Articles

How to Trade With Price Action – Master

Author’s Note:

For all traders, the trend is the big picture. It is the rising tide that lifts all. For day traders, the intraday trend makes the difference between a session of windfall profits and one of major losses. By trading along with the intraday trend, we are following the path of least resistance to day trading profits.

As the trend is the big picture, it seems removed from current price action. Hence, many traders are tempted to leave price action out of the trend equation. They rely on a distant moving average to define the market trend and do not factor in price action. These traders are missing an important confirmation tool.

Using indicators to identify the intraday trend is reasonable. However, if we link them up with price action, we are able to enhance their prowess. Hence, in the first part of this two-part series, we will focus on using indicators with price action to track the intraday trend. In the second part, we will discuss two other methods to find the intraday trend.

Some Pictures From the Book

Table of Contents:

- Looking Inside the Inside Bar for Day Trading

- 10 Types of Price Charts for Trading

- 4 Price Action Methods to Define the Intraday Trend

- Day Trading With Only The 20-Period Moving Average

- How to Enter the Market as a Price Action Trader

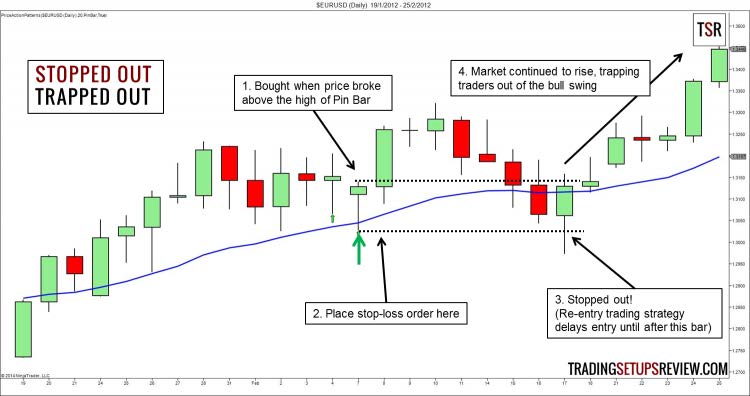

- 4 Trading Strategies That Profit From Trapped Traders

- Forex Price Action Re-Entry Trading Strategy

- Price Action Trading Tips from the Reminiscences of a Stock Operator

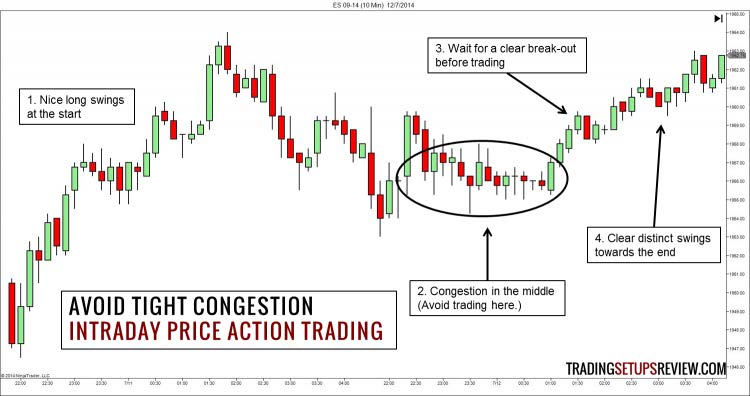

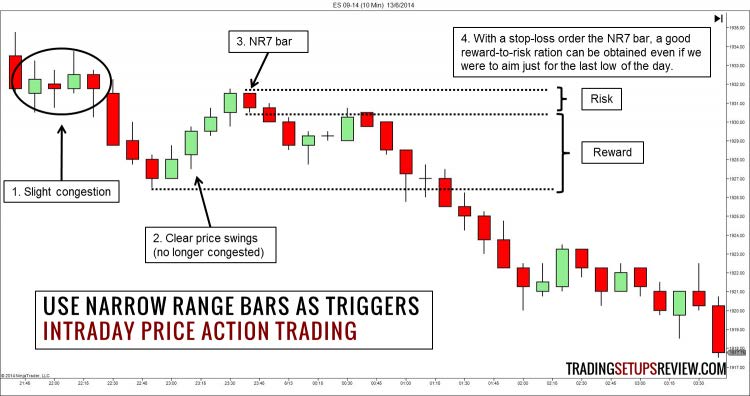

- 3 Useful Tips for Intraday Price Action Trading

How to Trade With Price Action - Master By Galen Woods