Articles

How to Trade with Price Action – Strategies

Author’s Note:

The charts below show the YM futures market using 4-minute candlesticks. The orange line is a 21-period SMA.

Winning Trade – YM Futures Bearish Inside Bar

- The market was above the SMA.

- This bar went below the SMA and signaled a change in trend. We started looking out for bearish inside bars.

- After YM pushed below the SMA, it did not prompt any significant bullish response. None of the candlesticks manage to test the SMA above it.

- At the end of its third attempt to rise towards the SMA, a bearish inside bar formed. We sold a tick below it.

There are many options for exiting. As we expected the trend to continue, the most conservative target is at the last extreme low.(horizontal dotted line)

Even with this conservative target, this trading setup gave us a 2:1 reward-to-risk ratio. Hence, it was a setup of high positive expectancy.

Losing Trade – YM Futures Bullish Inside Bar

The first bar on this chart is also the first bar of the session.

- This session started below the SMA.

- Within half an hour, YM managed to clear above the SMA.

- The SMA rejected the first test by the market from above, giving hope to bullish sentiments.

- However, as the market made a new session high, it started congesting. The candle bodies contracted and prices moved sideways.

- Within this congestion, a bullish inside bar formed. We bought above this bar and got stopped out immediately.

Review – Simple Inside Bar Day Trading Strategy

In an active market, using the right time-frame, inside bars offer great trading windows. It is a tool to control our risk and time our entries in a trending market. While we used YM futures in this example, you can use this strategy in other liquid and volatile markets. This trading strategy is simple as you only need a SMA and knowledge of inside bars. But there are two points to take note of when employing this trading strategy.

First, look for new trends. This is because retracement trades early in a trend has higher chance of success and more room for profit.

Second, avoid congestion areas. This is crucial for inside bar trading. This is because inside bars are often found in congestion patterns. The trick here is to distinguish between an inside bar in congestion and one that is not. You will suffer whipsaws if you assume that the trend will continue when the market is actually in congestion.

Look at the two examples again. In the winning example, YM was clearly drifting upwards and the top shadows were more prominent. It was not congesting. But in the losing example, the price bars were meandering sideways with both top and bottom shadows. It was definitely forming a congestion pattern. Hence, we should have avoided trading the bullish inside bar.

With regards to target placement, you should at least aim for the last extreme of the trend. When the momentum is clear, you can aim further. You can use support/resistance areas projected using past swing pivots and price thrusts. Another good option is the high or low of the last trading session.

In all, this YM futures strategy is a solid starting point for building your own simple trading method.

Some Pictures From the Book

Table of Contents:

- A Simple Inside Bar Day Trading Strategy Using YM Futures

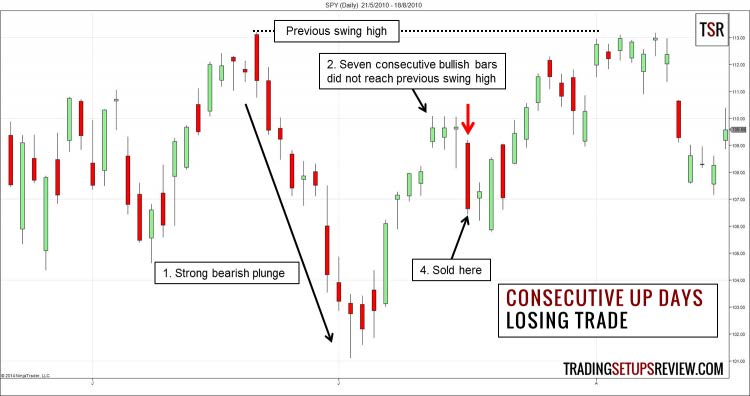

- Trading Consecutive Up/Down Days With Lower Risk

- Three-Bar Reversal Pattern For Day Trading

- NR7 Trading Strategy

- A Simple and Effective Price Action Trading Setup

- Two-legged Pullback to Moving Average (M2B, M2S)

- Candlestick and Pivot Point Day Trading Strategy

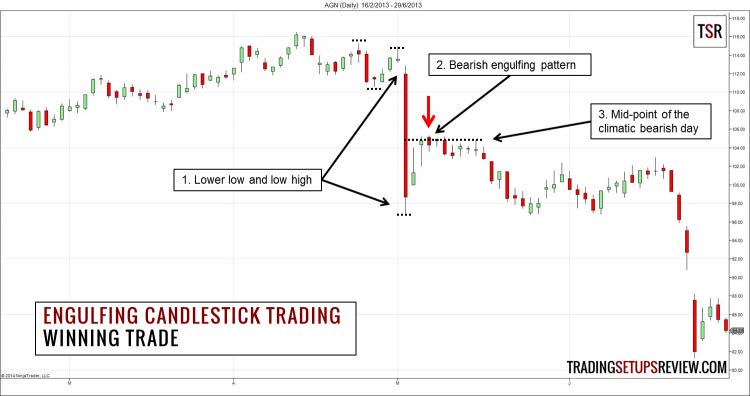

- Trading The Engulfing Candlestick Pattern With Market Structure

- Hikkake Trade Setup

- Capture High Profits with Low Volume Pullback Trading Strategy

How to Trade with Price Action - Strategies By Galen Woods