Articles

Inside Bar Trading

An inside bar is an important price action pattern that shows up about 10% of the time, or one in every ten candles from the 30m time frame up to the daily time frame. A simple definition of an inside bar is when the price action of one bar (or candle) is inside the one prior. Thus, it is often referred to as an AB pattern, meaning it has to have an A bar and a B bar.

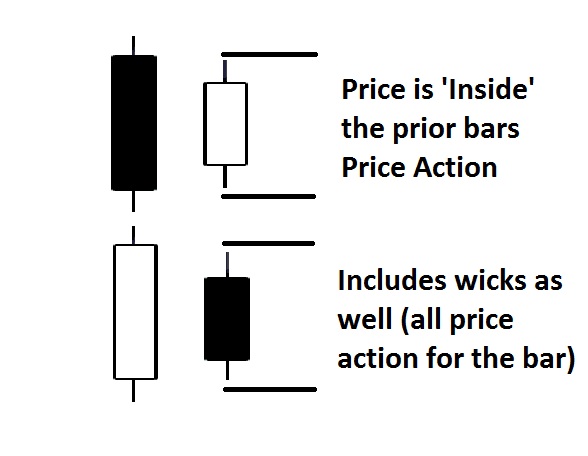

Below is an example of an inside bar pattern.

As you can see by the chart above, the B bar or second bar in the chart has all the price action inside the prior bar or candle. This includes the tails or wicks of the B bar inside below the highs and above the lows of the A bar. When you have this type of setup, you have an inside bar pattern.

What Do Inside Bars Mean from a Price Action Perspective?

Generally, inside bars translate into a reduction in order flow buy and sell orders. This could be for several reasons, but some of the common ones are;

- Liquidity is dropping due to an upcoming news event

- Profits are being taken

- Price is approaching a critical resistance or support level

- Price is consolidating after a large impulsive or corrective move

In terms of the above, the last three offer the best trading opportunities for using inside bars. This is because the first one is around an economic event and we cannot predict how it will come out or how the price action will respond.

However, if price is consolidating after a large impulsive or corrective move, then this could be a pause before the trend continues, offering us a trend continuation price action setup.

Also, if profits are being taken, this could communicate to us the market may pullback before continuing the trend so watch for a pause here.

Lastly, if price is approaching a critical support or resistance level, an inside bar may print near this level to indicate the strength of the counter-trend opposing force, telling us if they are going to reverse it at this level, or the market is more likely to break out.

Thus, inside bars can communicate a lot to us from a price action perspective so learning how to to trade them is critical as they will show up approximately 1 in every 10 bars.

To learn more about how to trade inside bars with trend, counter trend, getting access to years of quantitative data on inside bars, or inside bar trading, visit the price action course to learn more.