Articles

Pin Bar Trading

A powerful price action pattern one will encounter often at key levels is the pin bar setup. The original definition of this was coined by Martin Pring where he called this formation a pin bar (for Pinocchio bar) a bar that was telling a lie.

What is a Pin Bar?

A pin bar setup is a price action reversal pattern whereby in an uptrend the pin bar has a small body and long tail or wick. In an uptrend, the pin bar wick will be the highest high in the uptrend, and the lowest low in a downtrend.

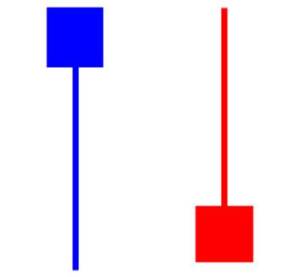

Below are two examples of pin bars:

The blue bar above is a bullish pin bar, while the red bar is a bearish pin bar. As stated before, these are generally viewed as reversal signals, but are also telling a lie. How so?

For our purposes, we will use the blue one here. Notice how the pin bar has a long wick which represents a strong rejection in price below. Most of the price action for this pin bar is the wick, which means the rejection of the price below was quite dominant to push the price above the open and close higher. So the price action started off selling from the open, dropped in price, then rejected strongly to close higher.

It is telling a lie therefore by starting off selling, but then quickly reversing during the candle to close higher as traders were likely trapped on the initial strong selling. Here is an example below of a good bullish pin bar setup.

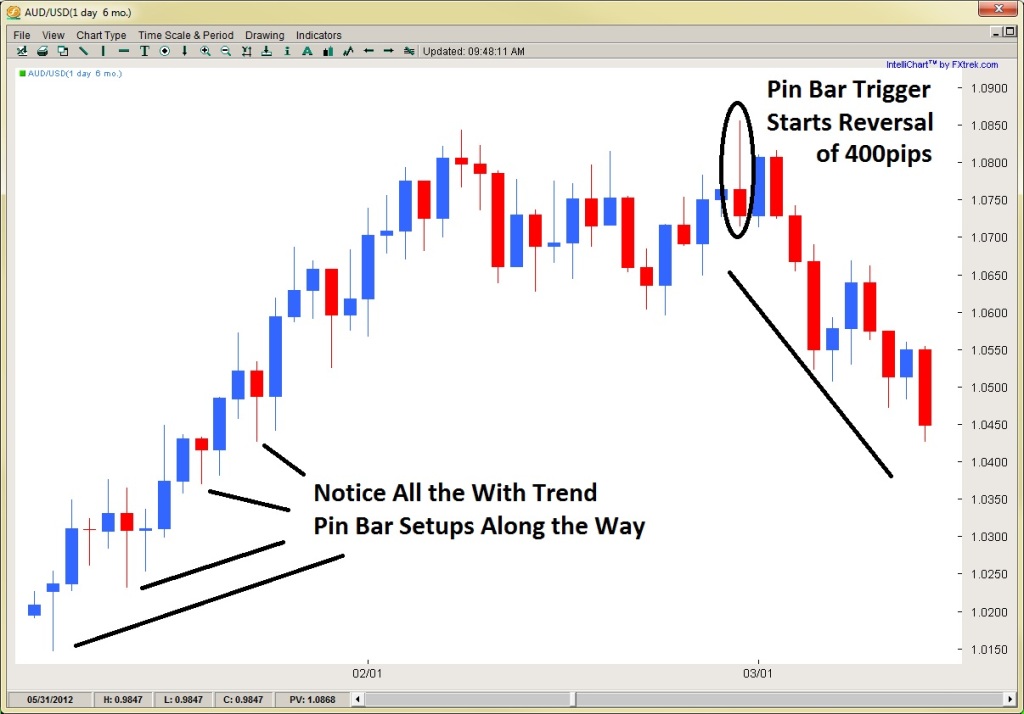

Below is another example of a bearish pin bar setup reversing a strong trend and giving us a price action entry to sell.

Do you see how in the example above price was trending strongly for over 700pips, consolidated, but could not reverse until it ran into the pin bar trigger. From here, it sold off over 400pips which you could have gotten if you had spotted this setup and learned how to trade it properly.

Also, you will notice how there were several with trend pin bar setups along the way, giving you one option for joining the trend.

Conclusion

There are many ways to trade pin bars (with trend, reversals, as tops and bottoms, etc) but the problem is to know when to use them, how to use them, at what levels to use them and where to enter. The other problem is the definition of a pin bar can be quite loose, so how do you know if what you are seeing is a pin bar? Tis an important question.

To learn how to trade pin bars using rule based systems, quantitative data, and have a precise way to trade pin bar setups, visit the price action course page to learn more about these key price action patterns and how they can help you find tops and bottoms as well as great with trend setups.