary method, rather than a mechanical system. It is a learning tool which should commend itself to the experienced trader, as much as to someone new to this business. Certainly I hope that any raw recruit would find it an easy read, even if it took a while longer to digest the subject matter as a whole.

How the book is structured:

The seasoned trader will probably start by skip reading, to see if he can cut to the chase quickly. The less experienced will immediately see – from the detail of the charts alone – that there is a great deal of information to absorb, and will have to start at the beginning! After that, wherever you place yourself as a trader, I hope you will find that the methodology is pretty straightforward, the approach you need to adopt clear-cut, and the various steps involved in the process uncomplicated.

It has to be said that there is nothing amazing or wonderful in learning to read the tape – for that, albeit in a computer environment, is what this methodology is all about – and the key to success in so doing, is in the application of a robust risk/reward/ratio. This means that the successful exponent of the art-cum-science of discretionary trading, in this particular way, has to have a mindset that can take the winning and the losing with complete equanimity. It is not easy. It is not for everyone. But . . . those who can learn how the market works and learn to go with the flow, putting the odds on their side, stand a good chance of creating the essential edge to win.

Those who already day trade in discretionary fashion will hopefully gain pointers here and there and find, as we all know, that it often takes just one pearl gained to make the trawl an eminently worthwhile exercise. Those who come to this book with little or no experience will gain from their lack of preconception, even if it takes a lot of reading and re-reading to get up to speed on the computer, with live charts.

Introduction:

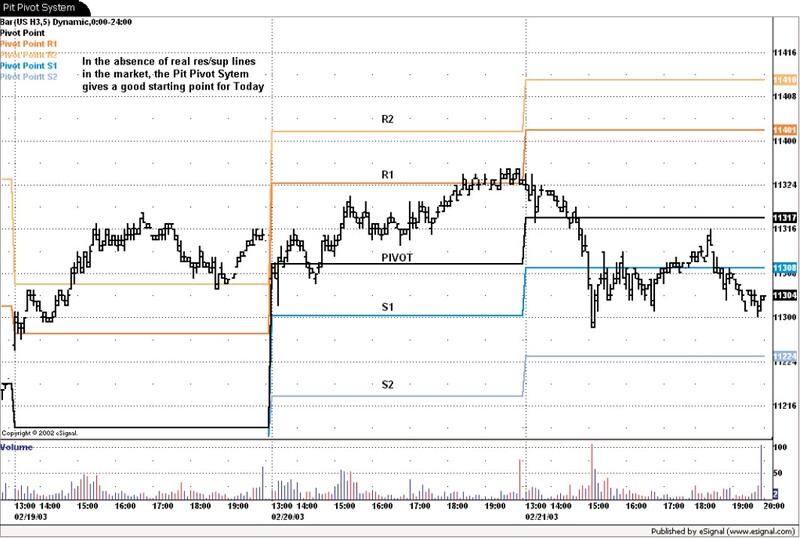

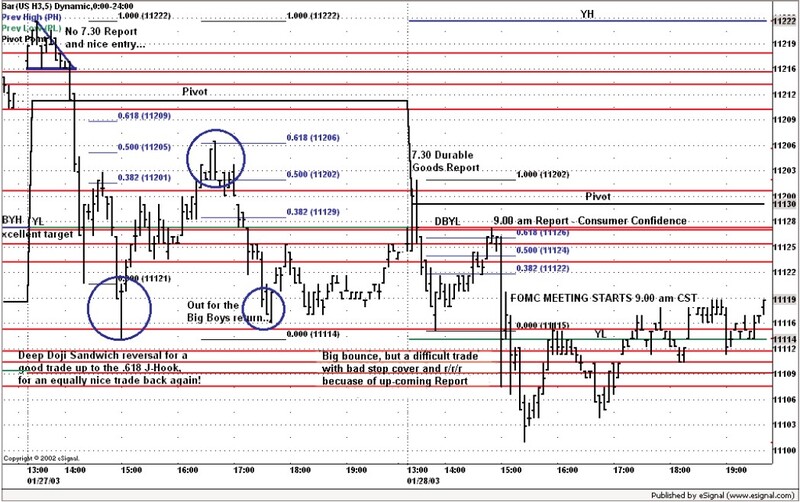

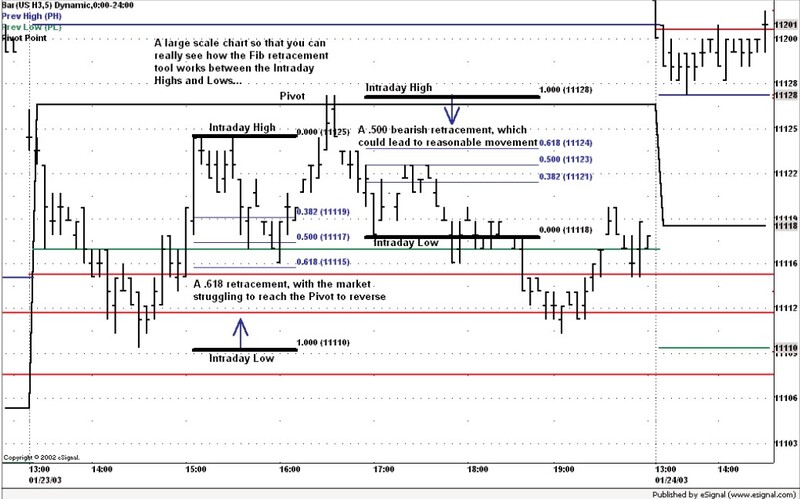

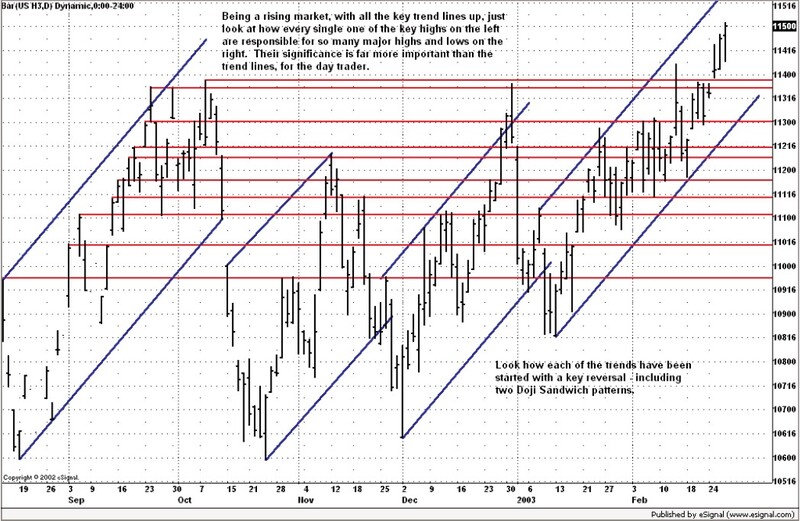

In exactly the same way that the chartist’s work is highly visual, so too is this book. The charts, as you will see, are crowded with lines: Resistance and Support lines. They play a key role in the trading methodology and, therefore, play a key part in this book. While some are more important than others, all lines have to appear in most of the charts, if only because that is how you will actually see and use them when it comes to trading in this way.

Since most of the charts have been updated in real time, I apologise now for any typing errors or other mistakes in the text, because they are very difficult to change afterwards. Obviously, I have had to use abbreviations and they have been incorporated in the glossary. When practical, I have tried to get all the information on the chart and, where it is impossible, I have had to use the text within the page, duly referenced.

Having been brought up with the concept of a book having a beginning, a middle and an end, I have tried to explain my methodology in that way. There is an awful lot of information to absorb, but at least the subject does have a very logical sequence of events. It is important to understand this and appreciate that certain things happen, or have to be done, as a matter of routine. The markets may be random, but the humans involved in it are for the most part creatures of habit. For example, every day at about the same time the Big Boys, as I call them, leave the pits and go for their lunch – or brunch! Their return is like clockwork. You can almost set your watch by them. Knowing this is vital information, and the significance of their return and how they act can help you to make money. But you would be surprised how few traders know about this – let alone how to take advantage of it, even though it happens every single day.

To day trade successfully, it is essential to have a large, liquid market, which you can dip in and out of, without being noticed. The trouble is that such markets – like the S&P or the FTSE – are also very volatile and are renowned for their wild swings. This makes it very difficult for the smaller trader to stay alive long enough to reap the rewards. Small people simply cannot afford big stops; for them, the market has to be of temperate volatility and within a smaller average range, as well as being large and liquid.

This is precisely what the T-Bonds are all about. As you will see, the instrument is ideally suited to the smaller trader who wants to day-trade. Furthermore, the market does, in my view, move generally at a pace which can be read and confirmed, most of the time – and certainly in time to place trades in an ordered fashion.

For the day trader, working in small time frames, there is no doubt that price action is the king. It is the leading indicator. There is nothing more up-to-date, on the mark, or a better gauge of what is likely to happen next. All of the other commonly-used indicators lag the market. It is using this fact, within various different time frames, set against the resistance and support in the market, which will produce trading opportunities for the astute observer of price patterns.

Price action is the very essence of day trading and the rationale of this book. You will see exactly how to lay out your stall before the day starts and then trade in tune with the market; hopefully you will be able to see how the market can be read and traded and, if you like, through the new(ish!) concept of spread betting test out the methodology in the market with very little capital involved.

Some Pictures From the Book

Table of Contents:

- Establishing a home-based trading business

- Choosing your markets

- Setting the scene

- Before the market opens

- The Fibonacci legacy

- Pattern recognition and price action

- Formations, First Fridays and other phenomena

- Risk/Reward ratio

- Low-risk learning

- Doing it all off PAT!

Price Action Trading: Day-Trading the T-Bonds Off Pat By Bill Eykyn