Articles

Supply and Demand Trading: How To Master The Trading Zones

A great way to make the best use of the trading zones is through identifying and analyzing the Supply and Demand Zones in the market. Supply and Demand Trading is a concept that digs in the very basic yet crucial elements of the market operation, whether in traditional or modern ones. With a simple yet effective approach, it deserves a thorough investigation by every Price Action trader.

In this book, you’ll learn:

- How supply and demand are a perfect supplement to the traditional support/resistance levels;

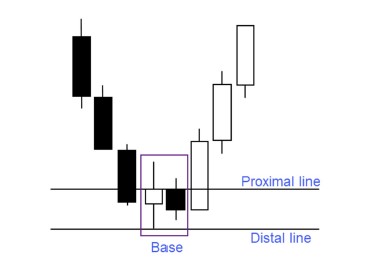

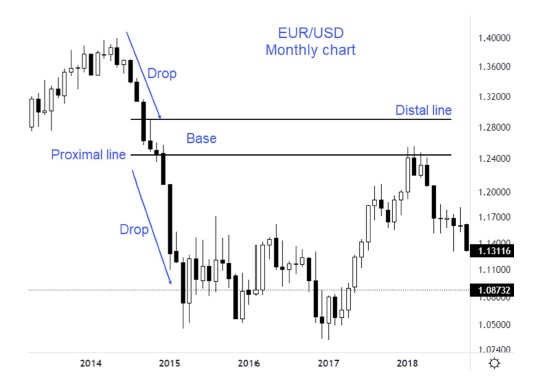

- What are the trading zones and how to find them on the chart;

- The art of drawing supply and demand zones under different approaches;

- A super-powerful way to identify a reliable trading zone;

- How to combine candlestick patterns with supply and demand trading;

- What is a flip zone and how to make the best use of this market formation?

- How to trade reversal and continuation patterns using supply and demand theories;

- Two ways of trading gaps in combination with the trading zones;

- How to implement supply and demand trading with a powerful technical indicator;

- The biggest secret in trading with the zones to secure a high winning rate;

- The secret of long-term success in trading;

Book Introduction:

Most traders will agree with me that the financial markets are full of risks. Those risks come from unpredictable price movements in the market, the big temptations to jump on unclear trade set-ups, the psychological and managerial obstacles that beat traders most of the time, and much, much more.

To minimize the risks and maximize the winning potentials in the market, we all need to stack the odds in our favor. In other books, I emphasize on the need for trading based on at least one confirmation signal. I call them “chart phenomena” as they appear on the chart constantly.

This book is different. It still mentions some visual signals on the chart, but the main building block stems from two key microeconomic concepts: supply and demand. By discovering how supply and demand can affect market orders, we are talking about the backbone that drives any market operations, not just financial markets.

Trading based on the correlation between supply and demand, we follow the footprints of the big players in the financial markets. You’ll get an idea of why some traditional market signals don’t work as you expect, and why the same market zone may generate very different winning potentials regardless of other trade confirmation signals. The utmost goal in this book is to increase your winning trade probability – a concept that I don’t focus on too much in other books.

One of the most interesting parts of this book is tons of trading examples and illustrations that make your learning process easier and more exciting than ever. You will be mind-blowing about how easy but effective all the theories and strategies are without having to rely on many technical indicators. The scoring system, which uses a quantitative measurement, will be one powerful security shield that helps you to confidently say “no” to a seemingly good opportunity when necessary. Also, the book will present 7 powerful different trading strategies based on supply and demand, and this is probably the first time I’ve ever accumulated such a large number of strategies in a book.

With a clear, concise, and straightforward way of presenting all information in this book, you will have all you need in trading with supply and demand, whether you choose to be a day trader, swing trader, or position trader. Having been in the financial market for over 20 years, I’m an advocate of backbone elements in trading and investing, and this pings a eureka moment in my mind in writing a book about supply and demand in trading. I want to show people how important it is in following the steps of the big players in the market. This is what we often refer to as “stack the odds in our favor” in trading.

Once you have mastered all the techniques presented in this book, you will be confident in identifying a high probability trading zone as well as entry, exit, and stop prices. You can even look back at your losing trades in the past and easily explain the reason behind the loss.

From my viewpoint, the book will be most suitable for someone who has certain experience in trading or investing. As I said, you may explain the reason for your previous failed trades, and this can only be done with a certain amount of trading experience. Yet, a newbie can still benefit from this book by incorporating supply and demand theories in their core trading system. In other words, sooner or later, you will be beneficial from the concepts I present in the book.

Before we dive into the main part of the book, let’s take a look at some of my thoughts before, during, and after writing this book.

1.Treat it as a friend of yours

As always, I hope you can treat the book not only as a learning material but also as a friend of yours. To me, conveying all information, strategies, and thoughts into a book effectively is never a quick and easy task. There is the editor, formatter, and designer who contributed to the completion of a good book. I hope you will learn something useful in this edition, and treat it as a friend which can help you pinpoint good opportunities in the financial markets and prevent you from taking unnecessary risks.

Some Pictures From the Book

2.No success guarantee

Although I truly believe in the effectiveness of all trading strategies presented in Supply and Demand Trading, I cannot make sure you will make instant profits after reading the book. As I said at the beginning of the book, financial trading is full of risks, and success in trading entails constructive actions repeated again and again. Reading is just the first part of the process where you obtain the necessary information. The next (more) important part is taking consistent actions without losing your enthusiasm and belief.

The degree of profitability in trading varies among traders. Ten traders applying the same best trading strategy in the world will produce 10 different results. Trading has a lot more to do with psychology preparation and risk management. Your success in trading main lies in how you apply what is taught in this material. You are the only person who can determine your success.

3.This may not be ALL YOU NEED

As you may already know, the trading metaverse includes many trading angles and each of them may give you a different trade idea and method. Although I believe supply and demand can be a perfect preparation in trading, learning from other sources and books will never be redundant. In the book, I refer to some other books that I believe will be a perfect supplement to your trading arsenal.

Book Table of Contents:

- INTRODUCTION

- Chapter 1: Traditional Support & Resistance

- Chapter 2: Introduction of Supply & Demand

- Chapter 3: Spotting The Golden Zone

- Chapter 4: How To Draw Supply/Demand Zones?

- Chapter 5: Always Stick To The Best

- Chapter 6: Tradable Or Not?

- Chapter 7: The Price Action’s Messages

- Chapter 8: Flip Zones

- Chapter 9: Reversal and Continuation Trading with Supply/Demand

- Chapter 10: Gap Trading With Supply and Demand

- Chapter 11: CCI Techniques

- Chapter 12: Multi-Frame Analysis 101

- Chapter 13: Trade Examples

- Chapter 14: Risk Management In Trading

Supply and Demand Trading: How To Master The Trading Zones By Frank Miller