Articles

The New Gann Swing Chartist

This is more than an article that teaches technical analysis. It’s also a story that tells how one professional trader, a New Market Wizard, came into possession of a rare technical method, and the steps he took to turn it into a valid trading plan. Here, then, is Robert Krausz’s Basic trading plan, one of four published in his book, A W.D. Gann Treasure Discovered.

INTRODUCTION

To many market participants, technical analysis is the foundation of any technical trading plan, when in fact, market analysis and trading are two different modalities. Market analysis can determine whether important information such as the trend has changed direction or the market has reached support.

The trading plan, however, will have specific rules for you to take action, and therein lies the difference. The market analysis can tell you when and why to take action; the trading plan tells you what action to take. It is the blending of these two modalities that is a key step toward becoming a successful trader. Every aspect of the two modalities — the market analysis and the trading plan; the entry and exit rules; money management and other details — must be in concert. Analysis is the handmaiden for trading, and not the other way around. If your technical work signals that the trend has changed direction, then that signal should be the same reason for you to take action in the market.

In this article, I present a unique technical analysis method as well as a trading plan called the Basic trading plan. I will explain the technical method, called Gann swing trading, providing both definitions of the trend direction as well as when the trend direction has changed. The Basic will have rules covering important details such as entering and exiting the market, techniques for managing your position, stopping your loss and more. But before I begin, let me tell you how I came into possession of this technical concept.

THE GREATEST MARKET RESEARCHER

Who is the greatest market researcher of all time? Before you answer, consider this: Do you know of anyone who has researched in depth price bar patterns, astronomy, multiple time frame relationships, swing chart trend definitions and support and resistance zones based on angles? Have you met any traders who have investigated numerology, ancient and modern geometry, mathematical relationships of numbers and squaring time and price? What about Western and Hindu astrology and pyramid technology, and their possible ties to the markets? Do you know of anyone doing this degree of research, and without a computer?

W.D. Gann was such a trader.

To this day, William D. Gann is an enigma. Much has been written about his success, or the lack of it. Questions remain about how great his techniques were, or how poor. Did he make fortunes or lose them? Most important, can any of his concepts stand up in today’s fast-moving computer-driven markets?

Back in the 1950s, W.D. Gann charged $5,000 for his courses. At that time, please recall, that was the price of an average three-bedroom house in the US. Today, the equivalent cost would be more than $50,000. So back then, you had to be pretty serious about trading to pay that much. And yet, would that price be worth it, then as now, if the techniques were genuine?

The answer to this question lies within each trader’s perception of value. Some traders consider $39.95 too high of a price for a book describing a trading technique, while to others, valid market knowledge is priceless and$39.95 is inconsequential.

SEPARATING THE WHEAT

W.D. Gann published a number of books. Unfortunately, most of the time Gann wrote in the manner of the ancient mystics, hiding the real meaning behind the surface explanation. Having read his books many times, I found his directions to be vague and convoluted. And not just me, others — both his followers as well as his detractors— have tried to explain his concepts in an understandable and usable way. Few have succeeded. A small example of the challenge is his overuse of the word square: squaring time and price; the square of nine; the square of 24; and on the square. Fortunately, while his books were obscure, his actual trading courses are more direct and straight to the point.

Some 10 years ago, I put out word that I was interested in purchasing original W.D. Gann material, especially his courses. All trails led to nowhere until last year, when my persistence was rewarded. Some of you may know that trader Joe Rondinone was the last trader taught by Gann. You can imagine my astonishment when Rondinone asked me if I were interested in buying some original Gann courses that he bought from Gann in 1955.

Rondinone explained that the courses were typed on W.D. Gann’s letterhead, not in the usual printed format. In addition, they had been signed and dated by Gann in his purple ink. All five courses were in their original binding. After much haggling, we settled on the price of $1.00 (yes, you read that correctly, one dollar).

Rondinone’s motives were clear, as he stated: “I want these manuscripts in the hands of a trader and researcher who appreciates their real value and will use them.” I was amazed at my good fortune. The entire collection consisted of five courses and two unfinished pages, dated April 18, 1955, with the heading: “Time Periods on the Master 7 Day Period for Soybeans.” Obviously, these were a work in progress, as Gann passed away soon thereafter.

One method, though, caught my eye. It was the “Mechanical Method and Trend Indicator for Trading Grains,” and it shouted to be studied first. I gave this method priority, and some of the results from that examination are what you will find here. Before we continue, I want you to understand the importance of having a trading plan.

TRADING PLANS

After 20 years of trading, I find it almost impossible to trade without a plan that does not have fixed rules. If you do not have a set of fixed rules, you cannot do a backtest. Without a backtest, how do you know if your plan worked in the past? Just because the plan produced positive results in the past does not guarantee success in the future. But I do guarantee that if the plan did not produce positive mathematical expectations during the backtest, then it would never work in the future.

Would you consider building a house without an architectural plan? Of course not. Having no plan would lead to chaos. The same thing applies to trading. So what constitutes a good trading plan? A valid trading plan must have some minimum components to earn the right to be called valid. At the simplest level, a plan must define:

1. Market direction. (The general direction of the market; for example, the overall trend.)

2. Tradable trend. (The trade direction — in other words, the immediate swing.)

3. Support and resistance points. (Exact zones.)

4. Action points. (Entry-exit-pyramid rules.)

5 .Money management techniques. These should include at least:

- a Capital required for your plan.

- b Stop and stop/reversal rules.

- c Profit protection rules.

- d Percentage of capital per trade. (This varies according to the plan.)

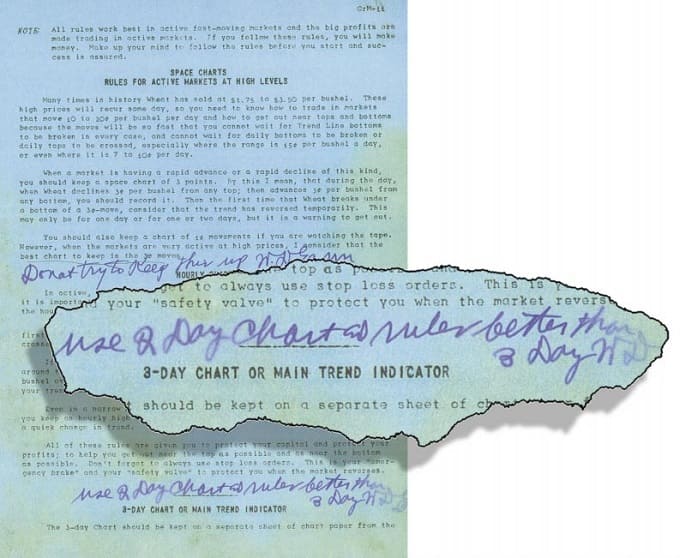

With a trading plan that fits this description, you may be ready to trade. Now, back to Gann’s mechanical method. Slowly, I worked my way through the well-worn pages, making notes as I went along. Imagine my surprise when I came to pages 11 and 12 (page 11 is reproduced here) and saw that Gann had altered some of his original calculations and signed these alterations in his distinctive and characteristic purple ink!

These alterations were fitted in between the paragraphs. Although the original course is dated June 1933, the actual alterations were handwritten in early 1955. Gann thought it was important enough to insert and sign it before he sent the course to Rondinone. And what did Gann write? Very simply: “Use 2 day charts and rules better than 3 day. [Signed] W.D. Gann.”

This hand-altered copy is the only one in existence, as far as I know. Did Gann changing a three-day swing definition to a two-day swing definition make the book a treasure? I could only come to a conclusion by doing a comparative backtest on today’s overheated markets using both daily charts and intraday periods, so that is exactly what I did. I charted by hand a backtest of various markets, which proved to me that W.D. Gann’s “new” two-day swing concept provided two pieces of vital information: First, the trend direction, and second, the points of support and resistance. The manner was simple, yet brilliant.

What were the results? Not only did I find that it held up on the daily chart, but the intraday results were also acceptable. All of Gann’s swing concepts had to be pulled together and integrated to formulate a mechanical trading plan that was tradable and profitable. Those of you who have tried to do this will know what I am talking about. Three points must be mentioned:

- Any valid plan of this mechanical nature must have a simple philosophical basis. It can be geometric, mathematical or time-oriented, or any combination thereof.

- Curve-fitting or overoptimizing is the kiss of death to any mechanical trading plan. Unfortunately, there are programs out there that encourage system designers to do just that. Robustness is the key.

- The plan must be dynamic enough to change with the market.

The concepts and techniques embodied in the trading plan presented here are based on these points and are similar to those I use in my own personal trading, which includes incorporating multiple time frames and Fibonacci concepts.

THE BASIC PLAN

Before we can discuss the rules, we must have a clear understanding of the definitions. An example is presented accompanying each definition:

- Upswing: From Down to Up. The swing direction can change to up only if the market makes two consecutive higher highs (Figure 1). Gann also needed higher lows for his swings to change direction. But in today’s fast computerized markets, I do not use that qualifier.

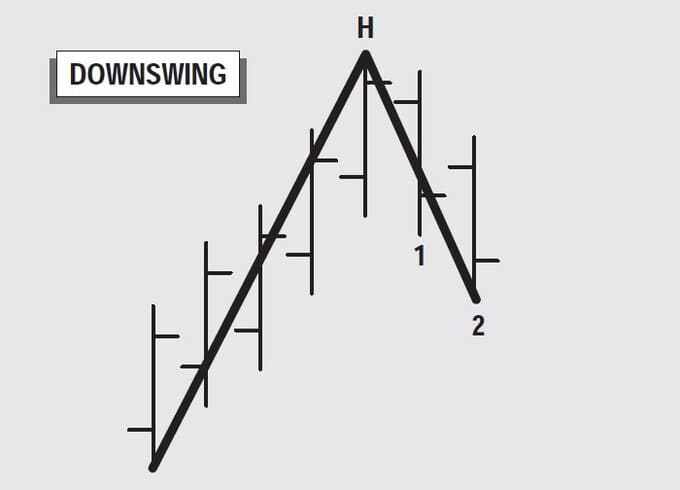

- Downswing: From Up to Down. The swing direction can change to down only if the market makes two consecutive lower lows (Figure 2). Both swings are applicable to any period.

- FIGURE 1: UPSWING: FROM DOWN TO UP. The swing direction can change to up only if the market makes two consecutive higher highs.

- FIGURE 2: DOWNSWING: FROM UP TO DOWN. The swing direction can change to down only if the market makes two consecutive lower lows.

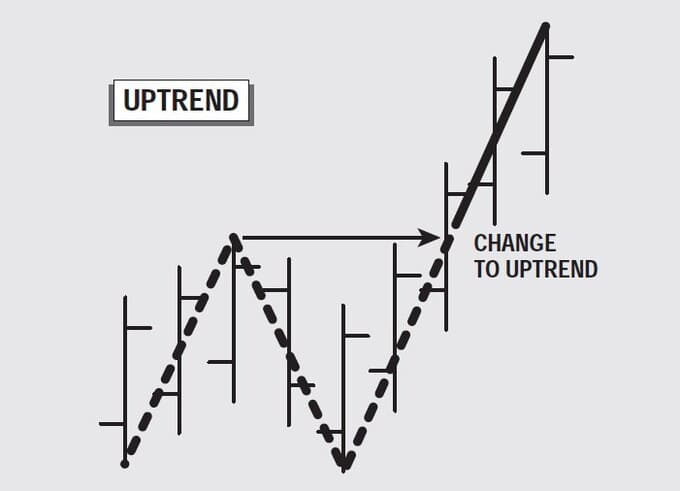

- Uptrend: Trend Change from Down to Up. Prices must take out the nearest peak, and the trend was previously down (Figure 3). In Figure 3, the uptrend is shown as a solid line.

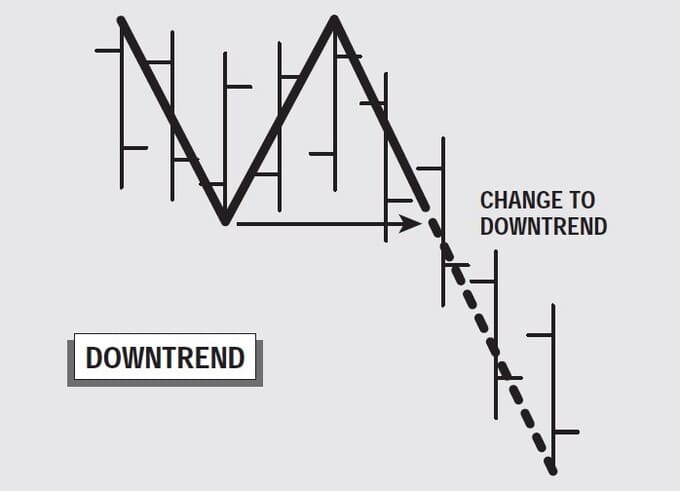

- Downtrend: Trend Change from Up to Down. Prices must take out the nearest valley, and the trend was previously up (Figure 4). In Figure 4, the downtrend is shown as a dashed line. In addition, the definition of a trend change is the same for any period being analyzed.

- FIGURE 3: UPTREND: TREND CHANGE FROM DOWN TO UP. Prices must take out the nearest peak, and the trend was previously down. Here, the uptrend is shown as a solid line.

- FIGURE 4: DOWNTREND: TREND CHANGE FROM UP TO DOWN. Prices must take out the nearest valley and the trend was previously up. The downtrend is shown as a dashed line.

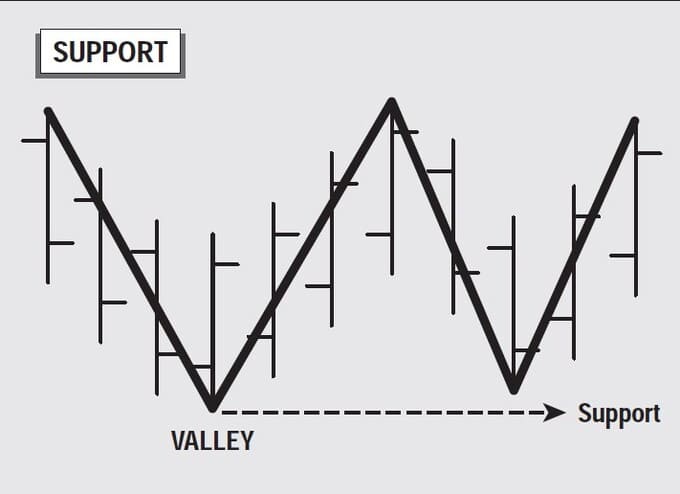

- Support: Support Is the Valley of the Previous Clearly Defined Swing. As long as prices do not penetrate below the valley point, support is holding. This valley point is actually the low of the previous swing (Figure 5). If prices penetrate below the valley, then support may be failing.

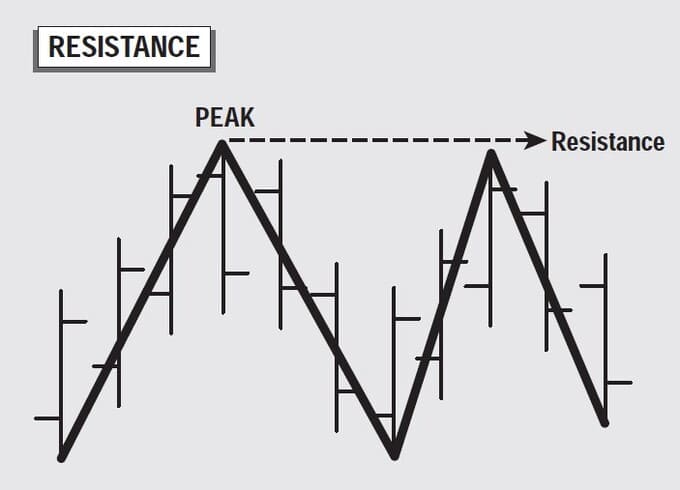

- Resistance: Resistance Is the Peak of the Previous Clearly Defined Swing. As long as prices do not rise above the peak point, resistance is holding (Figure 6). If prices rise above the resistance point, then resistance may be failing.

- FIGURE 5: SUPPORT. Support is the valley of the previous clearly defined swing. As long as prices do not penetrate below the valley point, support is holding. This valley point is the low of the previous swing. If prices penetrate below the valley, then support may be failing.

- FIGURE 6: RESISTANCE. Resistance is the peak of the previous clearly defined swing. As long as prices do not rise above the peak point, resistance is holding. If prices rise above the resistance point, then resistance may be failing.

VALLEYS AND PEAKS

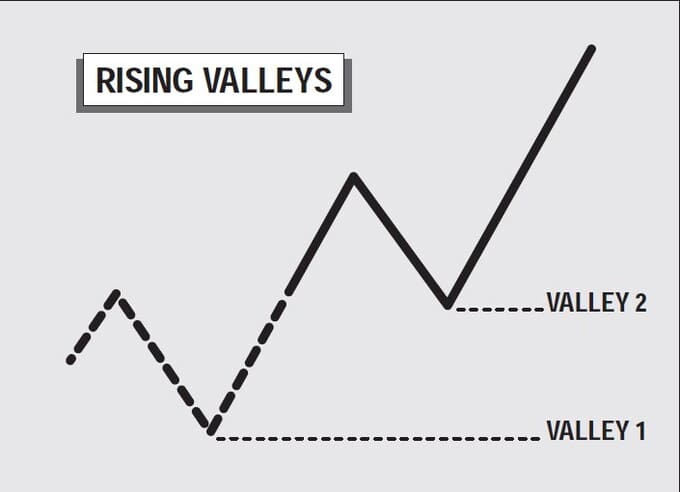

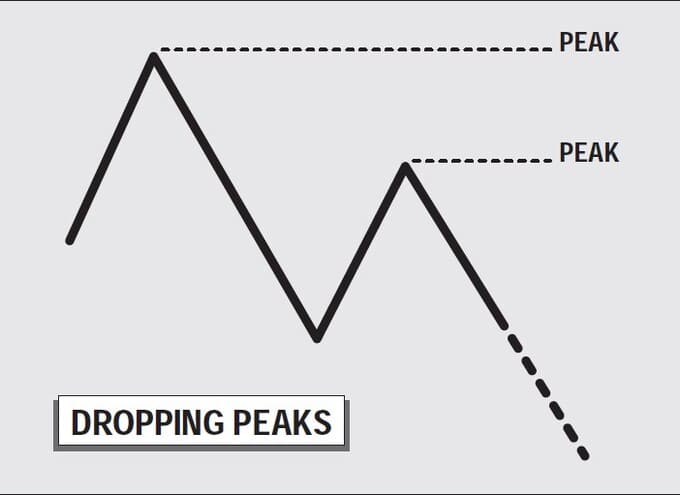

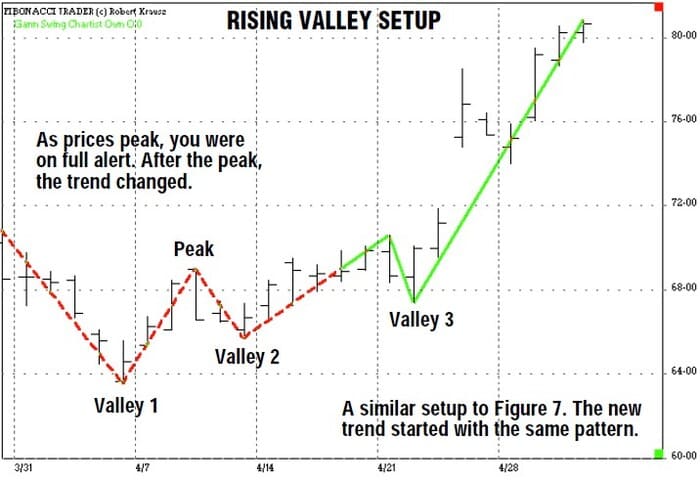

An important part of swing trading is understanding how rising valleys (Figure 7) or dropping peaks (Figure 8) can forewarn of a change in the trend. For example, take a look at Figure 9. You can see a setup for a bottom in IBM using the rising valleys concept. According to our rules, the first valley formed when the market turned up from the low established on April 4, 1997. We’ll call this valley 1. The market then formed a peak on April 9.

- FIGURE 7: RISING VALLEYS. Rising valleys are often the indication of a bottom forming in the market.

- FIGURE 8: DROPPING PEAKS. Tops may be indicated by declining peaks

Two days later, the low of what was to be valley 2 was completed. Then, according to our rules, when the market passed the April 9th peak, the trend changed to up. This setup offered two important points: Prior to valley 1, the price was in a downtrend. After the April 9th peak, a second attempt to make new lows (valley 2) in the downtrend failed. The observation that valley 2 was higher than valley 1 is evidence that support for the market was increasing and forewarned about the possibility of the April 9th peak being surpassed.

- FIGURE 9: IBM. Here, you can see a setup for a bottom in IBM using the rising valleys concept. The first valley formed when the market turned up from the low that was established on April 4, 1997, valley 1. The market then formed a peak on April 9. Two days later, the low of what was to be valley 2 was completed. When the market passed the April 9th peak, the trend had changed to up.

- FIGURE 10: T-BOND FUTURES. On August 12, the highest peak formed at point A and then the valley at point B was completed, followed by short-term rise that formed the peak at point C. The second peak was lower than the first, and this series of declining peaks indicated an important downtrend was under way.

Figure 10 presents Treasury bond futures tracing out a series of declining peaks. On August 12, the highest peak formed at point A on the chart. Next, the valley at point B was completed and was followed by a short-term rise, which formed the peak at point C. The second peak was lower than the first. This series of declining peaks represents lower levels of resistance. Prior to valley B, the market was in an uptrend, and after valley B formed, the trend had turned down. The second peak at point C, which was lower than the peak at point A, indicated that an important downtrend was under way.

BASIC GANN

The Basic swing charting technique is relatively simple, yet important because the technique lays the foundation for a deeper understanding of the markets and swing trading techniques in particular.

This trading plan is built upon the definitions we have previously reviewed. Because the concepts of trend as well as support and resistance are clearly defined, you could dovetail your own favorite tool with these concepts. For our purposes, we will turn our definitions into simple rules that follow our analysis. This step requires that we have action points. Our action points are our entry rules as well as our stop-loss or stop and reverse rules. We never enter the market without placing a stop-loss order, in case the trade goes against us. This way, we protect our capital by knowing how much we are risking before we enter the market. Next, I will present the hi-lo activator, a new tool we use as part of our action points.

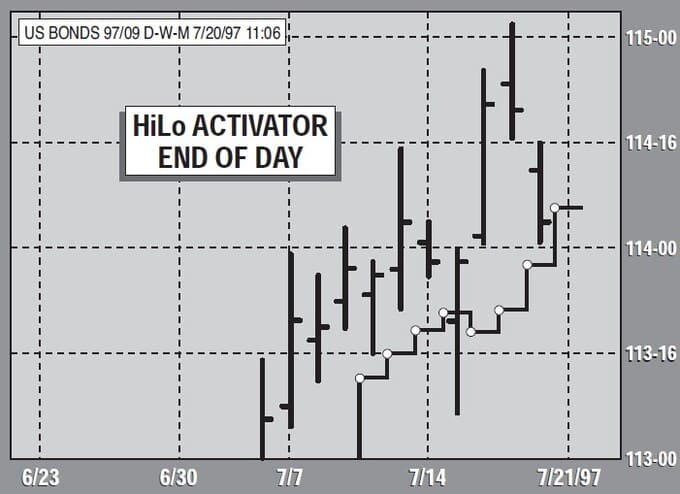

- FIGURE 11: THE HI-LO ACTIVATOR. This indicator signals entry as well as the trailing stop. For end of day, the hi-lo activator is plotted one period forward as a horizontal line, so that you have a horizontal price point to act with tomorrow.

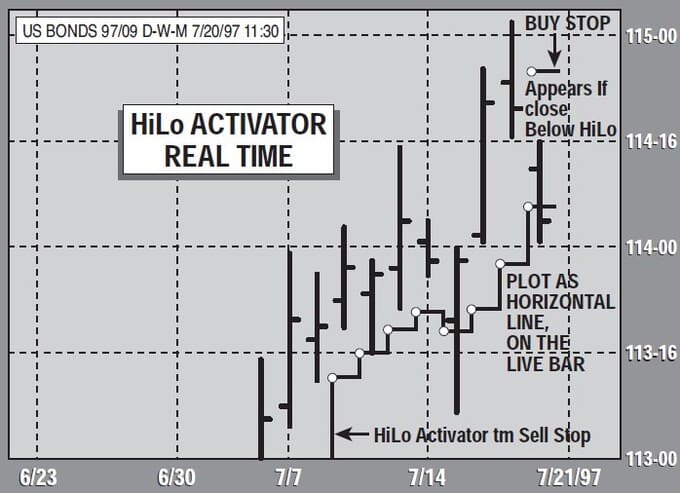

- FIGURE 12: THE HI-LO ACTIVATOR. For real time, use the current day’s high (or low) in the calculation so that we have a price level to monitor during the day for real-time action.

The hi-lo activator is our entry as well as our trailing stop.(More about this later when I show the rules of the Basic swing plan.) The hi-lo activator is a three-period simple moving average of the highs or the lows but plotted in a unique manner. Figures 11 and 12 shows how the hi-lo activator is used for either end-of-day calculation or real-time calculations. For end-of-day, we add the last three periods highs (or lows) and divide the sum by three. This must include the latest bar. The result is then plotted one period forward as a horizontal line, so that you have a horizontal price point to act with tomorrow (Figure 11). For real time, we use the current day’s high (or low) in the calculation so that we have a price level to monitor during the day for real-time action (Figure 12).

All of the rules illustrated for the Basic and the charts clearly show the effect of the hi-lo activator. Once a buy setup is activated, the hi-lo sell-stop follows the rising market plotted below the rising bars, and a sell setup is the opposite. This step formation is visually easy to follow, and once you get accustomed to it, then you will know the market trend is up until you see a close below the hi-lo activator sell-stop, and then the hi-lo activator buy-stop will appear. You can plot this by hand; I did it that way for years. The simplicity of the hi-lo activator may deceive you into believing that it may be of little value. I suggest that you check it out before you pass judgment.

BASIC GANN SWING PLAN RULES

Long Entry (Buying)

Qualifiers (Setup)

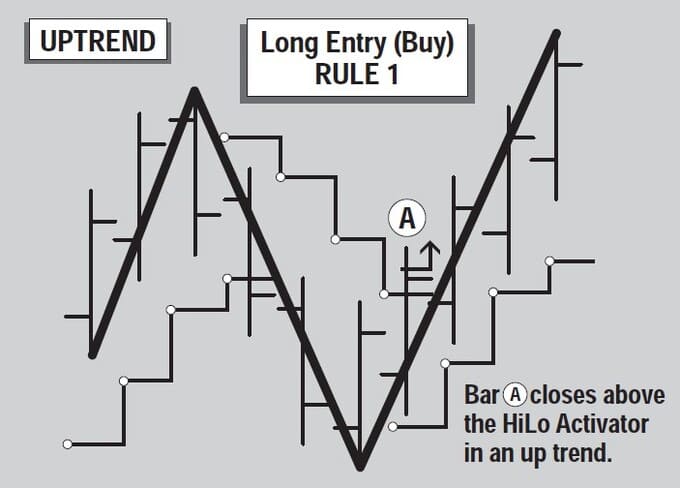

- Gann swing chart must be in an uptrend (solid line).

- The bar must close above the hi-lo activator. The buy stop is two ticks above the hi-lo activator.

Entry Rules (action points; use the one hit first)

- FIGURE 13: UPTREND, BUY RULE 1. Buy on bar A provided the Gann swing chart shows an uptrend (solid line) The buy signal occurs on bar A when prices close above the hi-lo activator.

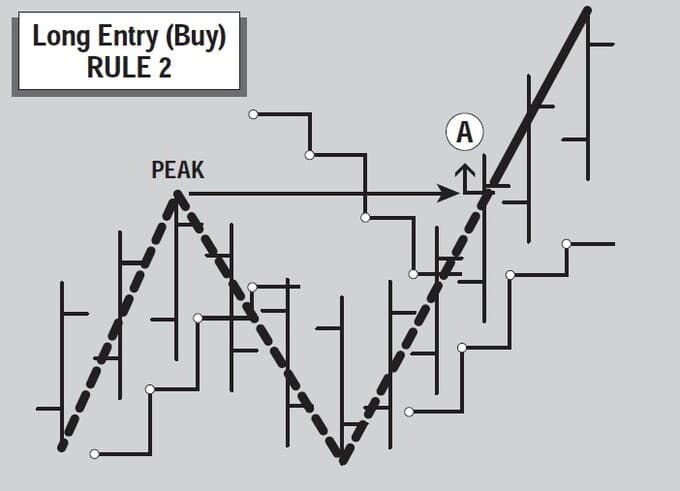

- FIGURE 14: TREND CHANGE, BUY RULE 2. Buy on bar A when prices pass the previous peak, provided the hi-lo activator sell-stop line is below the bars.

- Rule 1 Buy when the bar closes above the hi-lo activator. Your buy-stop is two ticks above the hi-lo activator (Figure 13).

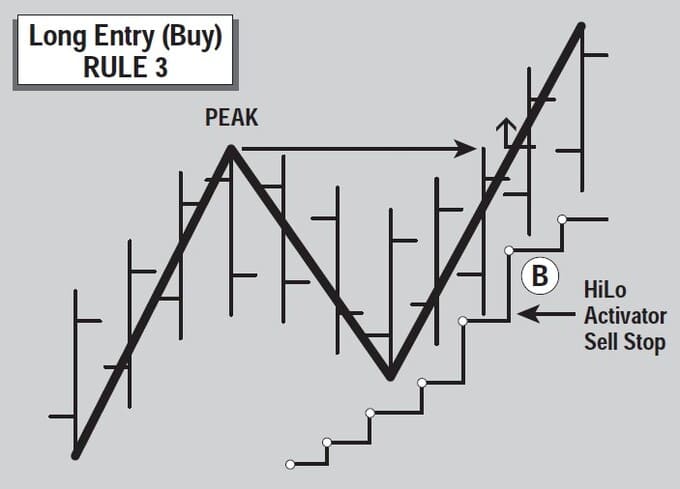

Rule 2 Buy when the Gann swing chart changes from a downtrend (dashed line) to an uptrend (solid line). The hi-lo activator sell-stop line must be below the bar (Figure 14).- Rule 3 Buy when the nearest peak is passed by two ticks. In addition, you must have the hi-lo activator sell-stop below the bar (Figure 15).

- FIGURE 15: UPTREND VIA PREVIOUS PEAK, BUY RULE 3. If the trend is up, then you can buy when prices surpass the previous peak, provided the hi-lo activator is below the bars. Action is taken intraday because you know the price level of the peak.

- FIGURE 16: DOWNTREND, SELL RULE 1. Sell on bar A provided the Gann swing chart shows a downtrend (dashed line) The sell signal occurs on bar A when prices close below the hi-lo activator.

Short Entry (Selling)

Qualifiers (Setup)

- Gann swing chart must show a downtrend (dashed line).

- Bar must close below hi-lo activator. The sell-stop is two ticks below the hi-lo activator.

Entry Rules (action points; use the one hit first)

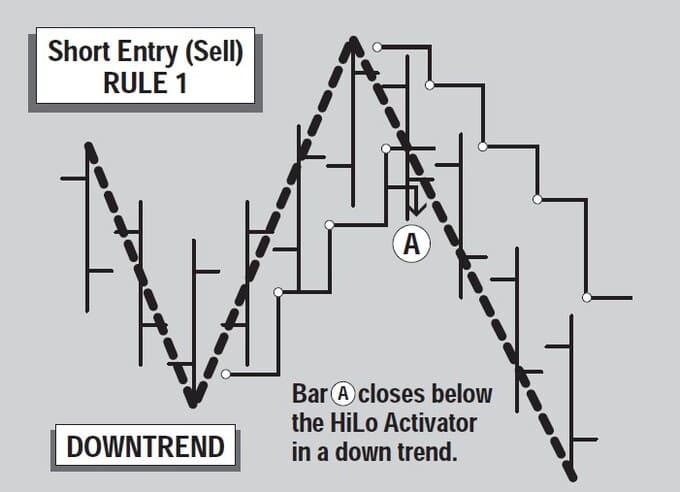

- Rule 1 Sell when the bar closes below the hi-lo activator. The sell-stop is two ticks below the hi-lo activator (Figure 16).

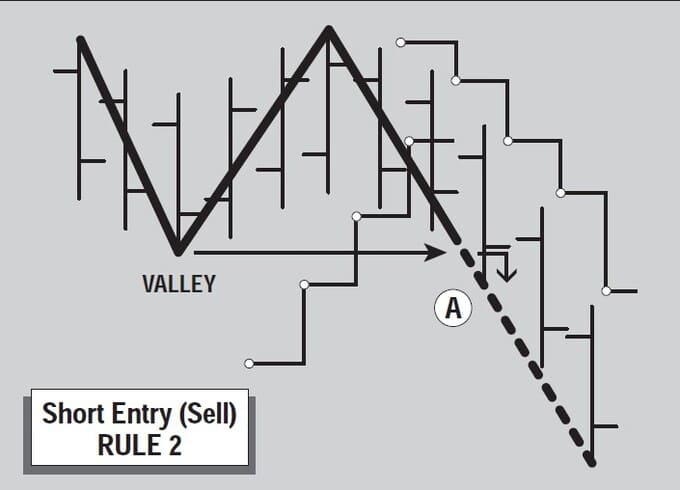

- Rule 2 Sell when the Gann swing chart changes from a uptrend (solid line) to a downtrend (dashed line). The hi-lo activator buy-stop line must be above the bar (Figure 17).

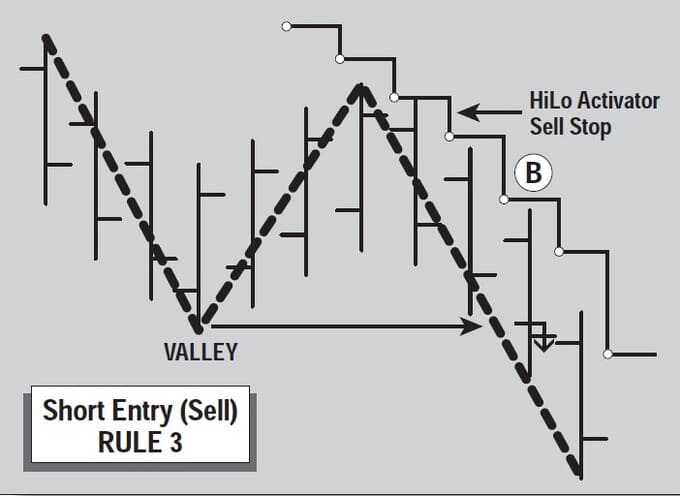

- Rule 3 Sell when the nearest valley is passed downward by two ticks. In addition, you must have the hi-lo activa-tor buy-stop above the bar (Figure 18).

- FIGURE 17: TREND CHANGE, SELL RULE 2. Sell on bar A when prices drop below the previous valley, provided the hi-lo activator sell-stop line is above the bars.

- FIGURE 18: DOWNTREND VIA PREVIOUS VALLEY, SELL RULE 3. If the trend is down, you can sell when prices drop below the previous valley, provided the hi-lo activator is above the bars. Action is taken intraday because you know the price level of the valley.

Profit Protection Rules (Longs and Shorts)

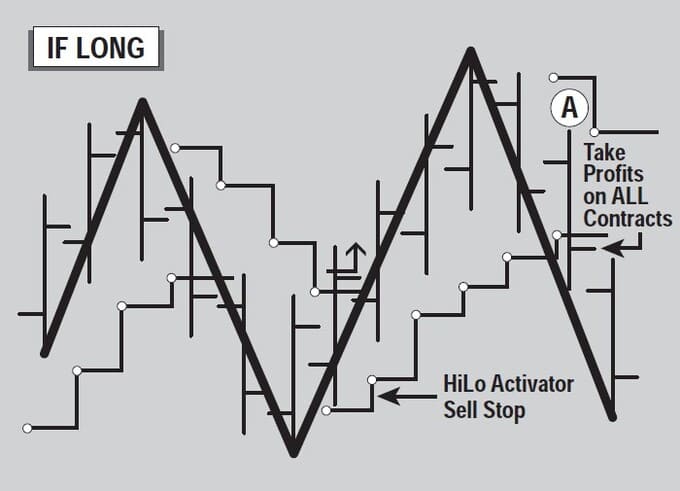

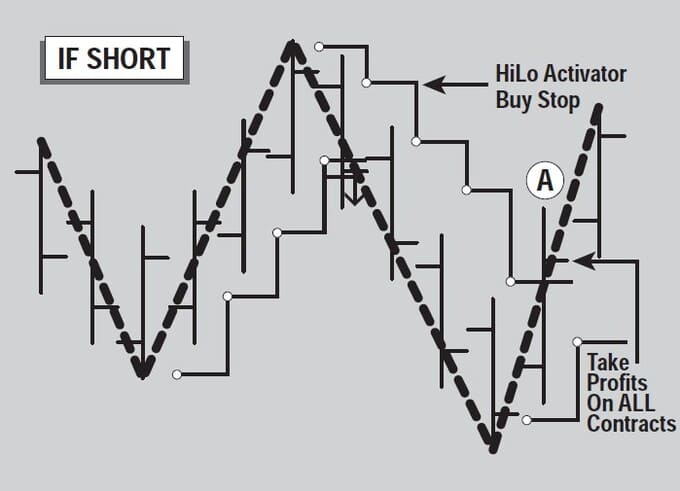

- Take profit on all contracts if price closes above/below hi-lo activator (Figures 19 and 20).

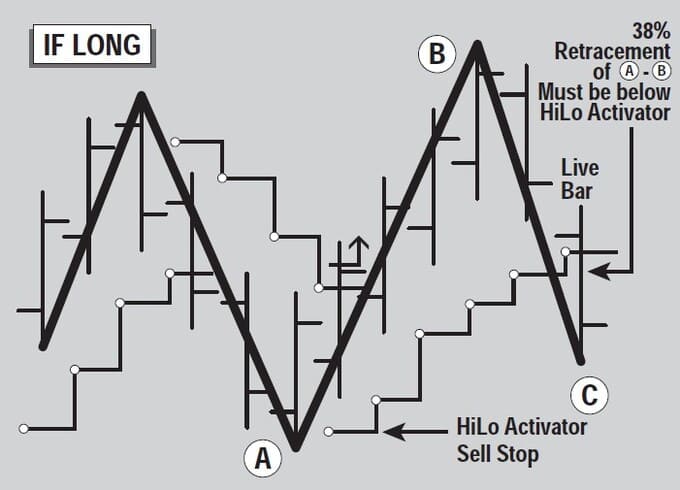

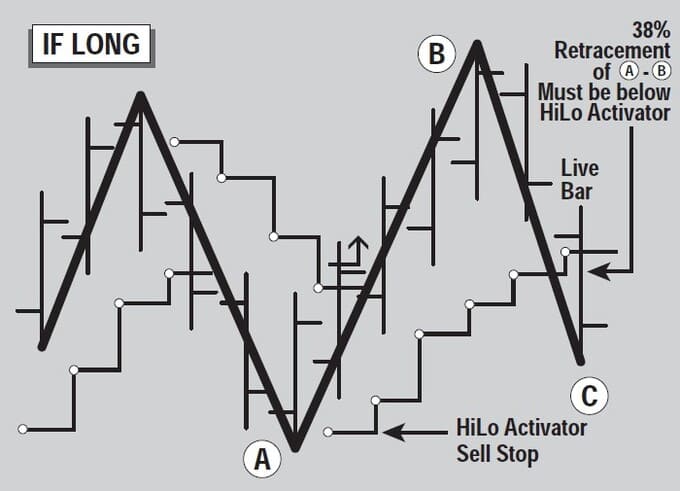

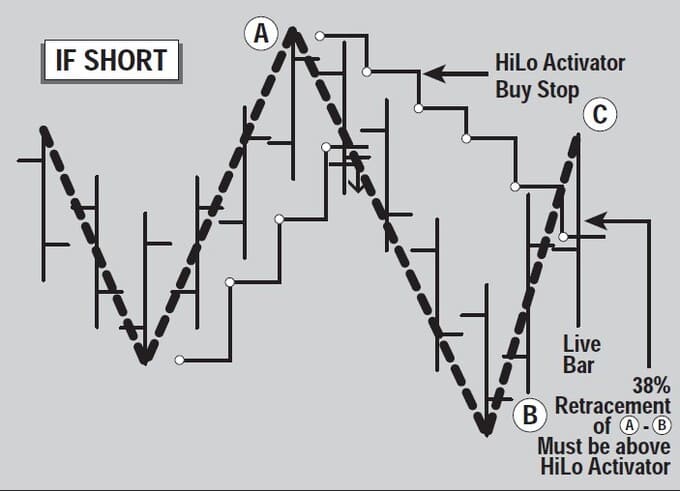

- 38% Retracement Rule. Take profits on all contracts on any 38% retracement of the current Gann swing. Do not wait for the close. The market must pass the hi-lo activator before using this 38% retracement rule (Figures 21 and 22).

- FIGURE 19: PROFIT PROTECTION IF LONG, RULE 1. If prices close below the hi-lo activator sell-stop line, then close out all long positions.

- FIGURE 20: PROFIT PROTECTION IF SHORT, RULE 1. If prices close above the hi-lo activator buy-stop line, then close out all short positions.

- FIGURE 21: PROFIT PROTECTION IF LONG, RULE 2. If prices retrace 38% of upswing A-B, then close all existing positions on bar C. The price must be below the hi-lo activator sell-stop line. Do not wait for the close.

- FIGURE 22: PROFIT PROTECTION IF SHORT, RULE 2. If prices retrace 38% of downswing A-B, then close all existing positions on bar C. The price must be above the hi-lo activator buy-stop line. Do not wait for the close.

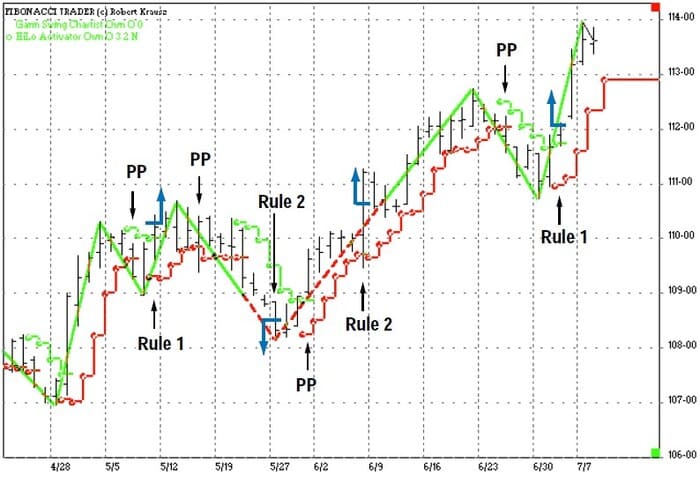

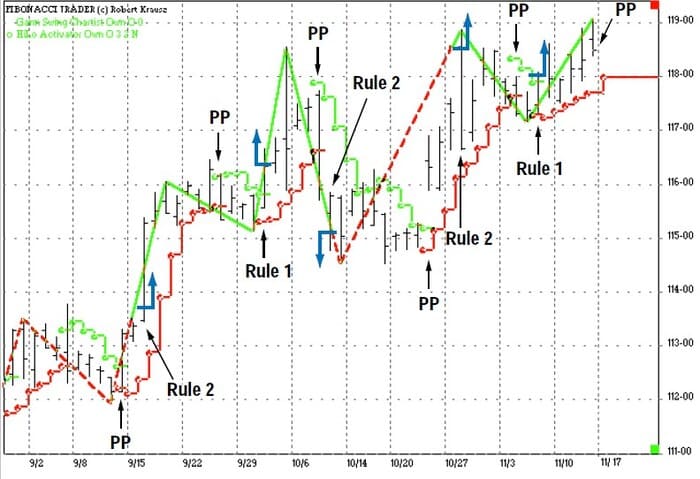

The rules for the Basic Gann swing trading plan can be seen in sidebar, “Basic Gann swing plan rules.” Each rule is illustrated in Figures 14 through 23. Some general notes are part of the Basic swing plan for Treasury bond futures:

- This plan trades only with the trend.

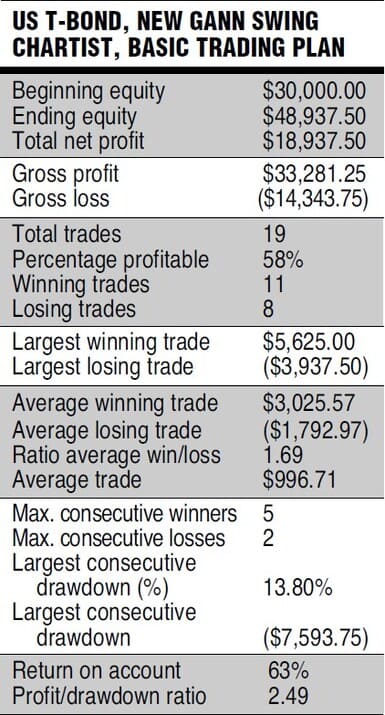

- Each new trade is based on three contracts, but the same rules and percentages apply for more or less.

- No commission or slippage has been deducted. Use whatever numbers you choose.

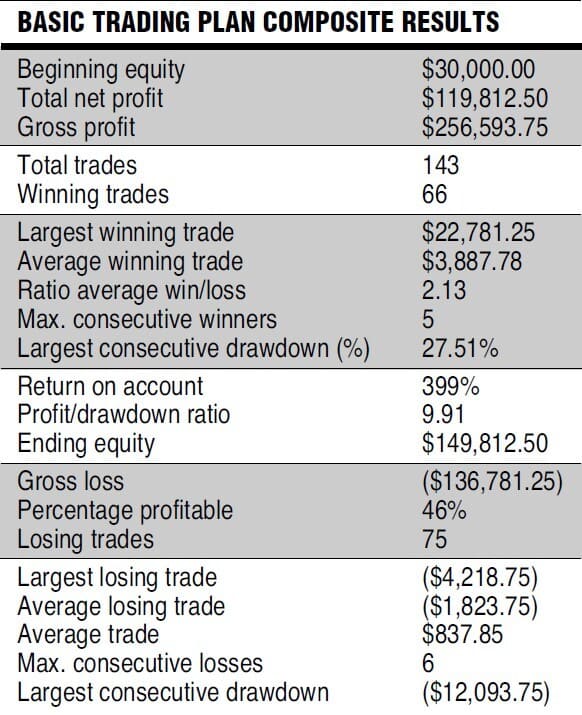

- The composite report is shown, as most investors want to see this.

- The initial capital is set at $30,000.

- FIGURE 24: 1997 RESULTS. Here is the break-down of the important statistics for 1997.

- FIGURE 23: COMPOSITE. Here are the results for trading only three contracts using the Basic plan from 1992 to November 1997.

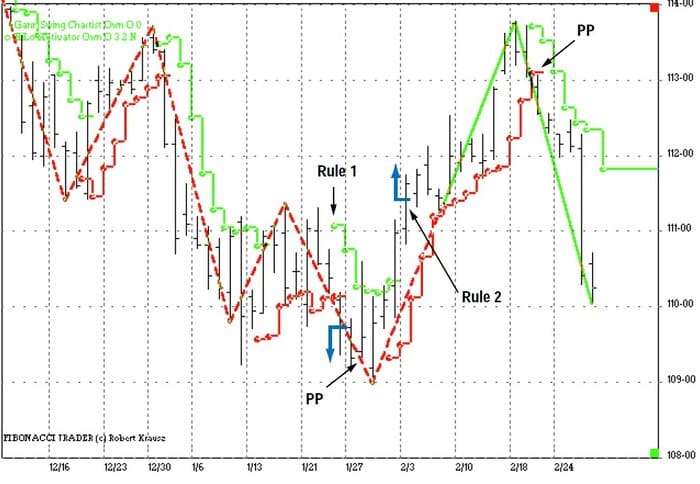

Figure 24 shows the composite report for the period of 1992 through November 14, 1997, and at no time was the report for more than three contracts. Figure 25 shows the results for 1997. Figures 26-29 shows the trades for 1997.

- FIGURE 25: TREASURY BONDS. Here are the actual trades for the period 1/1/97-2/20/97. In the following charts, the rule number for each entry is shown. “PP” indicates that profit protection rules were used.

- FIGURE 26: TREASURY BONDS. Here are the actual trades for the period 2/18/97-5/5/97.

- FIGURE 27: TREASURY BONDS. Here are the actual trades for the period 4/28/97-7/7/97.

- FIGURE 28: TREASURY BONDS. Here are the actual trades for the period 6/30/97-9/8/97.

- FIGURE 29: TREASURY BONDS. Here are the actual trades for the period 9/8/97-11/17/97.

SUMMARY

Here, I have reported what I call the Basic trading plan applied to trading Treasury bond futures for the last five years. I call this plan Basic because it is built upon the simplest application of the Gann swing charting concepts. More sophisticated plans can be developed from these essential techniques. Of course, the success of the trading plan will vary from market to market, as well as from stock to stock.

As always, check this plan out carefully; learn the rules. Work your way through all of the trades. Take nothing for granted — after all, you are trading your own money.

Robert Krausz is private trader and president of Fibonacci Trader Corp. He was featured in Jack Schwager’s New Market Wizards. This article was adapted from Krausz’s book A W.D. Gann Treasure Discovered. The Basic swing plan shown here is one of four plans: Two end-of-day and two real-time plans for professional traders.