Articles

Pivot Points

Classic techniques still work on charts at all time levels, and the most basic charting technique is the identification and development of pivot points. Take a look. Cut your losses, ride your profits! That adage should be familiar to all traders, and it may buzz through their minds as something taken for granted but not easy to implement. The pivot point technique can help you do both. Floor traders use pivot points to determine critical price and support/resistance levels. It is a relatively simple calculation that can be jotted on the back of a trading card for easy reference. Off-floor traders who have the luxury of looking at monitors with real-time datafeeds can adopt this technique as well.

CALCULATION

A pivot point is the price at which the direction of price movement changes. It is calculated using data from the previous trading day. By looking at the high, low, and close, you can calculate the next day’s pivot point as well as support and resistance levels. Many variations exist for calculating the pivot point and its related support and resistance levels. Here are a few:

Traditional method

- Pivot point = (H + L + C)/3

- First support = (2 * Pivot) – H

- First resistance = (2 * Pivot) – L

- Second support = Pivot – (H – L)

- Second resistance = Pivot + (H – L)

Variation 1

One variation involves adding the trading day’s open and calculating the average of the four values. This takes into account any opening gaps and also accounts for overnight or extended-hours trading. The formula changes to:

- Pivot point = (Hyesterday + Lyesterday + Cyesterday + Otoday)/4

The support and resistance calculations remain the same.

Variation 2

Another variation of the calculation is to substitute yesterday’s close with today’s open. This also accommodates opening gaps and extended-hours trading. The calculation changes to:

- Pivot point = (Hyesterday + Lyesterday + Otoday)/3

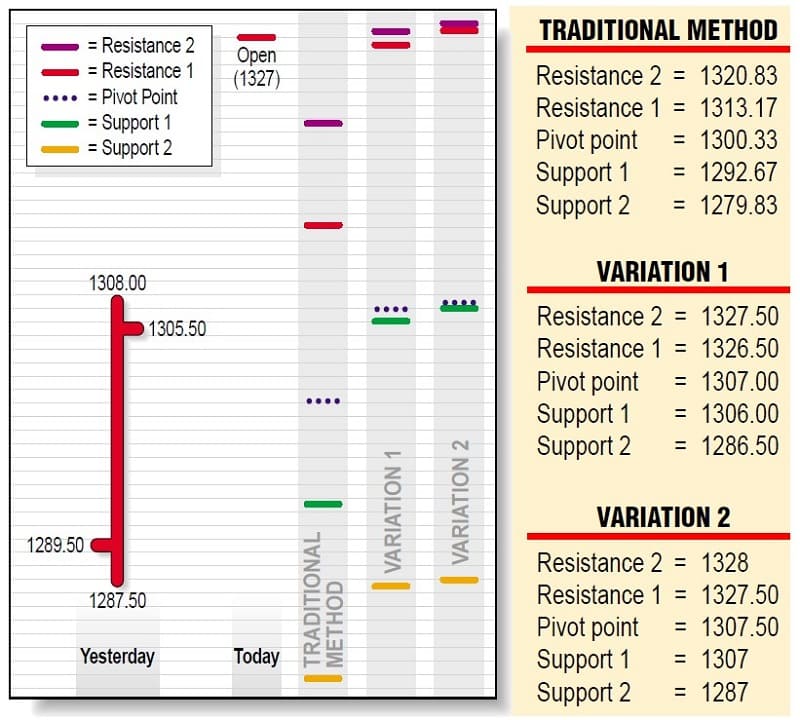

The calculations for the support and resistance levels remain the same. Figure 1 shows the difference in results of the three variations. I prefer using the traditional method to calculate the pivot and support/resistance levels for the next day’s trading. However, if the open is either a gap-up or gap-down day, I have found that the second variation may be more effective.

FIGURE 1: PIVOT POINT CALCULATIONS. Different methods are used to calculate the pivot point. Here, you see the results of the traditional method and two variations of it.

IN THEORY

The pivot point should be the first place you look at to enter a trade. Only when prices reach this point will you be able to determine whether to go long or short and set your profit objectives and stops accordingly. Generally, if prices are above the pivot it’s considered bullish, and if they are below, it’s considered bearish.

Suppose the price is below the pivot at the open and you decide to go short at that point. The first price you will look at to cover is the first support level. Of course, you would rather hold onto the short position if there were an indication that prices will fall further. If traders are reluctant to lower prices, you should cover your short position at the first support level. However, if you see prices continue to fall below the first support level, then you should place a stop-loss order just above the first support level and watch carefully.

If prices fall further still, you will have to use a trailing stop-loss and keep moving it lower to take advantage of higher profit margins. Typically, the second support level will be the expected lowest point of the trading day and should be your ultimate profit objective. When prices reach this level, the last thing you want to do is go long. So cover your short position and stay out of the market! You should opt to go long in your strategy only when the price retraces back to the pivot and penetrates it to go up toward the first resistance level. The converse applies to an uptrend. If prices were above the pivot, you would enter a long position and use the first and second resistance levels as your profit objectives.

APPLYING IT

The technique sounds simple, and it seems as though it should be easy to use. Unfortunately, it does not work all the time. There will be many occasions when you find that prices do not touch either support or resistance levels. It is best to use this technique for securities with a wide price range and high liquidity. You must be very selective and create a strategy that you intend to follow strictly.

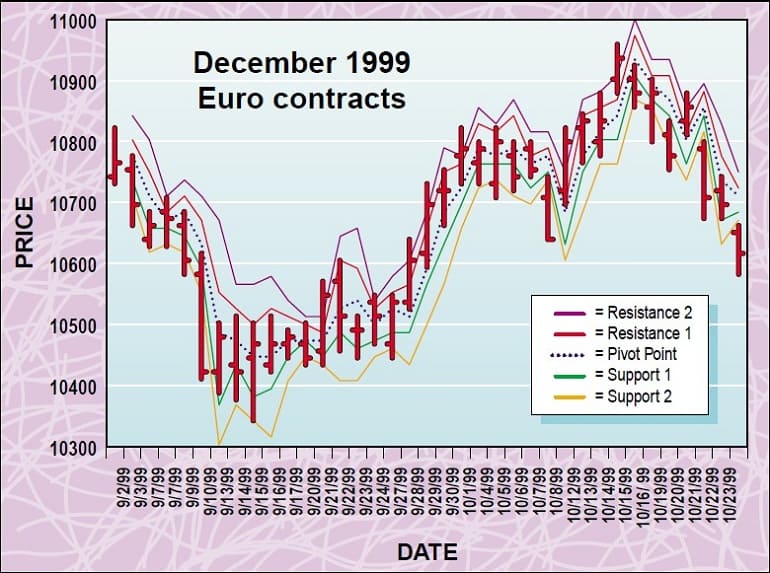

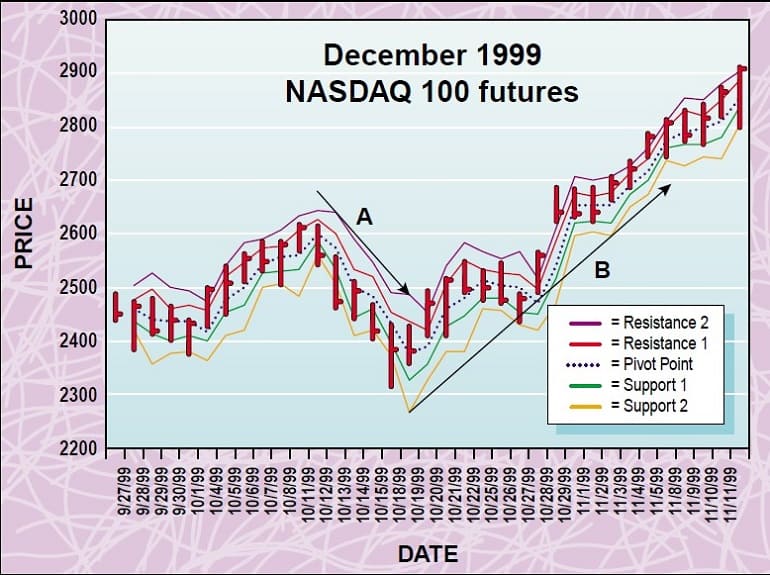

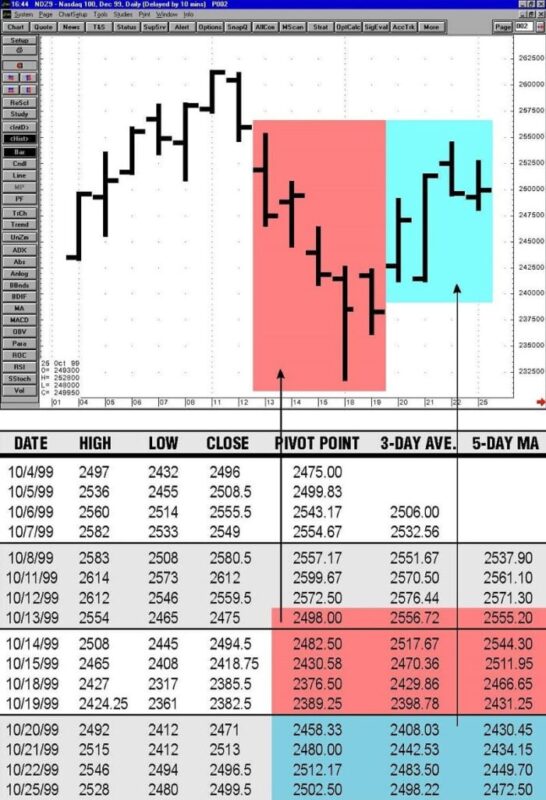

In Figures 2 and 3, the pivot points and support and resistance levels using the traditional method are plotted on the price chart to determine this technique’s effectiveness. The December 1999 Euro contracts represent a market in a trading range, and the Nasdaq 100 futures represent a trending market. The use of pivot points does not seem to reveal any significant differences between trending and bracketing markets, but this could be because you are only looking at the data for one day. What is important here is that markets have different patterns, and it is best to analyze them prior to applying pivot points.

- FIGURE 2: PIVOT POINTS, SUPPORT AND RESISTANCE LEVELS FOR DECEMBER 1999 EURO CONTRACTS. The second support level is touched or penetrated more frequently during a downtrend, and the second resistance level is penetrated or touched more frequently during an uptrend.

- FIGURE 3: PIVOT POINTS, SUPPORT AND RESISTANCE LEVELS FOR DECEMBER NASDAQ 100 CONTRACTS. Here as well, prices touch or go below the second support level more frequently during a downtrend, whereas the second resistance level is penetrated or touched more frequently when prices trend up.

Since this technique is useful for short-term trading, it may be worth your while to determine the short-term trend. Analyst Neil Weintraub introduced a methodology to help determine both the daily and short-term trends using pivot points. Besides looking at just the pivot points, he also uses their average. The period you use for calculating the average depends on what works best for you.

After experimenting with various periods, I found the three-day average of the pivots to be the most useful with which to determine the daily trend. I update the three-day average on a daily basis and compare it to the pivot point. If the daily pivot is higher than the three-day average, it is indicative of a positive trend. If, on the other hand, it is lower, that indicates a negative trend.

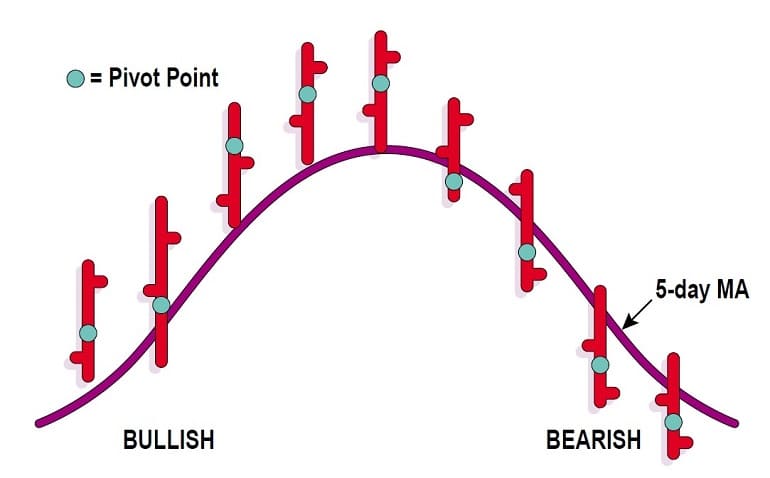

Next, I look at the five-day moving average to determine the weekly trend. If the pivot is above the average, a bullish trend is indicated. If it is below, that is a bearish sign (Figure 4). If both the daily and weekly trend shows bullish strength, I consider going long. Conversely, if both show a bearish trend, I consider shorting. If there are conflicting signals, I stay out of the market. This method helps to get a broader picture of the market.

- FIGURE 4: PIVOT AND THE AVERAGE. In looking at the five-day moving average to determine the weekly trend, if the pivot is above the average, a bullish trend is indicated, but if it is below, that is bearish.

- FIGURE 5: PIVOT STRATEGY. When using pivot points to determine entries and exits, here’s a strategy to use.

STRATEGY

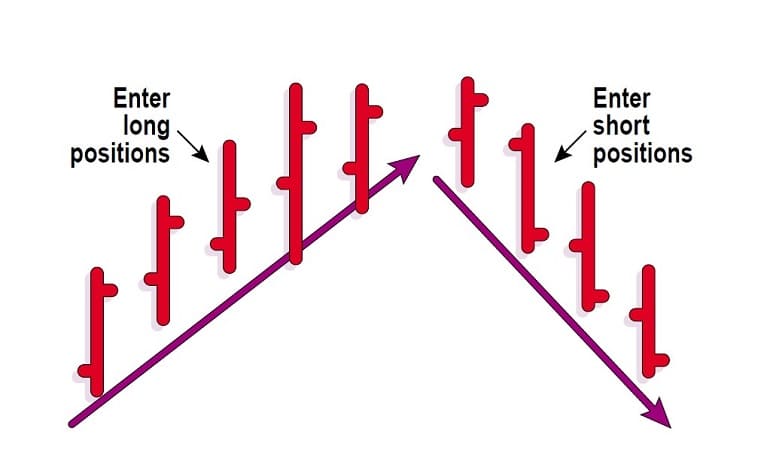

When using pivot points to determine entry and exit points for the following day’s trading, I use the following strategy:

- Calculate pivot point and support/resistance levels.

- Determine the direction of the daily and weekly trend.

- Set profit objectives and stops.

- Wait 20 to 30 minutes after the market opens for prices to stabilize.

- Enter long positions if the trend is up and price is turning in an upward direction from the pivot.

- Enter short positions if the trend is down and price is turning in a downward direction from the pivot (Figure 5).

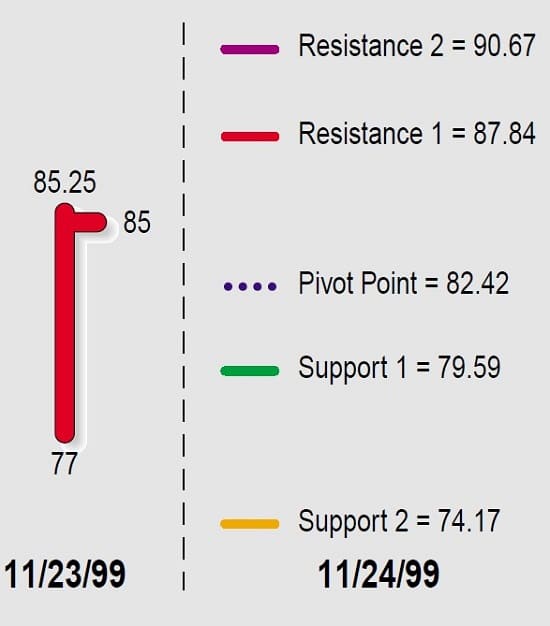

The pivot point technique works differently for different markets, and hence, it may be necessary to make adjustments in your strategy. For example, when I use pivot points to trade equities, my strategy is slightly different. On November 24, 1999, America Online [AOL] was the only security on my watchlist that signaled an alert set at the pivot point (Figure 6).

FIGURE 6: USING PIVOTS TO TRADE STRATEGIES. The strategy to trade equities using pivot points is slightly different. Here, America Online signaled an alert that was set at the pivot point.

The price range between the pivot and first resistance level was $87.84 – 82.42 = $5.42, which is relatively wide. When the difference is so large, usually, I will not set my profit objectives at the first support and resistance levels. I entered a long position (since the short-term trend was positive) around the pivot and closed my position at $85.00.

TESTING IT

The December 1999 Nasdaq 100 contract is an example of using the strategy. In Figure 3, you can see that from October 11, 1999, to October 18, 1999, the price of the contracts was trending downward (A). From October 19, 1999, onward, however, prices have been in a steep ascent (B). I tested this technique to determine its effectiveness in determining the direction of the trend.

FIGURE 7: DETERMINING THE SHORT-TERM TREND OF THE PIVOTS. You can determine the short-term trend by comparing the three-day average of the pivot and five-day moving average with the pivot point. If the pivot point is higher than the averages, it indicates a positive trend, and if it’s lower, it indicates a negative trend.

Figure 7 shows the pivot points together with the three-day average of the pivot and the five-day moving average of the price. From October 13, 1999, till October 19, 1999, the pivot point was below both averages. From October 20 onward, the pivot point was higher than both averages, indicating an uptrend.

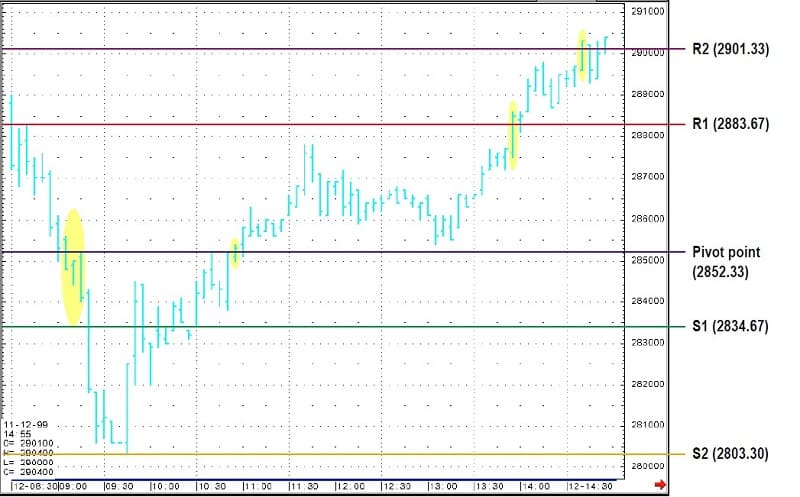

Now that I knew the direction of the trend, was the pivot point effective in determining exit/entry points for the next day’s trading? A five-minute intraday chart of the December 1999 Nasdaq 100 contracts on November 12, 1999, can be seen in Figure 8. Using the traditional method, the pivot and support/resistance points for November 12, 1999, based on the previous trading day’s data, were as follows:

- Pivot point = 2,852.33

- Support 1 = 2,834.67

- Resistance 1 = 2,883.67

- Support 2 = 2,803.3

- Resistance 2 = 2,901.33

FIGURE 8: PIVOT POINTS, SUPPORT AND RESISTANCE LEVELS IN ACTION. You can see how pivot points and the support and resistance levels play a significant role in the December 1999 Nasdaq 100 contracts.

The Nasdaq 100 contracts had been in a steep uptrend since the end of October 1999, so the last thing I would want to do is go short. On November 12, 1999, the December 1999 Nasdaq 100 contracts opened at 2,888, which is above both the pivot point and the first resistance level. This indicates a continuation of the bullish trend. This might have prompted me to enter a long position, but since my strategy is to enter a trade at the pivot and to wait 20 to 30 minutes after the open, I did not.

Prices didn’t continue to move up. Instead, they moved lower, which prompted me to keep a close eye on the pivot point (2,852.33). Between 9:05 and 9:15, the decline stalled for a short period around the pivot. The 9:15 bar shows that prices went as high as 2,852, which did not quite touch the pivot, and then continued its downward movement. Since I am not interested in shorting this market, I waited on the sidelines.

Pivot points are especially useful to short-term traders who are looking to take advantage of small price movements.

At 9:20, the price penetrated the S1 level. The price touched 2,803 (S2) very briefly, followed by an upward movement in price. Because prices started showing signs of moving back up after touching the second support level, my focus shifted back to the pivot point. At 10:55, this price was hit, which alerted me to consider entering a long position. Typically, I would enter the long position slightly above the pivot point and place a stop-loss slightly below, at around 2,850.00. My first profit objective was the first resistance level, 2,883.67.

At 13:55, prices broke through 2,884. I had two choices: I could either exit my long position, or cancel my original stop-loss and place a trailing stop, which would follow the price as it moved above the first resistance level. I could have opted to use the trailing stops to maximize my profit margins. The maximum profit objective was the second resistance level, or 2,901.33. I could get stopped out anywhere between the two resistance levels, depending on how tight the trailing stops were. My maximum profit objective was reached at 14:40. Ultimately, I exited my position at 2,901.33, the second resistance level, and closed my position before the close.

CONCLUSION

Pivot points are a technique used by floor traders to determine entry and exit points for the trading day based on the last day’s trading activity. Off-floor traders can take advantage of the pivot and support and resistance levels to determine when to enter and exit a trade. Pivot points are especially useful to short-term traders who are looking to take advantage of small price movements. It is best to use this technique after determining the direction of the trend. Keep two things in mind, both of which should be familiar to traders: Cut your losses, ride your profits, and Don’t trade against the trend!