Articles

Forex Price Action Scalping: An In-Depth Look Into the Field of Professional Scalping

Forex Price Action Scalping provides a unique look into the field of professional scalping. Packed with countless charts, this extensive guide on intraday tactics takes the reader straight into the heart of short-term speculation. The book is written to accommodate all aspiring traders who aim to go professional and who want to prepare themselves as thoroughly as possible for the task ahead. Few books have been published, if any, that take the matter of scalping to such a fine and detailed level as does Forex Price Action Scalping. Hundreds of setups, entries and exits (all to the pip) and price action principles are discussed in full detail, along with the notorious issues on the psychological side of the job, as well as the highly important but often overlooked aspects of clever accounting.

Author’s Note:

Ever since the days of old, the markets have suffered no shortage of volunteers ready to sacrifice themselves on the ever-growing battlefields of supply and demand. Fortune-hunters, plungers, gamblers, misfits, and a motley crew of optimists and adventurers, all have roamed, and will continue to roam, the marketplace in search for quick-and-easy gains. Yet no other venture has led to more carnage of capital, more broken dreams and shattered hopes, than the act of reckless speculation.

Strangely enough, despite the ill-boding facts and the painful fate of all those who perished before him , the typical trader still shows up on the scene wholly unprepared. And those who do take the trouble to build themselves a method, in most instances seem to only postpone their inevitable fall. On the slippery slope of the learning curve, things can get pretty unpleasant and many never recover from the tuition bills presented on the job. Not surprisingly, this has led to an endless debate on the actual feasibility of profitable trading, in which skeptics and romantics fight out a battle of their own.

To the skeptic, no doubt, the glorified image of a consistently profitable trader seems highly suspect. After all, the only ones who have always prospered in the trading field, at the expense of the ignorant, are brokers, vendors and clever marketeers. And if it is already hard to picture himself a proficient long-term investor surviving the odds, then, surely, the idea of a consistently profitable scalper must be bordering on the idiotic. To see the skeptic’s point, one only needs to follow the route of common logic: in a line of business where so many traders have tried, and failed, to successfully trade the long-term charts, those venturing out on the miniature frames can only be setting themselves up for an even uglier fate, and a faster one at that. And indeed, the shorter the time frame, the more erratic the moves on the chart; and with spreads and commissions cutting deep into a scalper’s average trade, the odds seem stacked against the enterprise from the very onset. Success stories are few and far between and it’s hard to not take note of the sobering statistics that appear to confirm all reservations, at least way more than defy them.

That being said, skeptics and statistics, of course, should never demoralize the dedicated. Scalping the charts profitably on a consistent basis is by no means an illusion. Nor does it have to take years to acquire the necessary skills. It is done every day again by many traders all over the markets, and it can be done by anyone who is determined to educate himself properly and diligently in all aspects of the field. The true issue is not the feasibility of profitable scalping but simply the quality of one’s education. Even so , scalping may not be for everyone. If nothing else, this book could be an excellent way to find out. Its sole objective is to show the reader all there is to know about the profession to effectively take on the job himself. Countless charts, setups and trade examples will be presented to fully ingrain the necessary techniques into the mind.

The contract of focus in all of the coming chapters will be the eur / usd currency pair. To a nimble scalper, this instrument is an absolute delight. It offers highly repetitive intraday characteristics, a low dealing spread and is accessible to even the smallest of traders; however, since price action principles are quite universal, not too many adjustments would have to be made to take the method to another market with similar volatility and attractive trading costs. In that respect, this guide may serve many non-Forex traders as well. The benefits of scalping are plenty and speak for themselves. Just one single chart. No fancy indicators. One-click in and out. Everything preset. And opportunities abound in an almost repetitive loop.

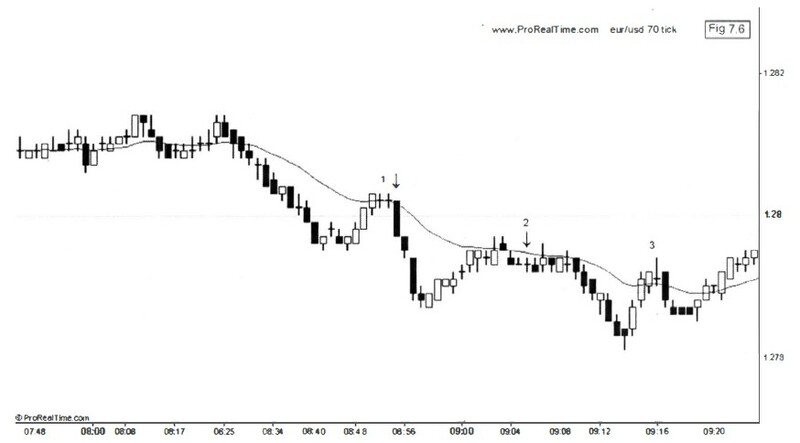

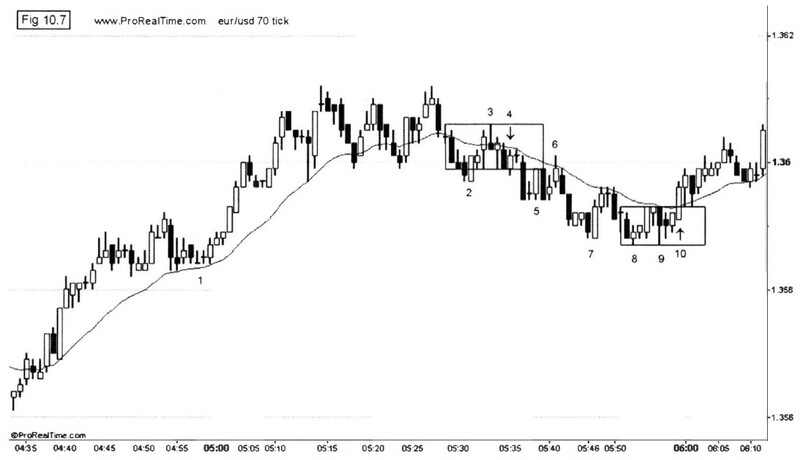

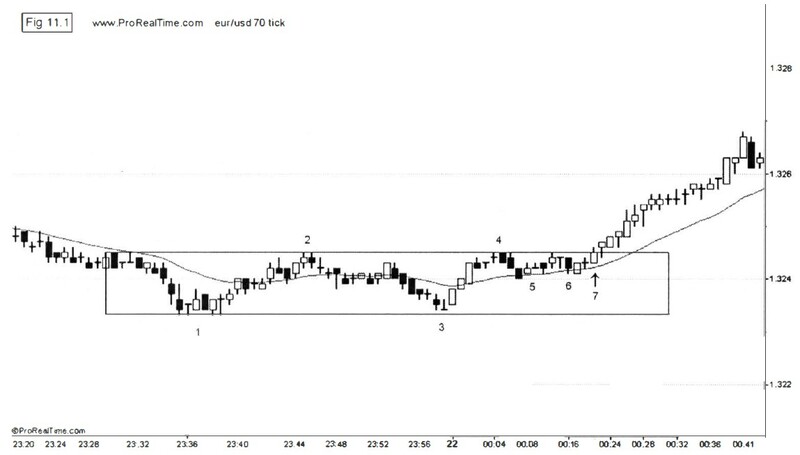

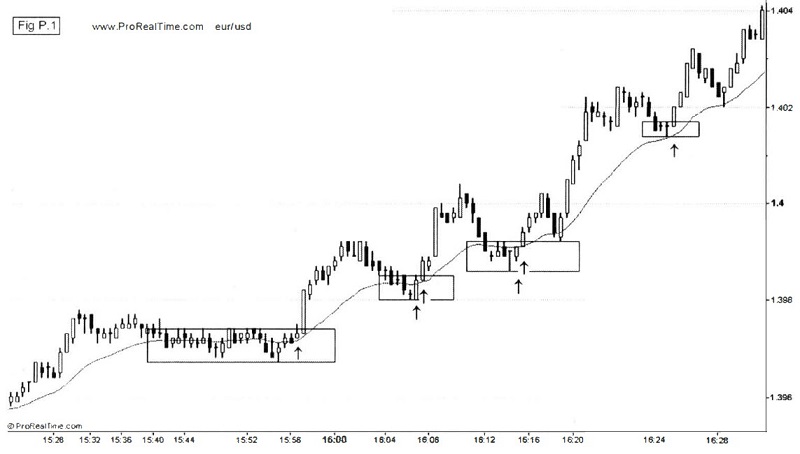

Have a look at the example below. Figure P. I is a snapshot impression of what a scalper’s chart of the eur / usd can look like. The vertical axis shows the price of the instrument; the horizontal axis displays the passing of time and the curved line in the chart is an exponential moving average, the only indicator allowed. The boxes encapsulate some of the price action patterns that we will get to discuss later on .

To build a solid foundation beneath a scalping method, it will not suffice to merely deal with the technical side of trade selection. We have to examine all aspects of the profession from every possible angle so as to filter potentially disruptive elements completely out of the equation. Each of the coming chapters will take on a part of the journey. We will delve into the specifics of chart selection, price behavior, pattern recognition, favorable and unfavorable markets, setups, entries and exits, targets and stops, traps and tricks, psychological issues, accounting matters-basically anything that comes to pass in the field of professional scalping.

Whether a beginning trader, a struggling one, or even a veteran in other fields of speculation , I sincerely hope this book will be enjoyed by all and that within its pages the necessary information is found to be able to scalp one’s way through the market for many profitable years to come. This work will not insult the reader’s intelligence by showing him all kinds of stuff that do not reflect the reality of trading. There is no plowing through endless chapters of meaningless babble and industry gobbledygook. Forex Price Action Scalping truly is about scalping. It is written by a trader at heart, and at all times with the aspiring trader in mind.

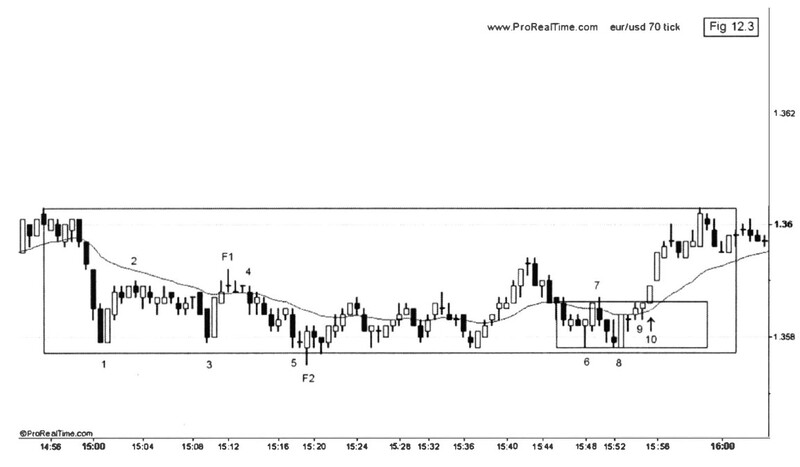

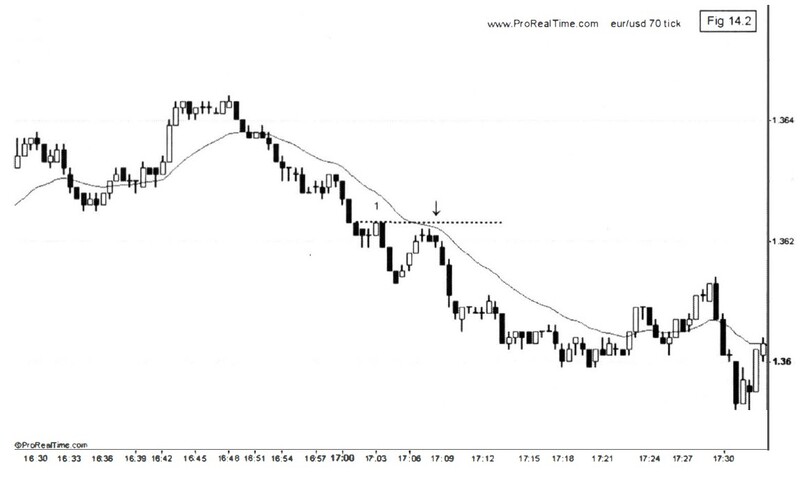

Some Pictures From the Book

Table of Contents:

Section 1 The Basics of Scalping

- Chapter 1 Trading Currencies

- Chapter 2 The Tick Chart

- Chapter 3 : Scalping as a Business

- Chapter 4 : Target, Stop and Orders

- Chapter 5 : The Probability Principle

Section 2 Trade Entries

- Chapter 6: The Setups

- Chapter 7: Double Doji Break

- Chapter 8: First Break

- Chapter 9 : Second Break

- Chapter 1 0 : Block Break

- Chapter 1 1 : Range Break

- Chapter 1 2 : Inside Range Break

- Chapter 1 3 : Advanced Range Break

Section 3 Trade Management

- Chapter 1 4 : Tipping Point Technique

Section 4 Trade Selection

- Chapter 1 5 : Unfavorable Conditions

Section 5 Account Management

- Chapter 1 6 : Trade Volume

- Chapter 1 7 : Words of Caution

Forex Price Action Scalping: An In-Depth Look Into the Field of Professional Scalping By Bob Volman