Articles

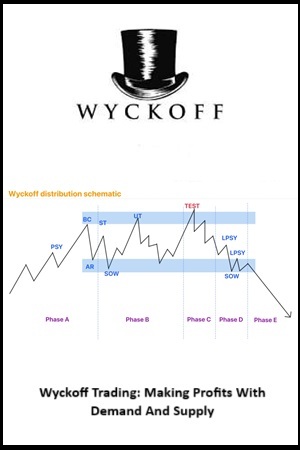

The Wisdom Of Wyckoff

At the root of all markets are the participants. Human nature does not change and therefore there is much to appreciate and learn from the observations Richard D. Wyckoff made nearly a hundred years ago.

In a poorly lighted room a youth sat deep in thought. Could he solve the riddle of the stock market? He knew he was on the right road. Study, effort, patient endeav-or, with these he was bound to be successful.

—Richard D. Wyckoff

A lifetime of closely observing market action and market participants led Richard DeMille Wyckoff to gain a deep understanding of both. This article will extrapolate from Wyckoff’s writings some of his observations about Wall Street and those who participate in what he described as the greatest of all the world’s games. Markets may grow and evolve, but at the root of all functioning markets are the participants whose behavior is guided by nature. Human nature does not change and therefore there is much to appreciate and learn from the observations Wyckoff made nearly a hundred years ago.

Wyckoff started work in a Wall Street brokerage office at the age of 15. He was employed as a stock runner, delivering bond and stock certificates between different brokerage offices on the Street. He grew to become a stock broker, a writer, and a respected magazine publisher. He raised money to invest in companies, and he developed and taught courses for potential stock market participants, which evolved into what is commonly known today as the Wyckoff method. But throughout his time as a Wall Street player, it was his deep understanding of stock market participants and their psychology that has stood the greatest test of time.

ON FUNDAMENTALS

[A] financial fundamentalist … is a man who knows very little about a great deal, and keeps on knowing less and less about more and more, until finally he knows practically nothing about everything.

Wyckoff was the youth in the poorly lit room determined to solve the riddle of the stock market. He first embarked on this task by voraciously studying the fundamentals of railroad stocks, which were the popular stocks of his time. He read the financial pages of newspapers, he read every edition of the Commercial and Financial Chronicle from cover to cover and Poor’s Manual for reference. He studied books on rail-road financial reporting, on banking, on railroad operations. It was many years and a lot of stock market knowledge that led Wyckoff to make the observation that the secret to stock market success lay in a sound understanding not only of the fundamentals but of the market participants themselves whose behavior caused the gyrations in the stock market, which went from booms to panics and back again.

THE UNKNOWN AND THE INCALCULABLE

Wyckoff had the opportunity to observe several Wall Street panics first-hand. In his first decade on Wall Street, he observed the Baring panic of 1890, the industrial and financial panic of 1893, and the Bryan panic of 1896. Studying these panics led Wyckoff to the following conclusion: “The bad news generally comes out at the bottom and the good news at the top of swings.”

A panic, Wyckoff observed, was “a psychological condition—a state of mind into which the public was stampeded, usually by sudden and unexpected events, or by a combination of influences which led to great uncertainty and ended in fright.” Wyckoff observed that while ultimately fundamentals controlled stock prices in the long run, in the short and intermediate term, stock prices were determined not by fundamentals but by the behavior of market participants. This led to stock prices reflecting behaviors, which caused much to be unknowable and incalculable about their future direction.

ABOUT MARKET PARTICIPANTS

Three men came to Wall Street. The first always knew what to buy. The second knew why it was best to buy. But the third knew neither of these things; he only knew when to buy. He made the most money.

Losses are punishment for bad judgment.

Wyckoff started writing to help educate his brokerage clients, whom he observed almost always lost money on Wall Street. He said, “Most people make money in some other profession and come to Wall Street to lose it.” Therefore, he decided that he would do his part to educate the public from incurring the massive losses he saw happening. Wyckoff found that the more he wrote, the more he realized he knew about stock market action. He began to see that Wall Street demanded a form of reasoning entirely different from that applied to static and allied subjects. One needed to understand how the large pools (now institutions) manipulated stocks, causing their stock prices to have nothing to do with the intrinsic values for large amounts of time. Wyckoff said, “I saw more and more that the action of stocks reflected the plans and purposes of those who dominated them. I began to see possibilities of judging from the very tape what these master minds were doing. My editorial work was proving a most valuable means of self-education.”

You have to learn how to use your judgment and discard that of others.

Self-study led Wyckoff to the conclusion that it was possible to judge, from price action itself, the probable future direction of the short term and intermediate term of an individual stock or the stock market as a whole. But one who endeavors to be able to interpret charts so as to understand the hidden meaning behind their seemingly random gyrations must first embark upon a long course of study over many years, with the same sort of seriousness and dedication one would apply to the mastery of professions like medicine or law.

SOONEST, FASTEST, AND FARTHEST

You always aim to select the most promising opportunities; that is, the stocks which are likely to move soonest, fastest, and farthest.

The successful reader must study the tape, not with an eye to recognizing patterns, but with the idea of deciphering the underlying reason for the behavior of price action. There is a continuous struggle between buyers and sellers, between supply and demand. When buyers overwhelm sellers, prices will rise and when sellers overwhelm buyers, prices will fall. That is the basic premise that underlies stock market action. Sometimes one side is weaker and the other is stronger, sometimes both sides are equal. The struggle is depicted on the chart much like a movie. Every minute of the day, its story is unfolding, telling the tale of the struggle for dominance between two sides. Prices climb when demand is greater than supply, prices fall when supply is greater than demand. Sometimes there is dullness, but like a swan appearing serene as it floats along the lake while beneath the surface of the water its feet are actually paddling furiously, so too, can the large players at times attempt to hide their activity. They may be accumulating stock or distributing stock, but prefer to create the illusion of a dull market and hide their intentions until their campaign is complete. The dullness of market activity might actually be disguising ferocious activity underneath as strong hands accumulate and build positions or distribute under the guise of stillness, never allowing the price of the stock to move beyond a certain tight band.

MARKET ACTION

The following selection represents Wyckoff’s approach to reading market action in his own words:

“Long ago, I learned that the market disregards what anyone thinks it should do. It has a way of its own. It is enough to know that the market tells me what it is probably going to do today and in the near future. I do not expect to be informed very far in advance, because the market often changes its course. I must change my position accordingly. Thus, my mind is a slate on which the market writes its forecasts; these I accept at par. As for instructions, these I execute—promptly and confidently. And when indications are altered or reversed, I shall execute—promptly and confidently. And when indications are altered or reversed, I shall continue to obey, because I am convinced that the market knows more than I know about its own future: more, in fact, than anybody and everybody.”

Today, we can thank Wyckoff for being one of the greats in the field that we call technical analysis.

PRICE MOVEMENT, VOLUME, AND TIME

Always remember this: An increase or decrease in volume is significant. Gradual or sudden increases or shrinkages will assist you in detecting turning points; determining the trend; when to open or close a trade; when to change your stops; when a move may be culminating or about to culminate.

The only things you need for successful trading are comparatively few tools: price movement, volume, and time. These few facts are reflected on the chart. Price movement shows the trend. Volume shows the intensity of trading. The relationship between price action and volume should be understood. Finally, time is the period required for price movement to run its respective course. Know them and you know a lot. Understand them and you are ready to begin trading. Master them and you have the ability to trade successfully.

Wyckoff said that as a means of making money, stock trading is potentially the most profitable of all pursuits. Once you master the relationship of price movement, volume, and time, you will come to find that you do not need the thousands of research reports, rumors, tips and all the other noise floating about Wall Street. Wyckoff said that the best equipped man in the Street is the man who wears earmuffs. Your own judgment is enough, once you learn how to use it.

SUCCESSFUL STOCK TRADING IS NOT AN EASY PURSUIT

It is a cardinal folly of human nature to believe what one wants to believe rather than what is so, and to love to hear what is pleasant rather than what is true.

Many come to Wall Street thinking that stock trading is easy, but this could not be farther from the truth. Successful stock trading requires an extensive amount of study and knowledge. Wyckoff described stock market forecasting as being like attempting to predict the temperature in a certain city at a precise time several weeks from now. Even a trained meteorologist with the most advanced tools is likely to have a low probability of success. But mastery can come with a right course of study and the determination to make it your business.

Also, because stock market mastery requires a form of reasoning entirely different from that applied to other fields, it is necessary for those who would achieve mastery to spend a considerable amount of effort and time on developing the correct temperament, flexibility of mind, and emotional control required for success. You have to learn how to use your judgment and discard that of others.

WHEN IN DOUBT, DO NOTHING

Don’t enter the market on half convictions; wait till the convictions are fully matured.

Wyckoff wrote about getting down to right principles. Select the best stocks to trade, exercise patience, and only enter a position when it is poised for a rise or a decline. Do not allow yourself to enter the guessing game and when the signals are unclear, stay out of the trade until they become clearer. The market always tells you what to do. It tells you: Get in. Get out. Move your stop. Close out. Stay neutral. Wait for a better chance. All of these things the market is continually impressing upon you and you must get into the frame of mind where you are in reality taking your orders from the action of the market itself—from the tape.

ASSUME A NEUTRAL POSITION FREQUENTLY

Do not expect your ship to come in unless you have sent one out.

Closing out your positions and staying out of the market for certain periods of time is useful because, as Wyckoff said, a neutral position clarifies the mind.

EMOTIONS

Fear and greed are two of the most dominant emotions in stock market trading. They act like a veil in the mind of the trader and obscure the trader from acting with the intelligence required for stock market success. Wyckoff gave the example of his brokerage clients for whom he successfully managed to help close their long positions early into a stock market crash. These clients looked on nervously, holding onto their cash as the market bottomed, but they were too frightened to get back into the market when stocks were to be had at bargain prices. It led Wyckoff to the observation that successful trading required courage and cash.

Wyckoff said of his own trading: “My greatest problem was to eliminate emotion—to learn to trade with a poised mind, without fear or hope. Whenever a stock went in my favor or against me, and I found myself still unbiased in my “feelings,” I was much encouraged. What I wanted was to acquire a trained judgment, combined with the experience that comes only from constant practice.”

A MASTER

Wyckoff was a presence in Wall Street for forty years in the early part of the last century. During his time on Wall Street he met and interacted with many of the legends and greats of Wall Street including J.P. Morgan, Jesse Livermore, E.H. Harriman, James Keene, John W. Gates, and more. He learned what the insiders did, he studied the master traders of the day, and detailed their activities for posterity. Today, we can thank Wyckoff for being one of the greats in the field that we call technical analysis. As maligned as it may be sometimes, we know that mastery of technical analysis can lead to stock market success. So we leave the final words of this article to the master himself:

“When anyone tells you that no one can forecast the short or intermediate movements in the stock market with any degree of success, he is merely confessing his own inability to do this. At one time, you recall, people said carriages must have horses hitched to them or they would not go. The few who have devoted their lives to the science of the stock market have found that accurate and profitable forecasting and trading can be done, has been done, is being done, and will be done.”