Articles

YTC Price Action Trader (All 6 Volumes) By Lance Beggs

Author’s Note:

Welcome to the YTC Price Action Trader. I have two primary aims for this book.

- To share with you the way that I view the financial markets and the way that I use price action to identify and manage trade opportunity.

- To share with you the development process that I believe you need to follow in order to become a consistently profitable and professional trader, regardless of the strategy you choose to implement.

Of these two primary aims, the second is by far the most important.

New traders mistakenly believe success is all about the right knowledge and the right strategy. While this is important, they fail to understand that becoming a trader is really a process of growth and development. Success is not a result of one day finding the right combination of indicators or parameters and the right set of trading rules. Success comes through a process of learning to trust yourself as you operate within an environment of uncertainty. Trusting your ability to make effective decisions, to manage risk, and to identify and manage opportunity.

In drafting this book I initially placed this material at the beginning, prior to any discussion of strategy. My fears though, were that too many would be tempted to skip over this information in an attempt to get to what they perceived to be the higher value material – the strategy. So, right or wrong, I’ve reworked the text to place this material at the end. And to be honest I feel it works better this way.

The real learning begins beyond the final pages of this book as you gain exposure to the uncertain nature of the markets. By structuring the book as I have, the routines and procedures required to ensure an effective learning process will be freshest in your mind. If I have done my job well, you’ll clearly understand the path that lay ahead of you and be approaching that journey well prepared for the challenges it will provide. You’ll have a newly discovered interest in learning theory, decision making, trading psychology, as well as risk and money management.

But don’t worry… we will discuss markets and strategy as well.

While not unique to me, you’ll find the way I view the markets to be different to the way the majority approach this game. It was this change in perspective which resulted in one of the greatest advances in my own development as a trader. I hope it has the same impact on you.

The strategy shared within this book is a discretionary method of trading. It is not a simple “buy on trigger A and sell on trigger B” system. Such simple systems do not work, no matter how much we wish they did. Spend a day surfing any of the numerous systems forums and you’ll see this for yourself. Many systems are presented which appear to offer great potential, generating excitement amongst the forum participants and a flurry of posting activity. Ultimately they fade away to nothing as the participants discover the system fails to deliver consistent results, or they become frustrated as it morphs into a completely different system as filter after filter is applied to try to overcome its limitations.

As you discover the way I view the markets you’ll understand why these systems don’t work. Typically they’re based upon a false premise; a false understanding of the market environment and a false understanding of the reality of the trading game.

In the chapters which follow, you’ll discover the reality of the market environment and finally understand what this game is really all about. And you’ll be free from the illusion that leads to so many traders being stuck on the seemingly never-ending search for the Holy Grail trading system.

Unfortunately though, discovering reality doesn’t make this an easy game. But at least you’ll finally be on the right path. I will be sharing the strategy that I use. However I can’t guarantee that it will suit your needs and provide you with consistent profitability. It is a discretionary strategy. Hence the importance of understanding the key points within the disclaimer at the start of this document; understanding that trading does expose you to risk and that you’ll most likely lose money as you progress through the growth and development process.

In applying the strategy, you’ll be required to use your own discretion and intuition. Results will therefore depend on your own level of growth and development. You can’t learn to ride a bike through reading a book; it requires experience. Trading is the same. This book will provide you with the underlying theory of the markets and a strategy which is designed to operate within that market reality. This is a starting point only; the real learning comes through exposure to the market environment.

Ultimately, I don’t expect to create carbon-copies of myself. The reality is that we are all different people operating with different perceptual and decision making abilities. Your application of my strategy will be uniquely yours. So don’t be afraid as you progress through the trader development phase to experiment with changes to the strategy. Take what works for you, and discard what doesn’t; blending my approach with your previous knowledge and experience to create your own work of art. Provided the end result is based upon the reality of the markets, as we’ll discuss in Volume Two, and the application of your strategy has been developed via the trader development process we’ll discuss in Volume Five, you’ll be on the right path.

Scope – Strategy, Markets & Timeframes

The strategy presented in Volume Three of this book is simply called the YTC Price Action Trader. It is a discretionary based, swing trading strategy, which involves analysis across three timeframes, in order identify and trade the swings on the intermediate timeframe.

Although the strategy is adaptable to any market and timeframe (provided sufficient liquidity), the examples and discussion will primarily focus upon one market and one set of timeframes. This will ensure simplicity as you will always know whether a particular chart relates to the higher, intermediate or lower timeframe.

The chosen market and timeframes for demonstration of the strategy are:

- 6B (British Pound FX Futures, equivalent to the GBP/USD)

- 30 min, 3 min and 1 min charts

Why this combination? Simply because it’s one of my favorites! Is it the only market and timeframe which works? Absolutely not! Do not be too concerned if you wish to trade other markets and other timeframes.

Chapter Six will discuss the factors which need to be considered in adapting this strategy to alternate markets and timeframes, as well as offer chart and setup examples. In particular we’ll look at the forex market, the emini futures markets, and stocks, as it’s a simple process to adjust and adapt to these markets. And we’ll look at higher timeframe considerations. Where there are other considerations that go beyond the scope of this book, and I’m able to provide expanded and detailed information related to these markets or timeframes (essentially making the adaptation for you), I’ll do so via a small supplementary ebook such as the currently planned:

- YTC Scalper

The strategy is the same; it’s just the application in these environments which has a few unique characteristics. I’ve kept them separate from the main book as they’re not going to be of interest to the majority of readers, who will simply trade the standard YTC Price Action Trader.

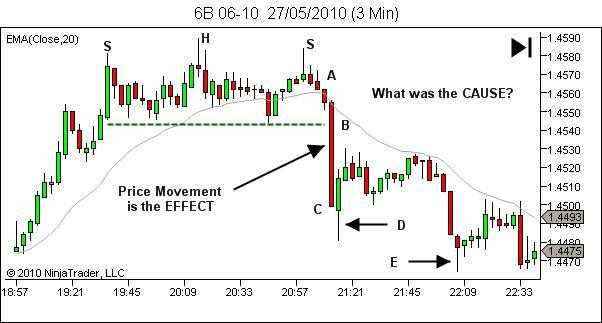

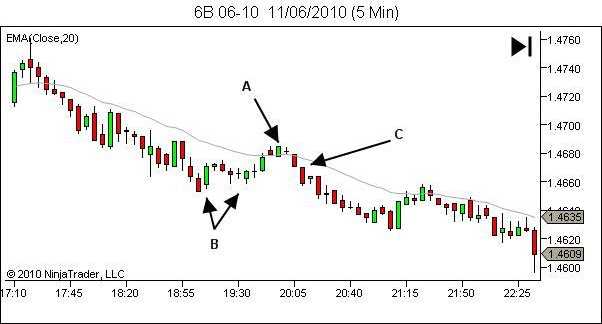

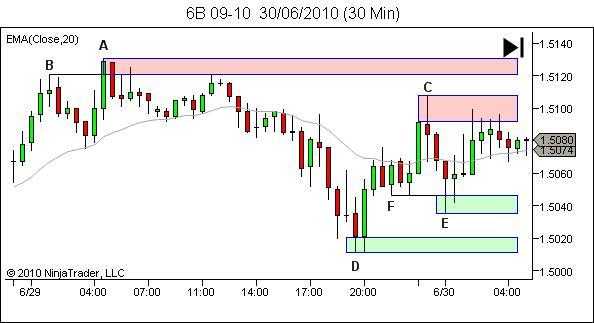

Some Pictures From the Book

Contents Overview

The following provides a quick summary of the material to come…

Markets and Market Analysis

Chapter 2 of the series is where we discover the reality of markets and the trading game. We’ll see the true nature of price movement and the way that I view markets that allows me to identify areas of trade opportunity. You’ll come away with not only a new understanding of the markets, but also an understanding of why most traders lose and why most other systems are ineffective.

Chapter 3 of the series covers market analysis. You’ll learn how I analyze price action within a framework of support and resistance. You’ll learn to develop a bias for future price action, and update that bias as the market data unfolds bar by bar.

Trading Strategy

In chapter 4, we’ll discover the YTC Price Action Trader. We’ll find out where the opportunity for profit exists within the market structure we have created and analyzed in chapter 3. And we’ll work through examples showing how to identify, execute and manage these trade opportunities.

In chapter 5, we’ll review a number of trade examples, from start to finish. A common complaint with trading books is that authors always seem to show the best trade examples; those that move immediately from the entry trigger to great profits. Interestingly, I have also felt this temptation –ego is an amazingly powerful force. However I’ve seen enough trading books to know that this does not serve you well. Reality is never as neat as the textbook examples. I have therefore attempted to show you trades based on the reality of the markets – a mixture of different setups –some which do move to profits – but others which will stop me out, or even cause me to scratch the trade at or around breakeven due to doubt about future profitability. Hopefully this will provide greater benefit.

Chapter 6 will discuss implementation of the strategy in other timeframes; as well as other markets such as forex, emini futures and stocks.

Your Trading Business

Volume 4 is where we approach our trading in a business-like manner. Chapter 7 and 8 ensure our financial survival, through establishment of our money management and contingency management plans. Chapter 9 discusses our goals and targets.

Chapter 10 aims to ensure our personal survival, through a practical application of trading psychology tools and techniques.

Chapter 11 sets up our trading platform.

Chapters 12 and 13 discuss the two primary documents used in our trading business – the Trading Plan which outlines our strategy for profiting from the markets; and the Procedures Manual, which establishes our daily pre-session, during-session and post-session routines, contingency management and review processes.

Chapter 14 will complete our discussion of documentation, outlining the numerous journals and spreadsheets that will be required, should you approach this challenge in a professional and business-like manner.

Trader Development

This is where we discuss the process of becoming a trader.

In Chapter 15 of the series we will reinforce the point that becoming a professional (and consistently profitable) trader is not an end-state, but a journey of growth and self-development.

Chapter 16 will talk about the learning process – the principles, tools and techniques needed to ensure efficient progress through your trader development journey. This is something you won’t find in most trading books, but which I believe is of great importance.

Chapter 17, Taking Action, will provide you with some direction for the way forward, and will establish a plan for your progression through the four stages of trader development.

Conclusion

Chapter 18 wraps up the series with a summary of the main concepts.

Before you begin, I recommend spending some time skimming through the six volumes in order to provide yourself with a bigger-picture overview and familiarize yourself with the structure of the contents.

YTC Price Action Trader (All 6 Volumes) By Lance Beggs